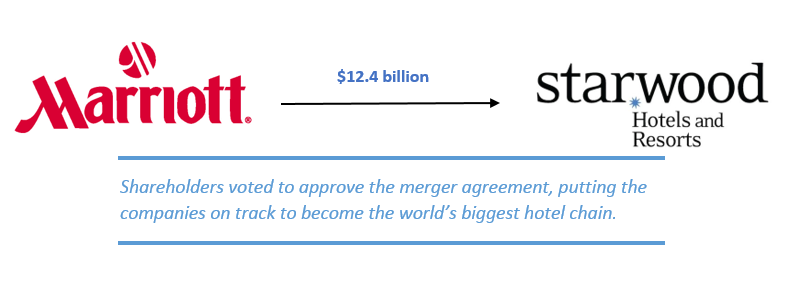

The Starwood-Marriott merger is a step closer to becoming a reality after shareholders of both hotel chains approved the tie-up.

Receiving shareholder approval is the latest victory for Marriott and its effort to acquire Starwood – creating the world’s largest hotel company.

Marriott will pay $12.4bn (£8.7bn) for Starwood after a bidding war against the Chinese firm Anbang.

Anbang had offered $14bn, but dropped the offer last week citing “market considerations”, giving Marriott a chance to merge with the owner of the Sheraton and Westin hotel brands.

“Today’s vote is a significant step toward closing, and we are grateful for the continued enthusiasm and support for this merger,” said Thomas Mangas, Starwood’s chief executive officer.

The tie-up will create a hotel chain with around 5,500 properties worldwide.

Marriott shareholders voted voted 97% in favour of the deal, while 95% of Starwood’s were in favour.

The deal is on track to close mid-2016. At closing Starwood stockholders will receive 0.8 shares of Marriott common stock plus $21.00 in cash for each share of Starwood common stock.

Arne Sorenson, Marriott’s president and chief executive officer, said, “With today’s successful stockholder approval milestone, we are that much closer to completing our transaction. Our teams continue to plan the integration of our two companies, and we are committed to a timely and smooth transition.

“We appreciate the stockholders’ vote of confidence in our ability to drive long-term value and opportunity as a combined company.”

Lazard and Citigroup are serving as financial advisors to Starwood Hotels & Resorts Worldwide and Deutsche Bank Securities is the financial advisor to Marriott International.

Cravath, Swaine & Moore is serving as legal counsel to Starwood Hotels & Resorts Worldwide and Gibson, Dunn & Crutcher is serving as legal counsel to Marriott International on the transaction.