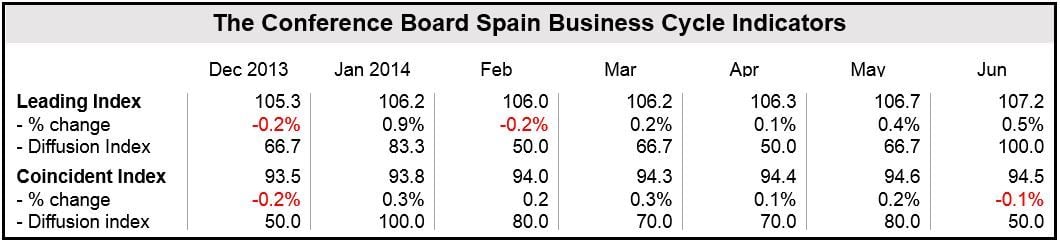

While Spain’s Leading Economic Index for June increased by 0.5%, its Coincident Economic Index declined by 0.1%, says The Conference Board.

Spain has had a turbulent time since the turn of the millennium. From 2000 to 2005, it created over half of all new jobs in the European Union.

In 2008, the bubble exploded. Its construction and real estate sectors saw massive layoffs, which led to collapsing demand for goods and services and rapidly-growing unemployment.

The country suffered a larger downturn during the Great Recession than most of its neighbors, with the exception of some other Mediterranean countries.

Earlier this year, signs have pointed to a sustained economic recovery.

Spain’s Leading Economic Index (LEI)

The LEI is aimed at predicting future economic activity. A rising index means outlook is positive, there is likely to be increased economic activity, while a falling index signifies the opposite.

All the six components that make up the LEI increased in June. Below is a list of their contributions in order of size (first is largest and last is smallest contribution):

- long-term government bond yield (inverted),

- order books survey,

- Spanish contribution to Euro M2,

- job vacancies,

- Spain’s equity price index,

- the capital equipment component of industrial production.

After June’s 0.5% rise, Spain’s LEI is currently at 107.2 (2004 = 100). In April and May LEI increased by 0.1% and 0.4% respectively.

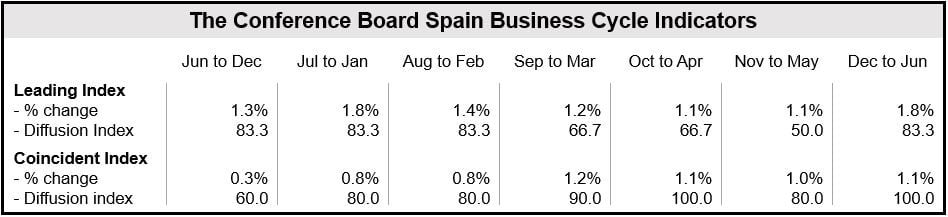

During the first half of 2014, LEI rose by 1.8%, with five of the six components contributing positively.

(Data source: The Conference Board)

Spain’s Coincident Economic Index (CEI)

CEI indicates the state of current economic conditions. It helps investors and economists determine where in the business cycle the economy is.

Of the five components that make up the CEI, three contributed positively to June’s results. Below is a list of their contributions in order of the size of their impact:

- Final household consumption (positive),

- employment (positive),

- real imports (positive),

- retail sales survey (negative),

- industrial production excl. construction (negative).

After June’s 0.1% decline, Spain’s current CEI stands at 94.5 (2004 = 100). In April and May it rose by 0.1% and 0.2% respectively.

From January to the end of June (first half of 2014) CEI increased by 1.1%, with all the five components making a positive contribution.

(Data source: The Conference Board)

In May, 2014, ratings agency S&P raised Spain’s rating from BBB- to BBB, saying the country was showing signs of GDP growth and fiscal consolidation.