The number of prospective buyers in the UK residential property market increased in November for a third consecutive month, with near term expectations pointing to a continued, “albeit relatively modest”, increase in activity in the early months of 2017, according to the Royal Institution of Chartered Surveyors (RICS).

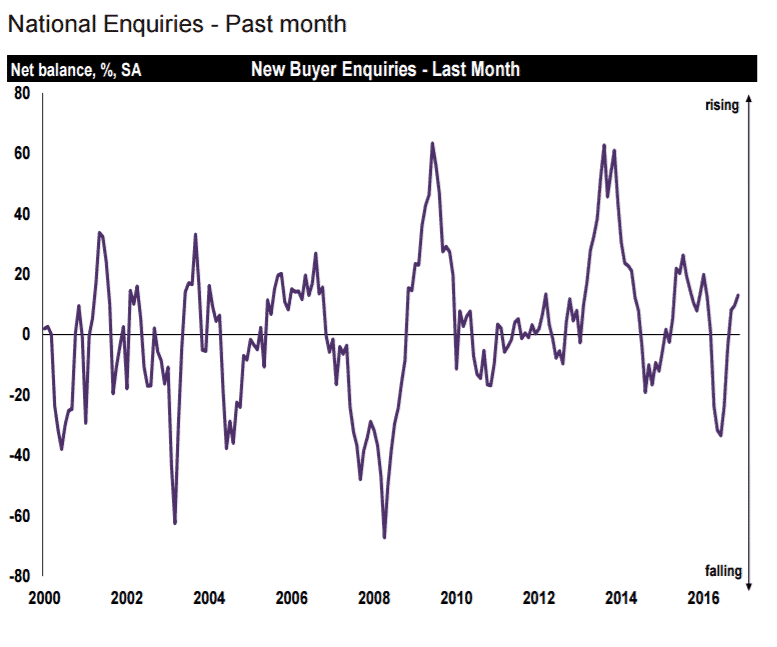

The November RICS Residential Market Survey said that a net 13% of surveyors reported a rise in new buyer enquiries rather than a fall.

The RICS price balance index (the proportion of surveyors reporting a rise in housing prices minus the proportion reporting a fall in prices) rose to 30% in November, the highest reading since April.

Supply shortages remain to be a constraining feature in the UK housing market, according to RICS:

“The combination of the tight supply conditions alongside growth in sales activity has led to a further erosion of available stock for sale, and indeed, respondents across most parts of the UK highlight the supply shortage as a very dominant feature of the market at present.”

A net balance of 14% of surveyors expect an increase in house prices over the coming three months, and some growth expected across most parts of the UK. The outlook over the year to come is positive in all areas with 40% of respondents expecting growth.

Simon Rubinsohn, RICS Chief Economist, said:

“A key issue for the housing market is the slowdown in transaction activity since the spring which is clearly being reflected in the RICS Agreed Sales data as well as in official figures.

“Although there are some signs that the numbers may begin to edge upwards in the new year, the combination of macro uncertainty, the on-going supply shortfall, with stock levels around historic lows, and the myriad of tax changes impacting on buyers suggest that any pick-up in activity will be relatively modest.

“This is significant not just for the housing market itself but also for the wider economy given how much of consumer spending is tied in with home purchases.”