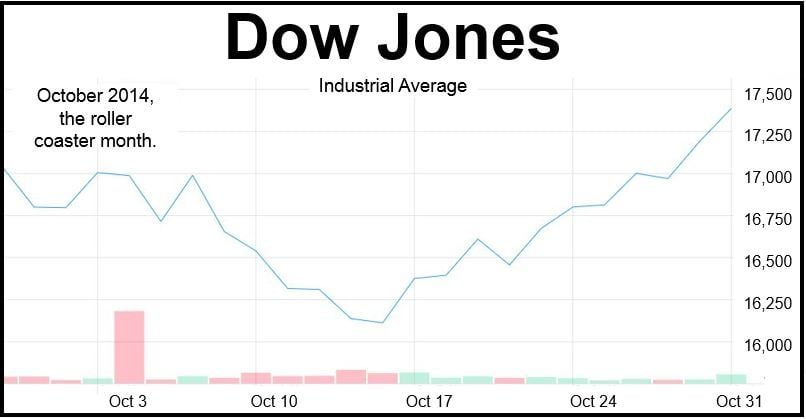

October was a roller coaster month for stock markets. It started marginally below a record high, slumped to a 2-year low, and then rebounded to an all-time high. Compared to the beginning of the month, October ended 2.3% up.

On Friday, October 31st, the Dow Jones industrial average jumped 195.10 points (1.1%), ending the day at 17,390.52. The Nasdaq composite rose 64.60 points to 4,630.74 points, a 1.4% increase, while the S&P 500 increased 1.2% (23.40 points) to 2,018.05.

Both the S&P 500 and Dow ended the month at record highs.

There were moments in October that investors started wondering whether it was the 2008 financial crisis all over again.

Historically, October was when major black stock market events occurred or started, such as the 1929 Wall Street Crash (late Oct) and 1987’s Black Monday (Oct 19).

In October 2014, investors became nervous as more gray clouds started bubbling up on the horizon – there was the unrest in Hong Kong, a Eurozone that seemed to be grinding to a halt, slumping oil prices, the growing Ebola epidemic, geopolitical conflicts, and indications of weaknesses in the American economy.

Like the grand old Duke of York, but the other way round, Dow Jones marched investors down to the bottom of the hill and it marched them up again.

For two straight weeks the market went just in one direction – downward.

On October 15th all bets were on a correction, which tend to occur in cycles of 18 months. However, the correction never came and markets did a U-turn and started moving upward, helped by strong US corporate third quarter results. Signs that the Bank of Japan and the European Central Bank were going to take measures to stimulate growth and push up inflation also helped.

Many economists were surprised that the correction never came, and a significant number still worry that what happened was just a postponement. Cycles tend to be relentless – they come whether we like it or not.

According to FactSet, US corporate profits in Q3 2014 were 7.3% higher than in Q3 2013, a much higher figure than analysts’ average forecasts of 4.5%.

Concerns about the global and US economy soon vanished when data published on Thursday showed that the economy had grown by 3.5% annually in Q3.

On Friday October 31st, the Bank of Japan surprised everybody when it announced it would raise its bond and asset purchases by a massive $90.7 billion to $181.3 billion to $725 billion, a gigantic increase for a central bank that is already spending hugely.

Japan’s economy is still weak, consumer spending is falling and joblessness is starting to creep up, hence the measure.

For many equity traders Japan’s move could not have come at a better moment, just as the US Federal Reserve terminated its own bond-buying effort. All bets are on the European Central Bank buying bonds soon.

Tokyo’s Nikkei average jumped 4.8% on Friday, reaching a 7-year high. The yen fell to 112 to the dollar, a 2.6% decline in one day and a five-year low. This is exactly what the Bank of Japan wants – a weaker yen to boost exports and push up an ultra-low inflation rate.

European stock markets also rallied on Friday following Japan’s announcement and expectations that the ECB will follow suit.