The Serious Fraud Office (SFO) has dropped a criminal investigation into allegations of price-rigging in the foreign exchange market. The SFO concluded that it found ‘insufficient evidence for a realistic prospect of conviction’.

Traders allegedly have used Internet chatrooms to organize the fixing of benchmark prices. The SFO looked carefully into activity during a 60-second window when key exchange rates are set – around 4pm each day (usually thirty seconds either side of 4pm).

“This decision follows a thorough and independent investigation lasting over one and a half years and involving in excess of half a million documents,” said an SFO statement.

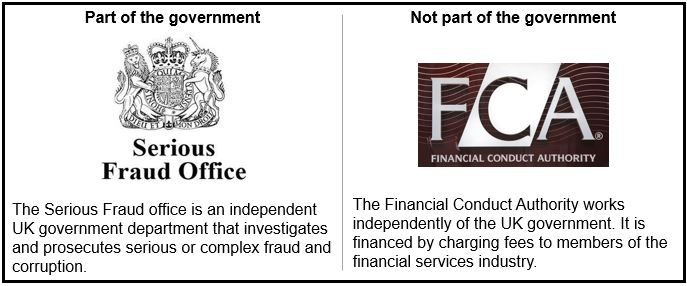

The investigation began in 2014 after information was passed by the UK’s Financial Conduct Authority (FCA) to the SFO about a group of traders in a chatroom called “the Cartel” who allegedly used coded language to manipulate benchmark exchange rates to increase margins.

HSBC, UBS, JP Morgan Chase, Bank of America, RBS, and Citibank were collectively fined £2.6 billion in 2014 over rigging foreign exchange rates. The following year RBS, UBS, Citibank, JP Morgan, and Barclays were fined by US authorities for misconduct in forex trading.

The SFO said that “based on the information and material we have obtained, that there is insufficient evidence for a realistic prospect of conviction”.

“Whilst there were reasonable grounds to suspect the commission of offences involving serious or complex fraud, a detailed review of the available evidence led us to the conclusion that the alleged conduct, even if proven and taken at its highest, would not meet the evidential test required to mount a prosecution for an offence contrary to English law,” it added.

“It has further been concluded that this evidential position could not be remedied by continuing the investigation.”

Robert Barrington, executive director of Transparency International UK, was quoted by The Financial Times as saying:

“This is a case in which there was clear wrongdoing, once again in the banking sector, and yet neither the individuals involved nor their senior managers have been held to account.”

Meanwhile Mark Taylor, Dean and Professor of Finance at Warwick Business School, told the BBC:

“I’m not really that surprised. They needed cast iron evidence of collusion.

“Obviously it’s not strong enough to test in court. I don’t blame the SFO if they didn’t have the evidence.

“I’m sure there are a few relieved traders out there, to be honest. People might say there is an issue in that people got away with it, but they are innocent until proven guilty.”

London accounts for 41% of global forex turnover, followed by the US (19%), Singapore (5.7%), Japan (5.6%) and Hong Kong (4.1%).

Mr Taylor, a former adviser to the Bank of England’s Fair and Effective Markets Review, said: “It’s time to move on. It would tarnish the reputation of the City more to have this dragged out over the next year or so.”