Palantir Technologies (NYSE: PLTR) continues to surprise investors.

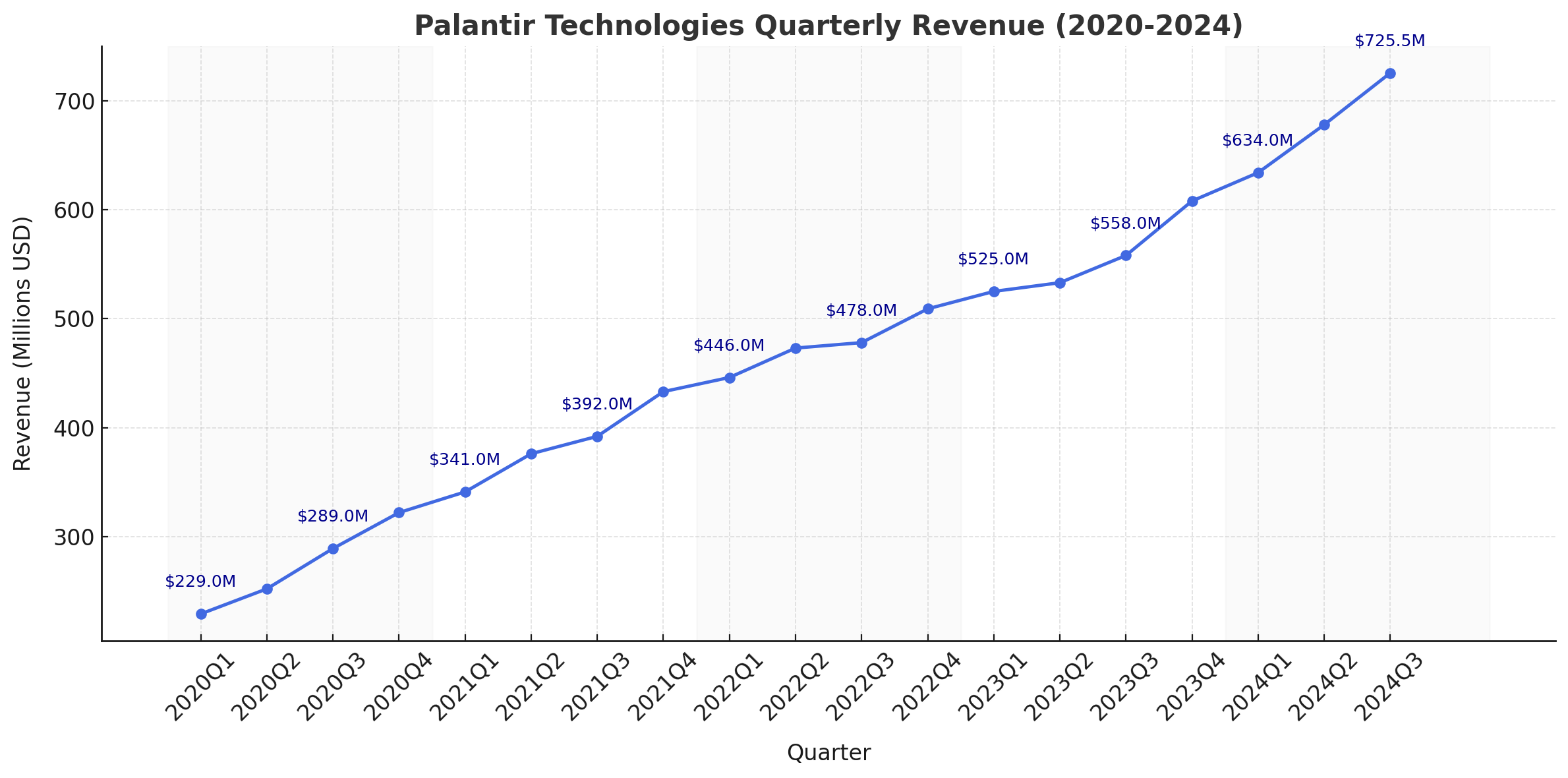

The software giant reported revenue that smashed expectations. In the third quarter, the company pulled in $725.5 million in revenue, a 30% increase from the year-ago period.

And investors liked what they saw: Palantir’s stock rose by as much as 13% after announcing its quarterly results.

Most of the company’s business was in the U.S., thanks to a surge in defense contracts.

Alexander C. Karp, Co-Founder and Chief Executive Officer of Palantir Technologies Inc, said in a news release to investors:

“We absolutely eviscerated this quarter, driven by unrelenting AI demand that won’t slow down. This is a U.S.-driven AI revolution that has taken full hold. The world will be divided between AI haves and have-nots. At Palantir, we plan to power the winners.”

Growth outside the US has been slow. About 70% of its revenue came from U.S. clients. However, this hasn’t dampened Palantir’s outlook. The company has raised its outlook for the year, expecting between $2.805 billion and $2.809 billion in revenue by year-end.

For the next quarter, the company projects adjusted operating income in the range of between $298 and $302 million.

So what does CEO Alex Karp mean when he says this moment is a U.S.-driven AI revolution? He’s highlighting the rate at which the U.S. is adopting AI, reshaping industries, and fueling Palantir’s growth in both government and private sectors.

What makes its AI offerings appealing is that the models are secure with human oversight to keep things in check. For clients like the military, this is a big boon. They want to leverage AI, but need it to be safe and reliable.

And it’s not just government clients who use Palantir’s tools. Large multinationals like BP and even the UK’s National Health Service have used Palantir’s tools. At the core of it all, is security.

This quarter, Palantir posted its highest net income ever, with net income of $144 million, a 20% margin. The results highlight its solid financial position.

After recently being added to the S&P 500, Palantir expects this growth to continue, especially with its strong foundation in defense and commercial work.

In short, Palantir’s growth is on a steady climb. Demand in the U.S. has given the company a strong boost, setting it up for more gains, even if other parts of the world are a bit slower to catch on.