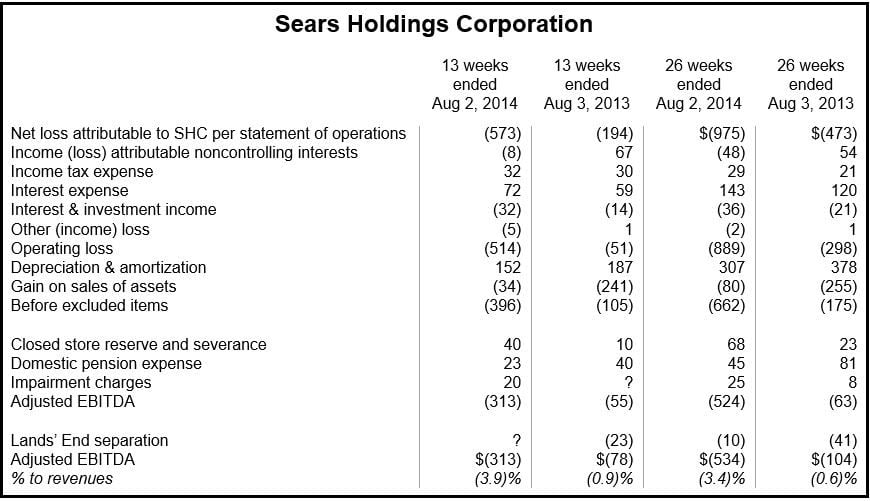

Sears Q2 loss widened as the multinational retailer continues its 10-year struggle with dwindling sales. The company made a $573 million loss, or $5.39 per share, compared to a $194 million loss ($1.84 per share) in Q2 2013.

The company, which owns the Sears and Kmart stores, has posted a loss for the last nine consecutive quarters.

Sales for the second quarter were $8 billion, about 10% down on Q2 2013’s $8.87 billion.

At Kmart stores that have been opened for at least one year sales declined by 1.7%. Excluding grocery, household goods and consumer electronics, sales dropped by 1%. At Sears stores, sales rose by 0.1%.

Sears Holdings Corporation is undergoing an overhaul, with efforts focusing on better prices and promotions, reducing costs, and investing in its loyalty program.

Divesting several businesses

The retailer, which has recently divested businesses, says falling electronics sales pushed down this quarter’s results, as did lower margins caused by aggressive promotions. It hopes its membership program and Internet business will push up sales.

Sears, which is controlled by billionaire Edward Lampert (Chairman and CEO), sold off its Lands’ End apparel unit earlier this year. The company says it plans to close down 130 stores in 2014, and hopes to sell its 51% stake in Sears Canada as well as its auto-center business.

During the last 14 quarters, Sears Canada reported a loss nine times.

(Data source: Sears Holdings Corporation)

While progress is evident in the company’s transformation, Mr. Lampert described Q2 results as “unacceptable”. He added that he was taking steps to address poor performance on several levels, including:

“…reducing costs as we evolve our business model, investing in our Shop Your Way and Integrated Retail customer initiatives, rationalizing our physical footprint and improving pricing and promotions.”

“As we move through the transformation, our new programs are becoming more prominent both in how we run the company and in how we serve our members, and we are pleased with how our members are responding.”