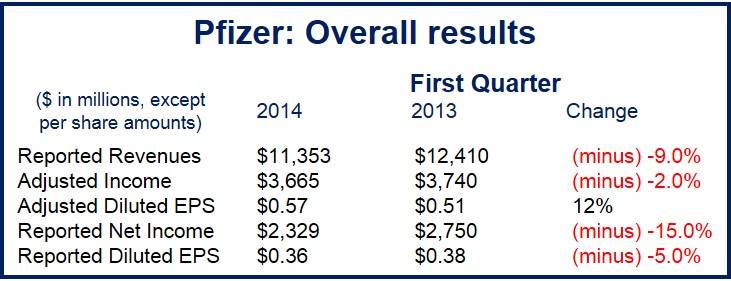

With Pfizer profits down 15% to $2.3 billion during the first quarter of 2014 compared to the same period in 2013, many experts comment on the consequences of a company obsessed with building up cash, scaling down R&D, and ending up with few new products to sell.

Pfizer’s Q1 2014 results come just a few days after the company made an offer to acquire the UK’s second largest pharmaceutical company, AstraZeneca.

As with the game Monopoly, Pfizer has a lot of cash while AstraZeneca has many hotels and train stations. One is cash rich while the other has a healthy number of promising experimental drugs in its pipeline.

In the long run we all know that the hotels-owner wins the game. So, who needs whom the most?

Pfizer, with headquarters in New York City, is the world’s largest pharmaceutical company. It employs 91,500 people worldwide.

Pfizer revenue down too

According to Pfizer, not only did profits decline but also revenue, which dropped by 9% to $11.35 billion in Q1 2014.

(Source: Pfizer)

Wall Street had expected revenues to be $730 million higher for the quarter.

The co-promotion period of Enbrel, Pfizer’s arthritis drug, ended in the US and Canada, as well as the development of cheaper versions of Lipitor, the cholesterol drug. Viagra drugs have also fallen since its patent life expired and European producers have entered the market with generic versions of sildenafil.

According to Frank D’Amelio, Chief Financial Officer in Pfizer, the firms financial performance reflected “continuing impact of product losses of exclusivity, the expiration and near-term termination of certain collaborations”.

Come-up-pance for ignoring R&D?

Less generous commentators might say this is an example of a company obsessed with building up cash, downsizing research and development, which is currently having to face the reality of very few new products to make up for patent expiries.

Ed Miliband, the leader of the UK’s Labour party, called for an inquiry into Pfizer’s desired takeover of AstraZeneca. The UK is a world leader in pharmaceutical R&D (research and development), there is serious concern that Pfizer, which has a history of buying companies and considerably scaling down research, may undermine the UK’s position globally as an R&D center of excellence.

Mr Miliband wrote to UK Prime Minister David Cameron urging the UK government to protect the long-term interests of the country. Business leaders and advocate groups have told UK lawmakers to stay away, insisting that whether or not AstraZeneca agrees to a Pfizer deal is up to the company’s shareholders, and not politicians.

Pfizer AstraZeneca deal is a shareholder decision, surely?

Dr. Roger Barker, Director of Corporate Governance at the Institute of Directors, said:

“It is misleading to present AstraZeneca as some kind of UK national champion. The company is a truly multinational enterprise that was created through the earlier mergers of UK, Swedish and American companies.”

“The majority of its employees are based outside Europe and its shareholders are overwhelming foreign institutional investors. It is run by a Frenchman and chaired by a Swede. It is a multinational company active in a global economy. The IoD (Institute of Directors) does not support any extension of any national interest test for takeovers. Takeovers are primarily a matter for boards and shareholders to determine, not government.”

There are widespread concerns in the UK that Pfizer’s approach to acquire AstraZeneca could be the start of a slippery slope towards jam today for shareholders at the cost of the country’s eminence in pharmaceutical R&D.

Ian Read, Chairman and Chief Executive Officer, stated:

“Despite continuing revenue challenges due to ongoing product losses of exclusivity and co-promotion expirations, I look forward to the remainder of the year given the strength of our mid- and late-stage pipeline, the continued growth opportunities for our recently launched products as well as opportunities for upcoming product launches. Within both of our innovative pharmaceutical businesses and our established pharmaceutical segment, I continue to see attractive opportunities to pursue profitable revenue expansion, both organically and through prudent business development.”