Private sector pay in the UK has grown this year at its fastest rate since the early 2000s, i.e. a fifteen-year high, according to a report released today by the Resolution Foundation, an independent think tank that aims to improve living standards for low- and middle-income households.

However, the authors of the new earnings outlook add that maintaining this growth surge into next year will prove challenging once inflation starts to increase.

In the three months to August 2015, real average weekly earnings in the private sector rose by between 3.4% and 3.6%. This would represent the steepest wage increase since July 2002 (3.45%) or May 2001 (3.54%).

Across the whole economy, i.e. the private and public sectors, real average weekly earnings are estimated to have risen by between 2.9% and 3%.

Private sector pay driven by more managerial jobs

The Foundation reported that while the recent increase in real wages has been driven mainly by extremely low inflation, there has also been “a welcome shift in job creation towards higher-paying roles.”

Over the past 12 months, the proportion of higher-paid managerial positions has increased, while the share of customer-service and care roles (which pay less) has declined.

In 2014, job creation was the other way round, with the number cleaning and caring jobs growing at a much faster rate than other types of employment.

This shift towards higher-paying positions should help boost productivity growth, the Foundation says. Productivity is what drives greater wealth and standard of living.

Pay still below pre-crash levels

There is still some way to go, however, before real average earnings return to their pre-global crisis levels. Had the crash not occurred and wages had continued to rise as they had been before 2007/8, they would have been £110 a week higher than they are today.

According to the Resolution Foundation:

“Big question marks loom over the medium term outlook for pay, and that it will take far stronger earnings growth to maintain the UK’s mini pay revival once inflation starts rising towards the end of the year.”

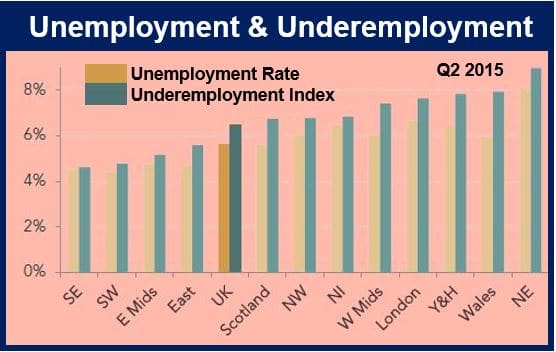

While under-employment has fallen over the last twelve months, it is still about two-thirds higher than it was in the early 2000s. As under-employment declines, wage growth should increase further.

Under-employment refers to the number of additional hours wanted by people both in an out of work.

Young people’s job mobility down

The Foundation reports that young people are moving jobs at a 40% lower rate than they were in the early 2000s. This lack of job mobility could undermine young people’s career paths, which in turn may reduce their pay prospects.

Of concern is training intensity, which has declined, and the number of graduates in non-graduate positions, which has increased over the past ten years.

Laura Gardiner, Senior Policy Analyst at the Resolution Foundation, said:

“Workers across the UK are enjoying a much-needed mini pay surge after a painful six year squeeze. And while much of this growth is down to historically low inflation, there are welcome early signs too of a shift towards higher paid job creation that could boost pay still further.”

“But while the immediate outlook for pay is healthy, it will be far harder to maintain this ‘catch-up’ growth once inflation starts to return, especially with the labour market still under-performing in many key areas.”

“The relatively subdued level of moving between jobs among young people is a particular cause for concern, as it can harm career prospects and their long-term earnings potential.”

“The jobs market has proved remarkably resilient over recent years. But securing a sustainable period of strong employment and pay growth will require a renewed focus on jobs quality, skills, investment and productivity.”