Optimism among UK manufacturers in the aftermath of the Brexit vote to leave the European Union slumps to the lowest it has been since January 2009, despite an improvement in activity in the last 3 months.

The latest quarterly CBI Industrial Trends Survey shows manufacturing output and domestic orders grew steadily over the past quarter, but industry leaders expect both to slow in the coming 3 months.

The survey of 506 UK manufacturers finds expectations for total new orders growth are at their lowest since January 2012.

Industry bosses also expect output growth to ease and employment to fall slightly over the next 3 months.

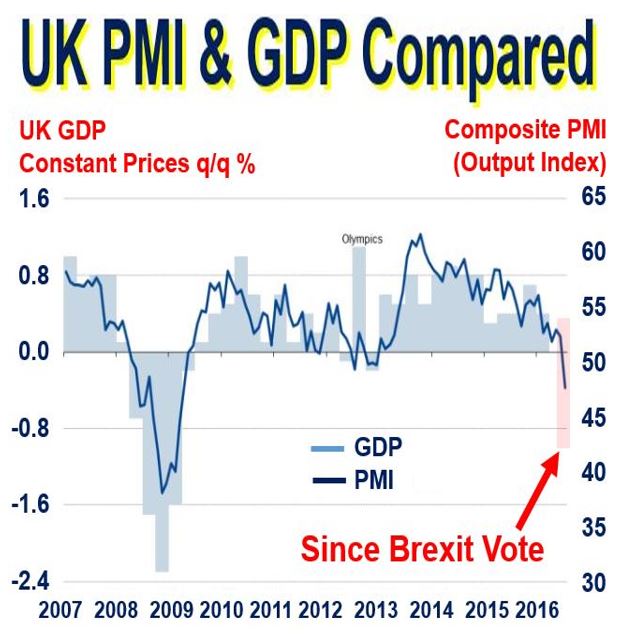

Several indicators are starting to emerge suggesting a significantly negative outlook for the British Economy. The latest Markit PMI (purchasing managers index) shows that economic activity is slowing down dramatically. (Source: Markit Economics)

Several indicators are starting to emerge suggesting a significantly negative outlook for the British Economy. The latest Markit PMI (purchasing managers index) shows that economic activity is slowing down dramatically. (Source: Markit Economics)

However, export orders are expected to rise faster than average in the next quarter, as competitiveness in international markets continues to improve at the strongest pace in over 6 years.

Rain Newton-Smith, CBI Chief Economist, says they are also “seeing encouraging signs of a boost to export competitiveness from a weaker sterling.”

“But it’s clear that a cloud of uncertainty is hovering over industry, post-Brexit,” she adds. “We see this in weak expectations for new orders, a sharp fall in optimism and a scaling back of investment plans.”

Before July, the sector was showing signs of recovering from the slowdown in activity seen in 2015 that continued into the first half of this year. Output was higher than it had been for 2 years, with domestic orders and employment also improved. Export orders were flat, but not as low as reported in the previous quarter’s survey.

Compared with the previous 12 months, UK manufacturers expect to be investing less in the coming year.

Also, capital expenditure plans for buildings, plant, and machinery are less ambitious than in the previous survey, which reported highs not seen for decades. However, they do not appear to be deviating much from the average.

Key findings of survey

The CBI Industrial Trends Survey is conducted monthly and quarterly and covers 38 sectors of UK manufacturing industry at chief executive level.

In the past quarter, 5 percent of UK manufacturers said they were more optimistic about the general business situation than they were 3 months ago.

However, more than half (52 percent) said they were less optimistic, giving a balance of -47 percent, the lowest it has been since January 2009 (-64 percent).

There was also a fall in optimism about export prospects for the year ahead.

Other key findings for the past quarter include:

– More businesses reporting increase in total orders than reporting a decrease

– Export orders were broadly flat, after a slight fall in the previous quarter

– Capital investment plans lower than for previous 12 months, but plans for training remained positive

– Competitiveness in the EU improved at the fastest pace since April 2010, also rising in non-EU markets

Key findings for the next quarter include:

– Total new orders expected to be flat

– Domestic orders also expected to be broadly flat

– More UK manufacturers saying export orders will rise than saying they will fall

– More businesses anticipate rise in output than anticipate a fall

– More businesses expect employment to go down than see it going up

These findings are drawn from percentage balances – the difference between the percentage of companies answering in the positive minus the percentage answering in the negative. Thus, “total orders expected to be flat” means as many manufacturers expect them to increase as expect them to decrease (giving a balance of 0 percent).

Video – How UK businesses will deal with Brexit

CBI Director Carolyn Fairbairn talks about how British Businesses will adapt after Brexit.