What is stagflation? Definition and meaning

Stagflation, a portmanteau of stagnation and inflation, is a term used in economics when a country experiences high inflation, elevated unemployment, and stagnant demand. A portmanteau is a word that combines the sounds and meanings of two others. When a country’s economy experiences stagflation, the economy is stagnant – not growing – and inflation is high.

The term was coined by Iain Macleod, a British conservative politician in a speech he delivered in 1965:

“We now have the worst of both worlds – not just inflation on the one side or stagnation on the other, but both of them together. We have a sort of ‘stagflation’ situation. And history, in modern terms, is indeed being made.”

However, the word did not become popular until the 1970s, when the combination of high unemployment and rising inflation plus sluggish GDP (gross domestic product) growth, occurring simultaneously, began to spread.

When there is stagflation, prices are going up too fast, consumer and business demand is weak, the economy is either growing at a snail’s pace or not at all, and unemployment is too high.

When there is stagflation, prices are going up too fast, consumer and business demand is weak, the economy is either growing at a snail’s pace or not at all, and unemployment is too high.

Stagflation in the 1970s

Between 1973 and 1982, stagflation had become prevalent in eight major economies – the United States, United Kingdom, Germany, Japan, France, United Kingdom, Italy and Canada.

By 1982, when inflation rates began to decline, economists shifted their focus towards what John Helliwell described in a 1988 article – ‘Comparative Macroeconomics of Stagflation” – to the “determinants of productivity growth and the effects of real wages on the demand for labor.”

Collins Dictionary has the following definition:

“If an economy is suffering from stagflation, inflation is high but there is no increase in the demand for goods or in the number of people who have jobs.”

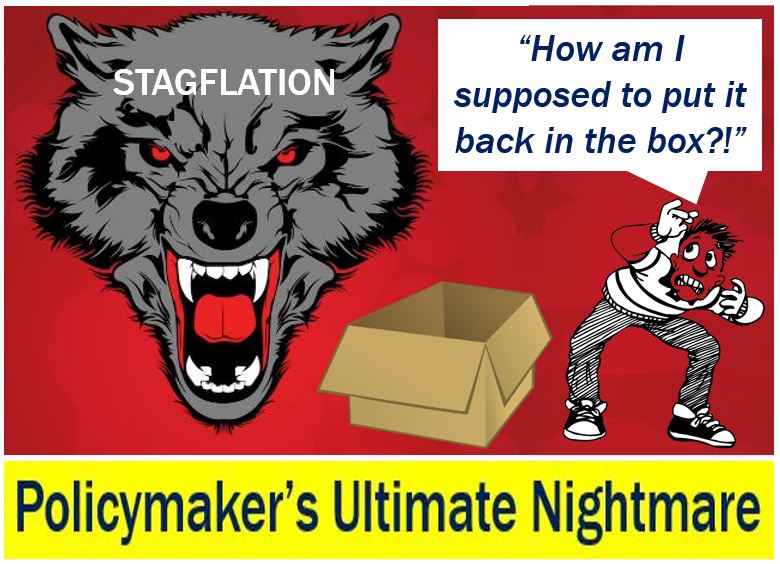

For policymakers, stagflation is the ultimate nightmare, because all measures taken to reduce inflation tend to push up unemployment, while actions used to bring down unemployment exacerbate inflation.

What causes stagflation?

Economists across the world have two possible explanations for why economies get stuck in a low growth, rising inflation, plus high unemployment rut.

1. It may occur when a country’s productive capacity is reduced by an unfavorable supply shock, resulting in an oil-price increase for an oil-importing nation.

This type of unfavorable supply shock tends to push up prices while slowing down the economy, by making production more expensive and thus less profitable at the same time.

2. Inappropriate macroeconomic policies can result in a combination of rising prices, a slowing economy, and higher unemployment.

The central bank may trigger stagflation if it allows excessive money supply growth. Measures taken to reverse the undesirable effects of too much growth in the money supply can bring on stagflation.

For policymakers, putting the stagflation demon back in the box is extremely difficult. Any measures they take to boost the economy are likely to make inflation worse, while anything they try to do to address rising prices will slow the economy down even further, push up the number of jobless people, and kill demand.

For policymakers, putting the stagflation demon back in the box is extremely difficult. Any measures they take to boost the economy are likely to make inflation worse, while anything they try to do to address rising prices will slow the economy down even further, push up the number of jobless people, and kill demand.

Excessive regulation of the goods and labor markets may also slow down the economy, raise unemployment and push up the prices of products and services.

In the 1970s, the price of oil shot up considerably. Central banks responded by excessively stimulating monetary policy to counteract the resulting recession. The result was a runaway price/wage spiral.

Video – What is stagflation?

In this Khan Academy video, the speaker explains what stagflation is using simple language and easy-to-understand examples. He starts by talking about what happened to several major economies during the 1970s, when the oil embargo hit.