As the oil price plunges it is taking stock markets across the world down with it, with investors running for cover. The looming US interest rate hike is not helping stock prices globally either. OPEC has stopped operating as a cartel, with all member states now pumping at will.

London’s FTSE 100 Index – (Footsie), a share index of the 100 companies listed on the London Stock Exchange with the highest market capitalization – declined 2.2% or 135 points on Friday, closing at the end of the day at 5,952, its seventh successive daily decline and the lowest level since late September.

The Footsie loss, in value terms, totaled £34 billion ($51.5bn, €47bn) just on Friday, spelling further bad news for investments and pensions. The FTSE started 2015 at 6,566, and has so far dropped by 9.1%.

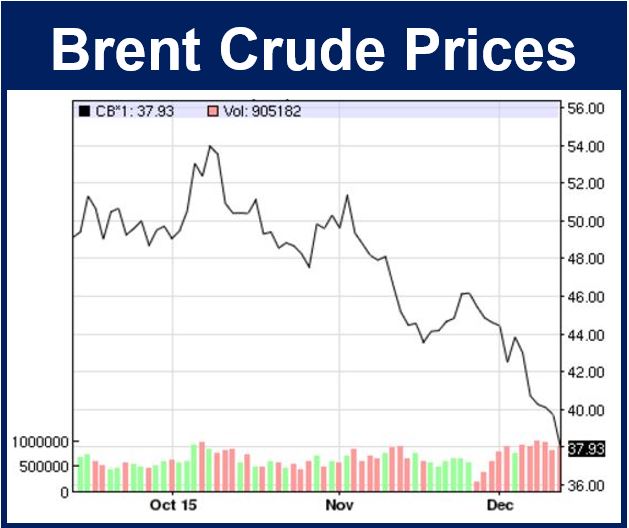

Oil prices just keep going down. (Image: www.nasdaq.com)

Oil prices just keep going down. (Image: www.nasdaq.com)

During Friday afternoon, Brent crude, a major trading classification of sweet light crude oil, took a 4.5% nosedive to $37.93 a barrel after the International Energy Agency forecast that the record oil stocks glut would prevail until well into the second half of 2016.

Russia is preparing for a Biblical collapse in oil revenues, with the Kremlin warning this week that crude prices may well stay around $40 a barrel for the next seven years. Deputy finance minister Maxim Oreshkin said the Russian Federation is drawing up plans based on a price band between $40 and $60 until 2022, which for OPEC would be a nightmare come true.

Such a scenario would spell disaster for heavily-indebted Western producers, Brazil’s off-shore programmes, North Sea producers, and the North American shale industry.

At a breakfast forum hosted by Vedomosti, a Russian newspaper, Mr. Oreshkin said “We will live in a different reality.”

Bank of America believes there is now a real risk of a ‘full-blown war’ within OPEC, as arch-rivals Iran and Saudi Arabia compete bitterly for market share in the global oil market.

According to the International Energy Agency’s (IEA’s) monthly market report, OPEC has ceased to operate as a cartel and is ‘pumping at will’. OPEC is desperate to drive out rivals and is aiming for victory at whatever the cost.

If current prices persist, OPEC’s revenues this year will plummet to $400 billion, compared to $1.2 trillion in 2012.

Global oil stocks have reached an incredible 2,971 million barrels, and will probably increase by another 300 million by the middle of next year as ‘free-wheeling OPEC policy’ inundates the market.

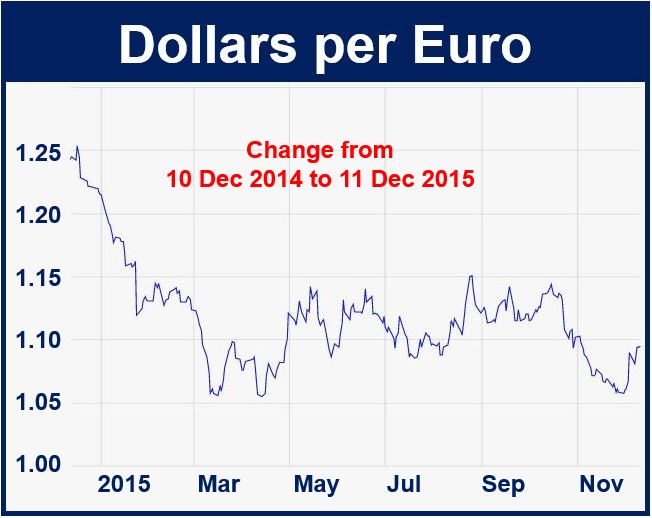

What will happen to the US dollar when interest rates start to climb in the United States? (Source: www.ecb.europa.eu)

What will happen to the US dollar when interest rates start to climb in the United States? (Source: www.ecb.europa.eu)

US interest rate hike expected

The US Federal Reserve System (Fed) – America’s central bank – is widely expected to push up interest rates for the first time since 2006, despite deep concerns across the globe about the potential impact.

If US interest rates rise the dollar will probably shoot up further, which would hammer commodity prices, which are priced in dollars, including oil.

Emerging markets would find it more expensive to service their debts if the dollar strengthens, which would undermine GDP (gross domestic product) growth.

While the largest FTSE fallers were companies with a heavy commodities exposure, such as mining firms, asset management firm Old Mutual lost over 10% of its value for the second consecutive day. Turmoil in South Africa, where a large chunk of its business is based, is scaring away investors.

After South Africa’s President Jacob Zuma fired his finance minister, the rand hit a record low against the US dollar.

The German DAX, a stock index that represents 30 of the biggest and most liquid German companies that trade on the Frankfurt Exchange, closed 2.4% down, while the S&P 500 in New York fell 1.6%.

There are concerns for the global economy, with traders citing weakness in the yuan (China’s currency).

In an interview with KLFM News, David Buik, market commentator at Panmure Gordon, said:

“Understandable correction waited in the wings in the early weeks of 2015 when oil dropped from $65 a barrel to $52. But then the FTSE 100, on reasonable earnings and no logical alternative asset class competition ploughed its way to a record 7104 at the end of April. But it never had the legs or the conviction to push on.”

“Soon warning bells in the shape of distress signals affecting growth in China threatened a meltdown. Oil prices continued to recede; that rattled the market’s confidence. Add to that ridiculous unsubstantiated threats from the Fed to raise interest rates, which made for a very strong dollar, thus trashing emerging markets brought about a change in sentiment.”

“Investors suddenly realised that stock markets were not delivering growth, triggering a fall in the FTSE 100 to 5900 in August.”

Video – Brent Crude plunges