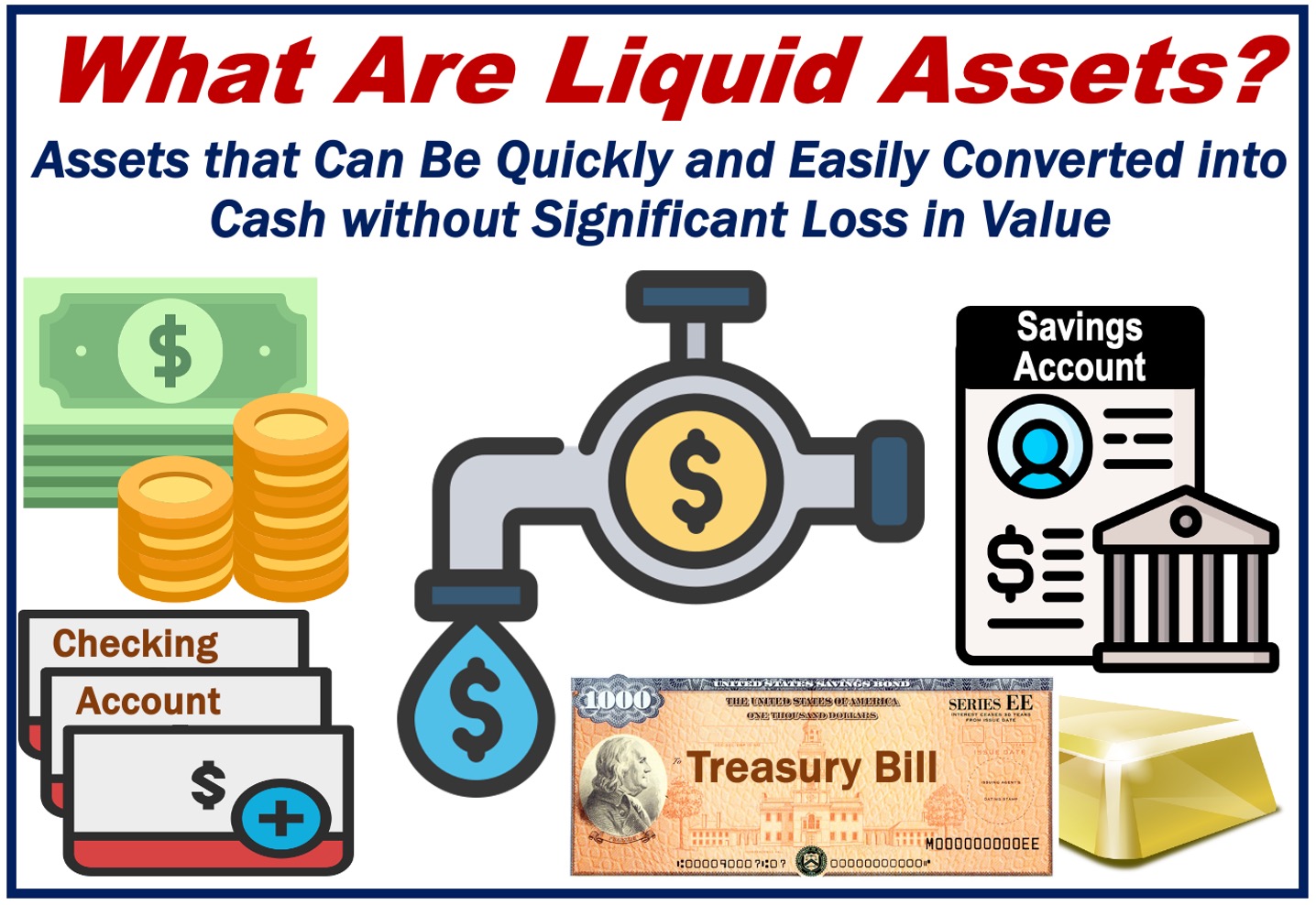

Liquid Assets, also known as Quick Assets, are current assets that we can turn into cash quickly. Quickly, in this context, means within about one month. The most liquid asset is cash, i.e., banknotes and coins. Checking accounts are also very liquid.

High liquidity facilitates a company’s ability to capitalize on market opportunities quickly, without the need to liquidate assets at a discount.

Almost as liquid as cash

A liquid asset is nearly as liquid as cash. It experiences negligible changes in price when we try to sell it. In other words, the difference between how much we pay for it and sell it for is very small or zero.

If you try to sell this asset, you will find many willing buyers in the market. This subsequently helps maintain its price.

A company rich in liquid assets can usually pay its bills on time. A company with mainly illiquid assets, on the other hand, has more problems.

We call an asset which we cannot convert into cash quickly an illiquid asset.

The Economic Times has the following definition of the term:

“An asset is said to be liquid if it is easy to sell or convert into cash without any loss in its value.”

Gold and silver are liquid assets because we can convert them into cash or cash equivalents easily. However, they are less ‘liquid’ than checking accounts or cash.

In addition to corporate finance, liquid assets are crucial for individual investors, providing a buffer in case of personal emergencies or unexpected expenses.

Examples of liquid assets:

- stocks

- money market instruments

- money deposited into a savings or checking account

- government bonds

- gilt-edged securities

- demand and time deposits

- accounts receivable (money owed to a company by customers) and inventories

Liquid assets and liquidity metrics

-

Calculating Current Ratio and Working Capital

According to the 2013 Basel Accords definition, there is a Level 1 liquid asset and also a Level 2.

– Level 1 Assets consist of highly-rated foreign sovereign debt and bank reserves. This category also includes domestic sovereign debt.

– Level 2 Assets are a little bit less liquid. This category includes top corporate bonds and lower-rated foreign sovereign debt.

We include these types of assets in several calculations to determine a company’s liquidity.

A company’s cash ratio, for example, tells us whether it could use its liquid assets to pay off its current liabilities. We calculate cash ratio by adding all cash and cash equivalent and dividing the total by short-term obligations.

Current assets include all liquid assets plus other assets that we can convert into cash within one year.

Derivatives of ‘liquid’ in business English

Derived from the root word ‘liquid,’ there are numerous terms in Business English that capture various aspects of asset convertibility and market fluidity. Below are ten such derivatives:

-

Liquidity

The ease of converting an asset to cash.

For example: “The company’s high liquidity allowed it to cover unexpected expenses without taking on debt.”

-

Liquidate

To convert assets into cash.

For example: “The business needed to liquidate some of its inventory to pay the urgent loan.”

-

Liquidator

A person or entity that conducts liquidation.

For example: “The court appointed a liquidator to distribute assets during the bankruptcy proceedings.”

-

Liquidation

The act of converting assets into cash.

For example: “The liquidation of assets was necessary to satisfy the creditors’ demands.”

-

Liquid Market

A market with frequent transactions allowing for quick asset sales without significant price impact.

For example: “He preferred trading in a liquid market to ensure he could buy and sell shares at any time.”

-

Liquid Asset

An asset that can be rapidly sold for cash.

For example: “Treasury bills are considered liquid assets due to their high market demand.”

-

Liquidity Crisis

Difficulty in meeting financial obligations due to an inability to liquidate assets quickly.

For example: “The company faced a liquidity crisis when its major debtors delayed payments.”

-

Liquidity Preference

The tendency to prefer holding cash or liquid assets.

For example: “Investors showed a strong liquidity preference during the economic uncertainty.”

-

Liquidity Premium

Extra return expected for investing in less liquid assets.

For example: “The fund manager sought a liquidity premium for the investment’s limited marketability.”

-

Liquidity Risk

The risk of not meeting short-term debts because of hard-to-sell assets.

For example: “The firm managed its liquidity risk by maintaining a balance between liquid and fixed assets.”

Video – What are Liquid Assets?

This educational video, from our sister channel on YouTube – Marketing Business Network, explains what ‘Liquid Assets’ are using simple and easy-to-understand language and examples.