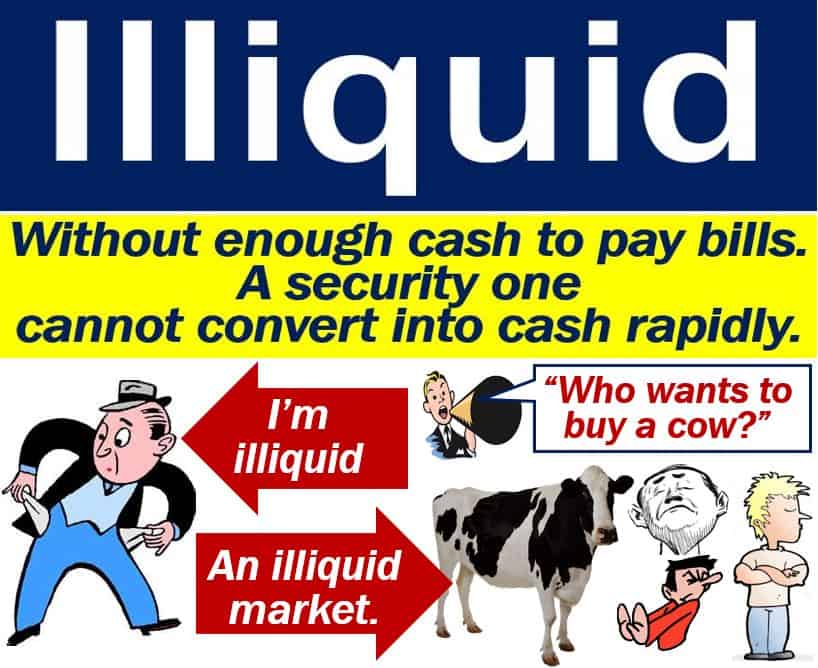

Illiquid companies do not have enough cash to pay bills, salaries, and other costs when they are due. An illiquid security is one that we cannot easily sell, i.e., we cannot convert it into cash easily. We can use that term for any asset that is difficult to sell quickly.

When there is very little trading volume in a market, we say it is an illiquid market, i.e., market liquidity is low. In this type of market, it is hard to purchase or sell assets quickly.

Illiquid securities

If you have an illiquid security, it means that you cannot turn it into cash quickly. There are not enough ready buyers for it.

This type of asset also has a greater discrepancy between its asking and bidding price. In other words, the difference between how much you pay for it and sell it for is larger than normal.

When this discrepancy is high, sellers can lose a lot of money, especially if they need to sell quickly.

The opposite of illiquid assets are liquid assets. Liquid assets or quick assets are current assets that we can convert into cash rapidly.

Illiquid company

When a company has low liquidity, it means that it does not have enough ready cash to meet its immediate debt obligations.

However, it does not mean the company has no assets. It might have expensive real estate, as well as vehicles, machinery, or livestock.

Nevertheless, it cannot convert those assets into cash rapidly. A low liquidity problem is a cash flow problem.

Cash flow refers to the flow of money in and out of a company or an account. Cash flow problems, in this context, means not having enough cash available to pay bills, costs, and other debt obligations.

Liquidity refers to how quickly I can convert an asset into cash or how much ready cash a company has.