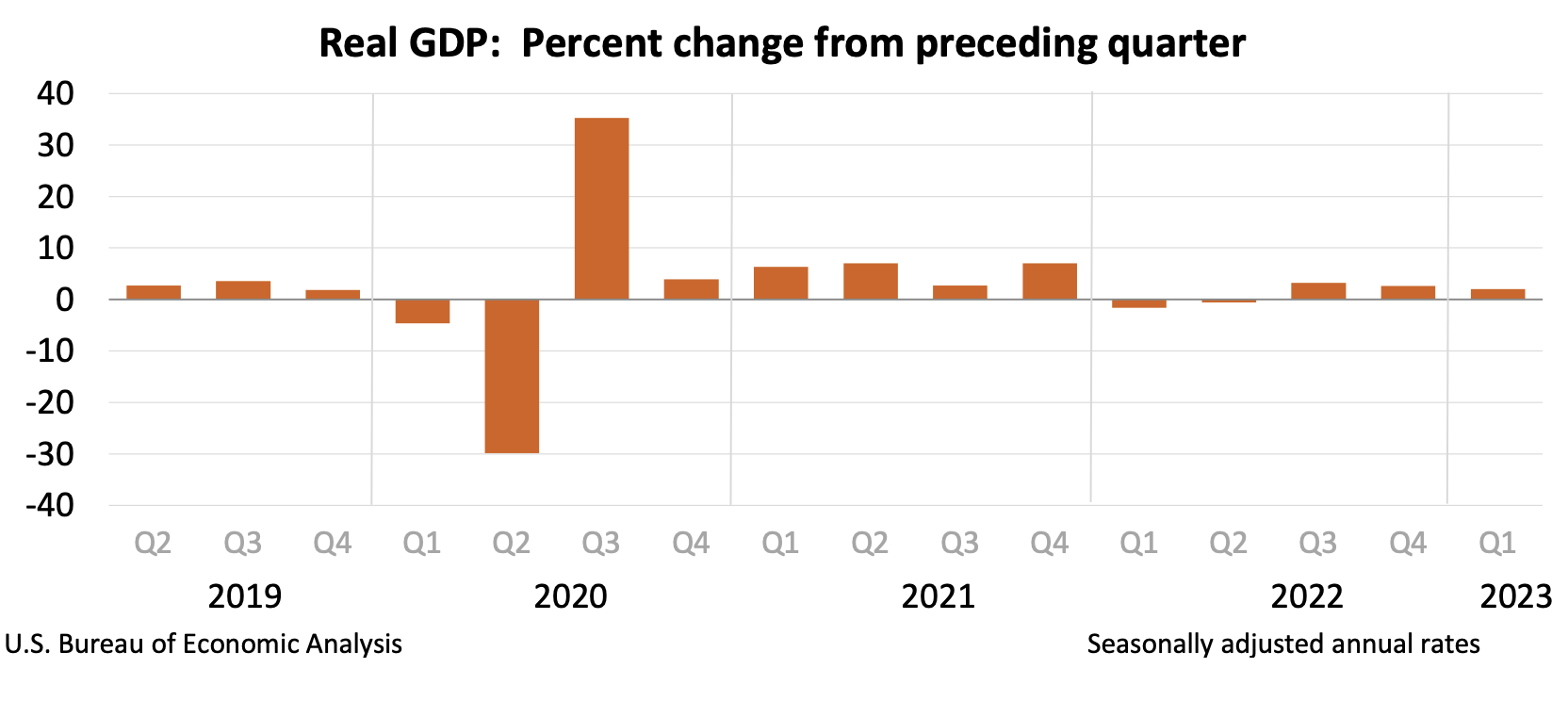

Real GDP in the US rose by 2.0% in the first quarter of 2023, according to the US Chamber of Commerce’s third estimate. In comparison, real GDP increased by 2.6% in the last quarter of 2022.

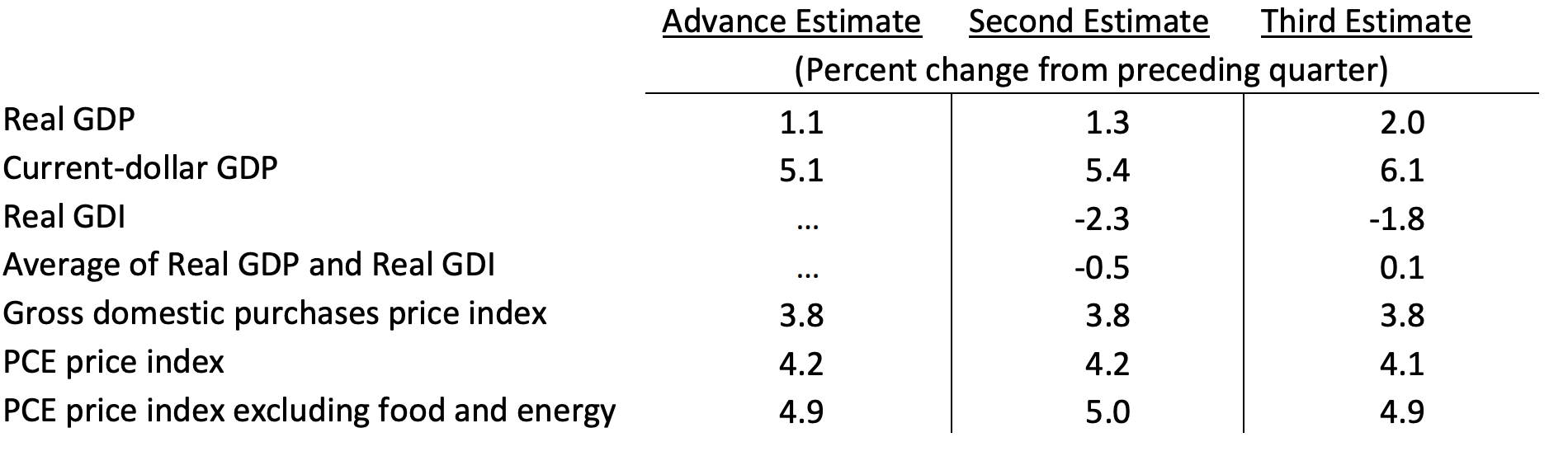

Last month, in its previous estimate, the Chamber of Commerce estimated that real GDP had only increased by 1.3%. This latest estimate (which, to be accurate, is the agency’s third estimate) is more accurate because it uses more complete data.

What caused the increase?

The increase was mainly due to upward revisions to U.S. exports and consumer spending – although this was partly offset by downward revisions to federal government spending, nonresidential fixed investment, and private inventory investment. The chart below provides a more complete picture of the revisions:

The data shows the US economy has been more resilient than previously thought.

In fact, earlier this month it was reported that the US labor market (the supply and demand for jobs) has been growing healthily as well. In May, the economy added 339,000 jobs. This is a good sign because it shows businesses are hiring, which can also encourage consumer spending. It’s even better news when you consider that this number far outpaced the prediction by Wall Street, which expected an increase of just 195,000 jobs.

So, Will the Federal Reserve Hike Interest Rates further?

Consumer prices – which is the cost of stuff that everyday people like you and me buy – rose 4% over the year up to May. Now, a 4% increase might sound like a lot, but it’s actually the slowest rate of increase we’ve seen in two years – it peaked at around 9 percent last summer. This is largely due to a decrease in fuel costs since they spiked last year.

However, the price of many other items continues to climb. Economists also like to look at something called “core inflation” to get a more accurate picture of how much prices are increasing. This measure takes out energy and food items, which can have very volatile prices, and focuses on the cost of other goods and services. Core inflation was up 5.3% over the 12 months to May.

Jerome Powell, who is the head of the Federal Reserve, expressed his concerns at a meeting in Europe this week. He doesn’t think the current measures they’ve taken are enough to tackle inflation.

In his own words, Powell was quoted by Bloomberg as saying: “Although policy is restrictive, it may not be restrictive enough and it has not been restrictive for long enough.” This comment, made during a panel hosted by the European Central Bank in Portugal, indicates that we might see even tighter policies from the Federal Reserve in the future.