Phone scammers have netted an estimated £23.9 million over the past twelve months, which is more than three times the previous year’s £7 million, according to a report published by Financial Fraud Action (FFA) UK on Tuesday.

The fraud prevention group, which is sponsored by the UK Cards Association, has called for a major awareness campaign.

According to the FFA, about 58% of Brits have received suspect calls, compared to 41% last summer.

An awareness campaign – “Joint Declaration of the UK Banks” – which is supported by the Police, has been launched today. Credit card companies, banks, building societies and Chief Police Officers have joined forces to help citizens identify the signs of a phone scam.

The campaign will be supported by a nationwide advertising campaign to make sure every household across the country receives its messages.

Only criminals will ask you for banking data, personal details or passwords over the phone!!

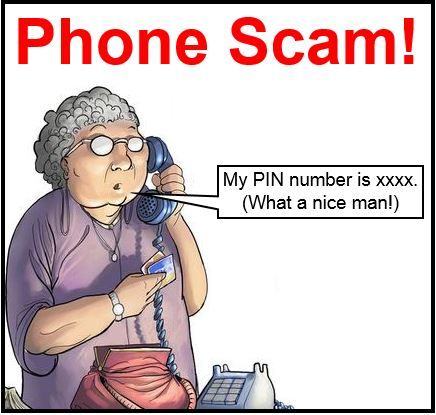

In these ‘cold calls’, the scammer will try to deceive the victim into believe he or she is talking to a police officer, bank employee, or a member of some trusted organization, such as a software company.

In a successful scam, individuals will be persuaded that they are victims of a fraud. The caller will ask for financial or personal information; the aim being to gain access to their account. Details requested may include PIN numbers, passwords or card details.

Some fraudsters may persuade their victim to transfer money into a bank account, or hand over their bank cards to a passing courier.

Number of potential victims is huge

The survey found that 25% of individuals make no effort to challenge the caller’s identity. Over one third (36%) of survey respondents said they found it hard to differentiate an authentic request for data from a fraudulent one.

The FFA was alarmed to find that 10% of respondents said they would willingly either hand over cash to a ‘courier’, give their card, or transfer money into another account if asked to do so by somebody pretending to be working for their bank.

The FFA emphasized that the police and banks will NEVER ask people to take such actions. Such requests will only come from criminals.

The survey authors extrapolated from their findings that up to 4.9 million bank customers in the UK would fall into a scammer’s trap.

Head of the DCPCU, a specialist policing unit funded by the banking industry, Detective Chief Inspector Perry Stokes, said:

“Always be on your guard if you receive a cold call and are asked for personal or financial information, or to hand over your card or cash to someone. The bank or police will never tell you to take such actions, so if you’re asked it can only be a criminal attack.”

“Wait five minutes and call your bank, preferably from a different telephone, if you have even the slightest doubt.”

Wait 5 minutes after hanging up

Remember that if you hang up and then call again, thinking it is the bank, it could be the same person you were talking to a few minutes ago. If the person at the other end of the line does not hang up, they can keep your line open, even after you have put your receiver down.

If the other person stays on the line after you have hung up, it can take up to five minutes for your line to finish the connection. The police advise people, if possible, to make their subsequent call from another telephone.