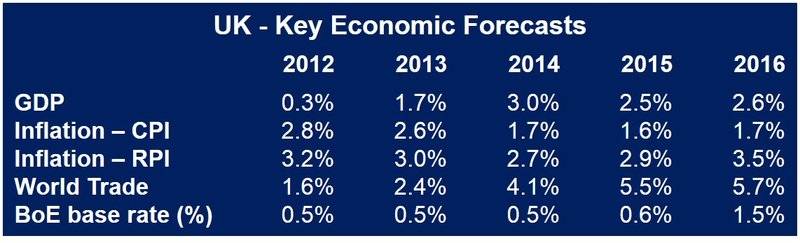

The manufacturers’ organization EEF has predicted strong British manufacturing growth for 2014, up to 3.6% according to its latest quarterly survey, well ahead of GDP growth forecast of 3%. The survey was carried out by EEF together with business advisers and accountancy firm BDO.

Manufacturing outlook for the second quarter reveals a continued optimistic picture with all sectors and regions showing strong trading positions.

Hiring intentions in UK manufacturing have been positive in every quarter except one since the beginning of 2010.

Exports weak

However, strong growth is depending too much on domestic demand, with export orders declining after last quarter’s record expectations. A stronger pound sterling plus weaker-than-expected GDP growth in the US and the Eurozone have kept exports down. However, EEF expects global opportunities to pick up in the third and fourth quarters.

Ms. Lee Hopley, EEF’s Chief Economist, said:

“There is a definite sense of confidence amongst manufacturers, reflected in a range of recent data releases and the continuing strong positive balances in our latest quarterly survey. This should help sustain broad based growth across the UK. Given that manufacturers’ investment plans have been hovering near record highs for several quarters, industry has likely been a significant contributor to the recent recovery in business investment.”

Ms. Hopley added that there is still some uncertainty regarding exports.

Motor vehicle sector especially strong

Head of Manufacturing at BDO, Tom Lawton, added:

“Now that Manufacturers have been freed from the shackles of recession they are proving their importance to the UK economy by leading it out of the downturn, outperforming both the service sector and GDP more generally. The motor vehicle industry is showing particular strength but the most encouraging aspect of this recovery is that it is so robust in nature with all subsectors showing an increase in output.”

Mr. Lawton praised UK government policies, which he says are now paying dividends and creating an environment in which manufacturers are confident enough to make future investment plans, both in terms of capital and employment.

Mr. Lawton said “What is now needed is a focus on how this success in the UK can be replicated abroad and we would encourage the Government to introduce more supportive measures to support exports, especially given the tentative nature of economic recovery in Europe.”

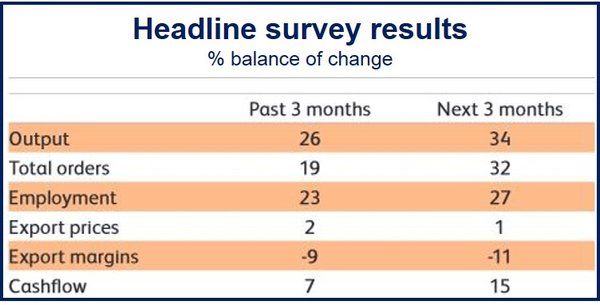

Output and order balances remain strong in Q2 compared to Q1, with output increasing to +26% from +22%, and new orders at +19% (about the same as during the last five quarters).

Positive responses were registered in all sectors, with motor vehicles reporting the strongest balance at +43%. With several new vehicle models being launched in the coming year, the sector is expected to continue with the strongest balance.

Future looks good

Forward-looking output balances are expected to rise to +34% from +29%. A positive balance of +32% of companies are planning for sales growth during the next three months.

A balance of +16% of manufacturers reported increasing UK sales, the same as the previous quarter, while the export order balance dropped to +9% compared to +16% last quarter. However, manufacturers are expecting a stronger exports increase in the third quarter.

(Source: EEF)

Both investment and hiring intentions remain strong. A balance of +23% of manufacturers expect to hire new staff in the next quarter, with all sectors except for metals registering positive balances.

In sixteen of the last seventeen quarters, EEF’s surveys have shown positive hiring intentions. According to official data, manufacturing employment has risen since the beginning of this year, the longest period of employment increase in manufacturing since the mid-1990s.

Although investment intentions remain strong and are positive in all sectors, they have eased from a positive balance of +34% in the previous quarter to +28%. EEF added “However, business investment remains 17% below the pre-crisis peak indicating significant scope for catch up.”

(Source: EEF)

The International Monetary Fund (IMF) warned the UK about its housing market. House price inflation is accelerating across the country and is particularly marked in London. The steady increase in the size of new mortgages in relation to people’s incomes points to an increasingly more vulnerable population to interest rate or income changes.