- Profit Decline: Ryanair’s profit dropped 18% in H1 FY25, despite a 9% rise in passenger numbers due to lower average fares.

- Strategic Fleet Expansion: Boeing delivery delays have led Ryanair to revise its FY26 passenger forecast down from 215 million to 210 million.

- Optimistic Outlook: Ryanair targets 198-200 million passengers in FY25, relying on cost advantages and stable demand, though aircraft delivery stability is crucial.

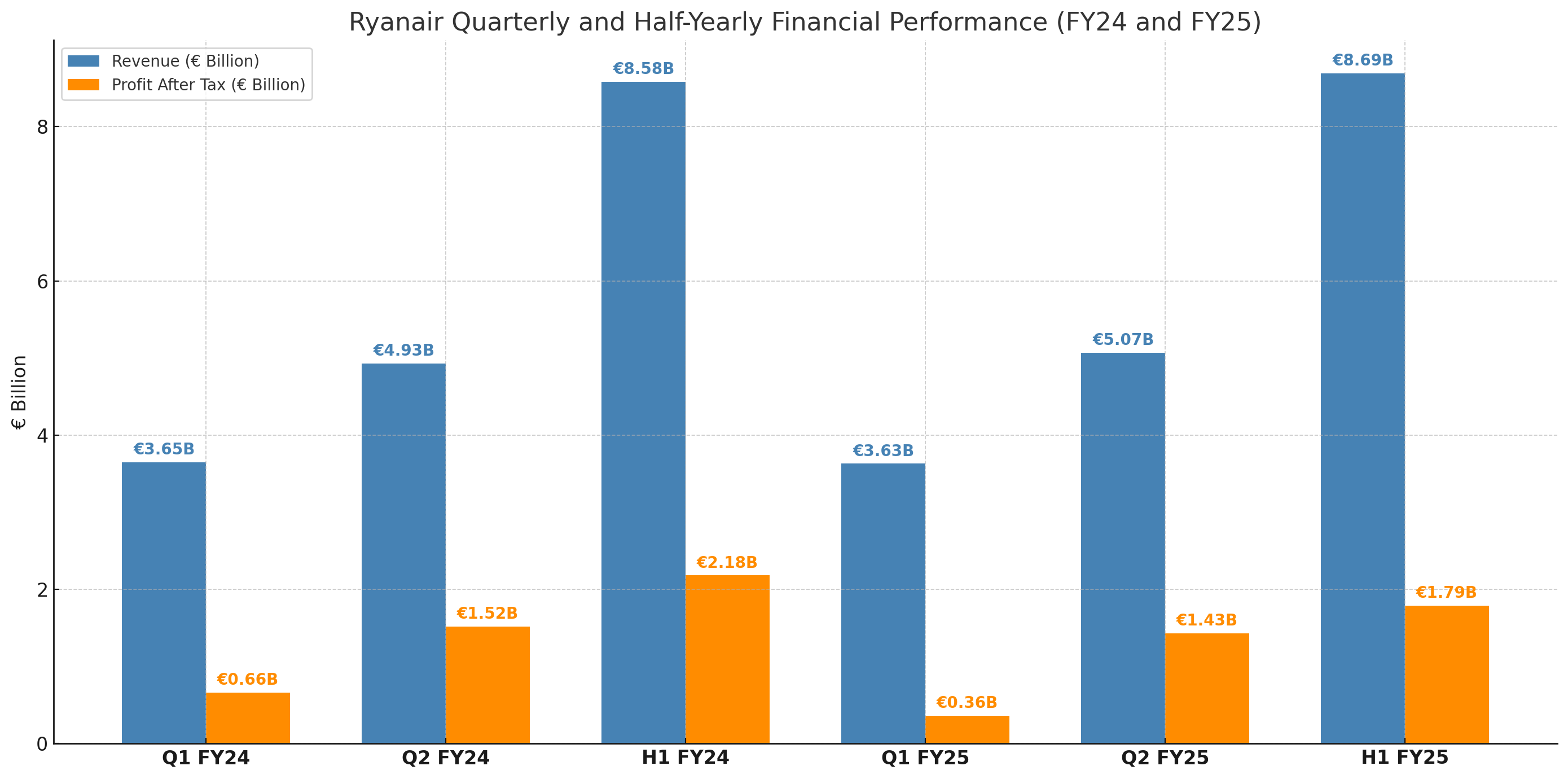

Ryanair posted an 18% drop in profit for the first half of fiscal 2025, from €2.18 billion to €1.79 billion (year-over-year). Even though the company enjoyed a 9% increase in passengers during the period, lower fares weighed heavily on its bottom line.

Instead of raising prices, Ryanair lowered ticket prices to fill up as many empty seats as possible. The strategy, “load active/yield passive,” helped boost passenger numbers, but it resulted in average fares falling by 10%.

According to Ryanair CEO Michael O’Leary, consumers have become more cost-conscious amid inflation and tighter budgets.

However, Ryanair also needs to grow its fleet for long-term success. This is where the delay of new Boeing 737 Max planes is an issue. Ryanair had expected to receive 57 planes, but will only be getting 40 by next summer.

Because of the delays, the airline lowered its passenger forecast for 2026 from 215 million to 210 million.

While revenue rose to €8.69 billion, costs were by 8% because of higher fuel and staff expenses.

Outlook

Ryanair said in its outlook that it’s aiming for 198-200 million passengers in FY25, up 8% year-over-year, assuming Boeing doesn’t face worse delays. In the first half of the year, the airline noted that its costs stayed low compared to its European competitors.

Michael O’Leary said: “We continue to target between 198m and 200m passengers in FY25 (+8%), subject to no worsening of current Boeing delivery delays. Unit costs performed well in H1 as the cost gap between Ryanair and EU competitor airlines continues to widen.”

Adding: We expect full-year unit costs to be broadly flat, as our fuel hedge savings, strong interest income and some modest aircraft delay compensation will largely offset ex-fuel cost inflation (particularly crew pay & productivity increases, higher handling & ATC fees and the cost inefficiency of repeated B737 delivery delays). Forward bookings suggest that Q3 demand is strong and the decline in pricing appears to be moderating. We remain cautious on Q3’s ave. fare outlook, expecting them to be modestly lower than Q3 prior year (subject to close-in Christmas and New Year bookings).”