Global oil demand growth outlook for 2015 has been reduced by 230,000 barrels per day to 0.9 million barrels per day as expectations from the Former Soviet Union and other oil-exporting nations decline, according to the IEA Oil Market Report for December, published on Friday.

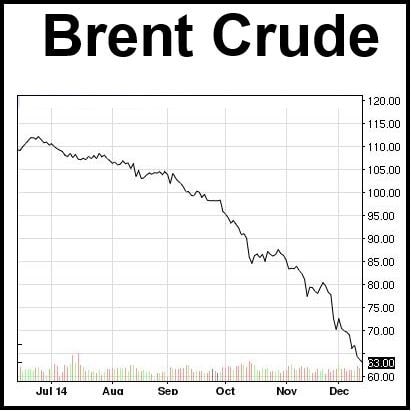

Equity and currency markets faced fresh turmoil this morning as Brent Crude slipped further on the news to $63. Iran’s Oil Minister’s comments that prices are likely to fall another $20, and further data pointing to a likely Chinese hard landing did not help.

The Oil Market Report informed that the lifting of subsidies combined with a strong dollar have so far undermined supportive price effects on demand, which is now expected to reach 93.3 million barrels per day (mb/d) in 2015, compared to 92.4 mb/d in 2014.

In November, OPEC crude supply fell by 315,000 barrels per day (kb/d) to 30.32 mb/d after Libya’s recovery hiccupped, but was 765 kb/d higher than in November last year.

Oil prices have fallen by more than 40% since the end of June. (Source: Nasdaq)

The “call on OPEC crude and stock change” for next year was revised down by 300 kb/d to 28.9 mb/d. The “call” is forecast to fall seasonally by 1.2 mb/d from Q4 2014 to Q1 2015.

Global refinery crude throughputs recovered in November from October’s seasonal low of 76.8 mb/d. The throughputs estimate for Q4 2014 has been revised higher since the previous report, to 78 mb/d, as refiners exploited strong margins ahead of a flood of refinery start-ups expected early in 2015.

Industry stocks in OECD nations built counter-seasonally to 2,720 mb in October, their highest level in over two years.

Video – Oil falls after IEA cuts oil demand forecast