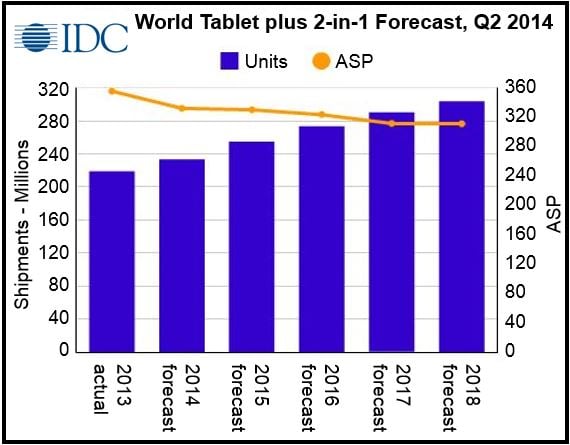

Tablet forecasts for 2014 have been lowered to 233.1 million units, following two successive quarters of softer-than-predicted demand. International Data Corporation’s (IDC’s) new Worldwide Quarterly Tablet Tracker reduced its previously predicted 12.1% year-over-year growth rate to 6.5%.

Personal computer (PC) sales, on the other hand, are forecast to decline less severely than previously estimated.

Jean Philippe Bouchard, Research Director for Tablets, said:

“When we look at the global picture, it would be easy to say that the tablet market is slowing down. But, when we start digging into the regional dynamics, we realize that there is still a good appetite for this product category.”

“While mature markets like North America and Western Europe will combine for flat unit growth in 2014, the remaining regional markets will generate 12% unit growth over the same period.”

(Data source: IDC)

Price pressure on tablets

IDC predicts that price pressure on tablets with screen sizes less than 8 inches, plus evolving tablet usage in emerging markets, will drive that unit growth.

In the advanced economies, consumer preference toward larger screens and cellular-enabled tablets will help keep average selling prices (ASPs) at about $373. In the other markets ASPs are expected to decline to approximately $302, i.e. an annual fall of 10%.

IDC gives as an example of evolving tablet usage, sales of tablets with a built-in option of voice calling over mobile networks in the Asia/Pacific region (excl. Japan), which reached 25% (60% annual growth).

(Data source: IDC)

Emerging market growth

This shift in consumer trends in the Asia/Pacific region suggests shoppers are seeking a single device that includes voice communication as well as media consumption – for some users, this means a tablet rather than a smartphone.

Jitesh Ubrani, Senior Research Analyst for the Worldwide Tablet Tracker, said:

“Driven primarily by small devices, we expect the rest of the world to account for the majority of shipments in the years to come. But in terms of dollars spent, medium- to large-sized devices in North America and Western Europe will still produce significant revenues.”

IDC predicts that sales in the mature markets will remain flat this year, but will grow by about 12% in the emerging markets.

PC sales forecast less pessimistic

IDC now expects the decline in PC sales to be -3.7% for 2014, rather than the previous estimate of -6%.

The improved PC outlook is mainly due to companies replacing their machines powered by the now obsolete Windows XP software.

Hewlett Packard earlier this month reported better PC sales for the same reason.

The increased sales of laptop and desktop computers in the advanced markets should more than offset the decline in emerging markets such as Latin America, the Middle East and Asia, says IDC.