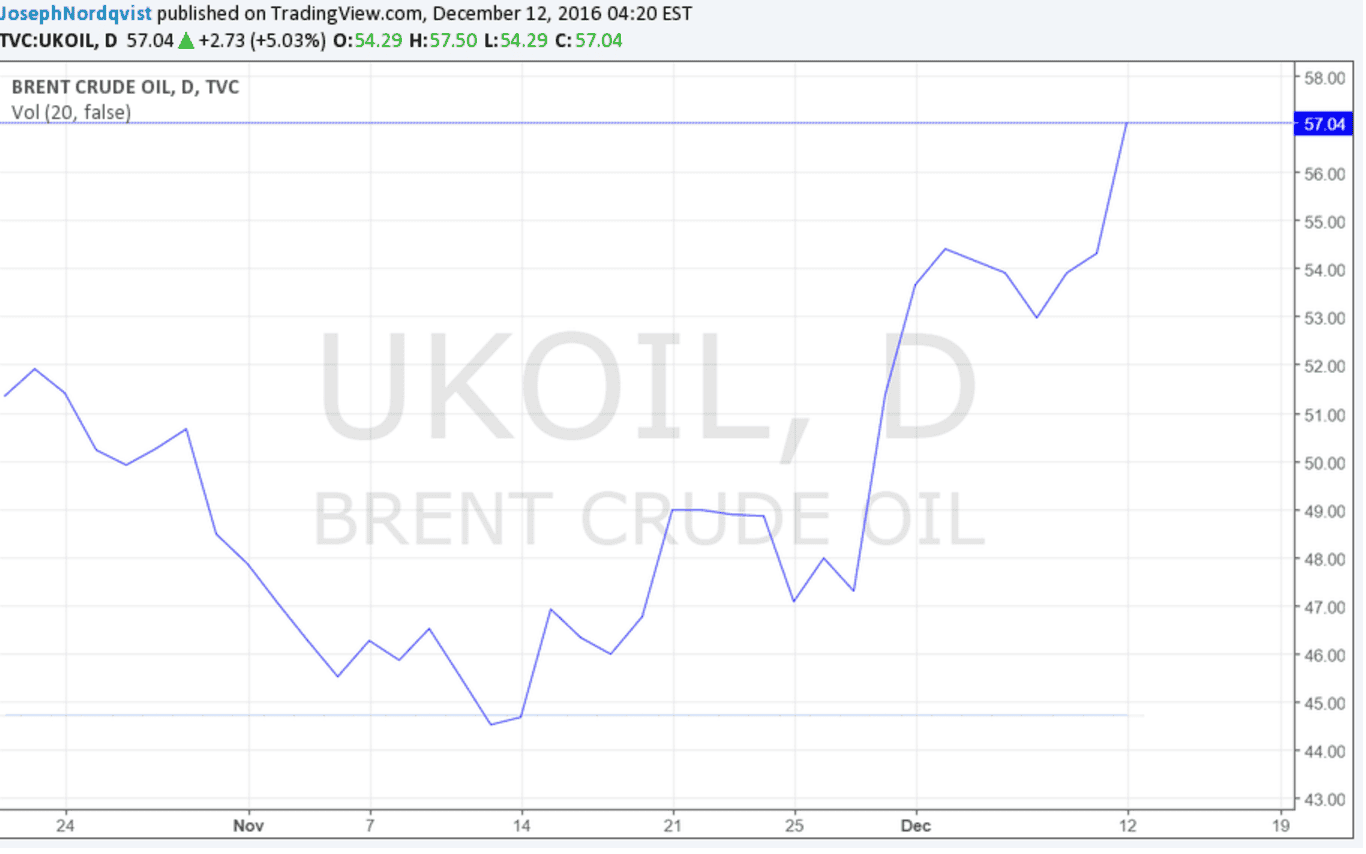

Oil prices surged on Monday following a landmark agreement between non-OPEC and OPEC countries in curbing production.

Brent crude increased to as high as $57.89 a barrel, while WTI Crude rose to as high as $54.43 per barrel.

OPEC agreed on November 30 to cut oil production by 1.2 million barrels per day.

Shortly after the OPEC call to curb output, eleven non-OPEC countries, including Russia, agreed to decrease production by 558,000 barrels a day at the OPEC Secretariat in Vienna on December 10 as part of an effort to boost prices and ease an oversaturated market.

“We believe that the observation of the OPEC-11 and non-OPEC 11 production cuts is required to sustainably support… oil prices to our 1H17 WTI price forecast of $55 a barrel,” Goldman Sachs analysts wrote in a note.

“This forecast reflects an effective 1.0 million barrels per day (bpd) cut vs. the 1.6 million bpd announced cut and greater compliance to the announced cuts is therefore an upside risk to our forecasts.”

According to Reuters, global asset management firm AB Bernstein said the deal “amounts to an aggregate supply cut of 1.76 million barrels per day (bpd) from 24 countries which currently produce 52.6 million bpd or 54 percent of world oil supply.”

“Once cuts are implemented at the start of 2017, oil markets will shift from surplus into deficit. Given the cuts in production announced by OPEC, we expect that markets will move into a 0.8 million bpd deficit in 1H17,” AB Bernstein said.