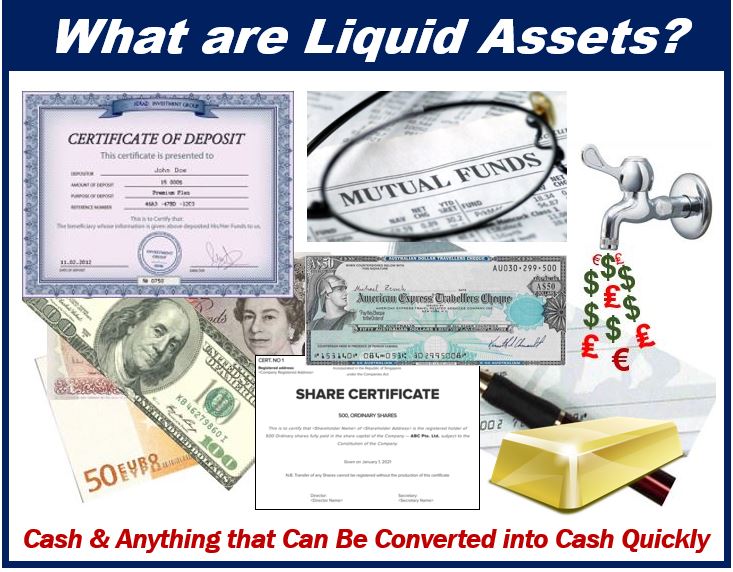

Liquid assets are anything that you own that quickly be converted into cash. For instance, in certain situations, such as when harassment by creditors occurs, and you want to pay them off quickly, access to liquid assets, such as money in your checking or savings account will allow you instant access to the funds needed.

Image created by Market Business News.

When talking about liquidity, cash will always be the priority, even when you may not have assets in the form of cash; something that can be sold for cash quickly is prime liquidity. In order to determine if assets qualify as liquid, there must be a large demand and market for the asset to be sold, and it must be easily transferable. Here are some non-liquid and liquid asset examples.

Non-Liquid Asset Examples

Non-liquid assets are things you have that are difficult to sell or liquidate quickly. This means that these specific assets generally won’t receive payment for a long period of time, even if there are interested parties or demand and market for these assets.

The length of time that it takes to receive payment is why they aren’t considered liquid. For example, if you own a property, and you want to liquidate it to pay off debts quickly, the period of time it will take to sell the property means you will not receive the cash in a short period of time. So, although it’s an asset, it is considered a non-liquid asset. Some non-liquid asset examples may include:

- Automobiles

- Recreational vehicles

- Boats

- Real estate

- Antiques and collectables

- Jewelry

- Retirement accounts, such as IRAs, 401ks, or investment accounts

Liquid Asset Examples

The main type of liquid asset you can have is cash; it is the most important asset you can have. Any amount of cash you have on hand or in your savings or checking account is considered liquid assets. Other liquid asset examples may include:

- Accrued income

- Certificates of deposit

- Tax refunds

Taxable investment accounts

If you have various investment accounts, they can be liquidated and converted into cash rather quickly. Investment accounts may include:

- Bonds

- Stocks

- Money market funds

- Mutual funds

- Other types of stock market investments

The only negative about investment accounts is that you should not depend on them the same way as you would rely on cash. This is because investments involve risk, so you may lose some of your money if the market decreases.

Accounts receivable

This is the amount of money you are due for services or goods that have been delivered and used by the customer, but you have not been paid in full for by the customer.

Inventory

This is the amount of materials and/or goods you have that are available to sell. Your inventory may be assets by personally owned or owned through your business.

Difference between Liquid and Fixed Assets

Fixed assets, also called liquid assets, are other assets or investments that you cannot liquidate quickly. For instance, your house or property, which may be valuable, would be difficult to sell quickly. If you are looking to sell a fixed asset quickly, you may be forced to accept less than it’s worth due to the lack of demand and market. Examples of fixed assets may include:

- Real estate properties

- Jewelry

- Antiques

- Your vehicle

- Furniture

The main thing about these types of assets is that they may have consistent prices and a fairly stable market; however, the ability to sell your vehicle or your furniture limits how quickly you’ll have access to the cash because it may be difficult to find a buyer. Whereas liquid assets are sellable quickly, for example, you can sell your investments quickly and have the cash in a relatively short period of time.

Tips to Build Liquid Assets

When you build your liquid assets, it means that you’re providing yourself with a financial insurance plan. If there is an emergency, you will have the money available to cover yourself for any unexpected incident.

The first step is to review all of your assets and then rank them in order of liquidity. If you do not have enough cash to cover an emergency, then you should start with building an emergency fund and add to the fund as often as possible.

It’s generally recommended that your emergency fund should cover your basic needs and expenses for a minimum of three months if you lost your job. Other ways to build liquid assets may include:

- Use mobile banking apps and investment apps that only initially require a few dollars

- Use a budget calculator to help with short-term planning and an investment calculator to give you an idea of how assets can grow over time

- Reduce expenses. The less money you spend, the more you can add to your net worth

- Pay off your mortgage. Once you get your largest debt paid off, you can quickly add to your liquid assets. Making bi-weekly payments instead of monthly will help you pay off the mortgage quickly.

Making sure you have access to plenty of cash and other types of liquid assets is critical, not only for covering your everyday expenses but also in case of an emergency. Carefully inventorying and understanding which assets are liquid will save you time if the need arises to get quick cash.

Interesting related article: “What is illiquid mean?”