While personal spending increased in December in the US, personal income remained virtually unchanged, says a new report issued by the Department of Commerce.

Personal spending grew by more than analysts had forecast.

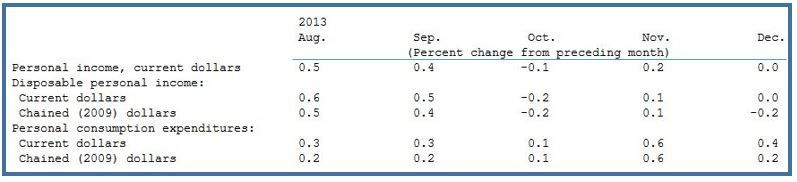

According to the Bureau of Economic Analysis, part of the US Department of Commerce, personal income grew by $2.3 billion in December 2013, i.e. less than 0.1%, while disposable income shrank by nearly 0.1% ($3.8 billion).

In November 2013, personal income had increased by 0.2%, or $29.8 billion, while disposable personal income had increased by $14.4 billion.

The December fall in disposable personal income was due in part to a $14.3 billion reduction in farm proprietors income.

Personal spending (personal consumption expenditure), on the other hand, rose by $44.1 billion, or 0.4% in December 2013.

The increase in personal spending during the last two months of 2013 were the strongest consecutive gains since in two years.

PERSONAL INCOME AND OUTLAYS, DECEMBER 2013

Personal spending driven by consumers drawing on savings

RTT News quoted Peter Boockvar, managing director at Lindsey Group, who said “Bottom line, spending was good but spenders are drawing on savings in order to drive it, but hopefully soon we’ll see a pickup in income growth as anecdotal signs of wage pressures are beginning to arise.”

Economists say that slower income growth could undermine the increase in consumer spending that has helped boost the US economy in recent months. Add to this concerns regarding the emerging markets and a scaling back in the bond-buying stimulus package from the Federal Reserve, and we can see there are several factors that could hurt the US economy in 2014.

Scott Brown, chief economist at financial firm Raymond James & Associates Inc., said to The Wall Street Journal “[The income figures] raise a degree of caution for the near-term outlook because some pullback in spending growth seems likely. We came into the year priced for a strong recovery, and now it looks like it might stumble a bit.”

The Bureau of Economic Analysis informed that overall spending was 3.1% higher in 2013 compared to 2012, the slowest annual increase since 2009, and much weaker than the 4.1% rise seen in 2012.

Inflation across the economy remains low, with the price index for personal consumption expenditures rising by 1.1% in December 2013 compared to December 2012, well below the Fed’s target of 2%.

Last month the Department of Commerce informed that the US economy grew by 3.2% in Q4 2013, and that since December economic activity has accelerated.