Illustration by Freepick

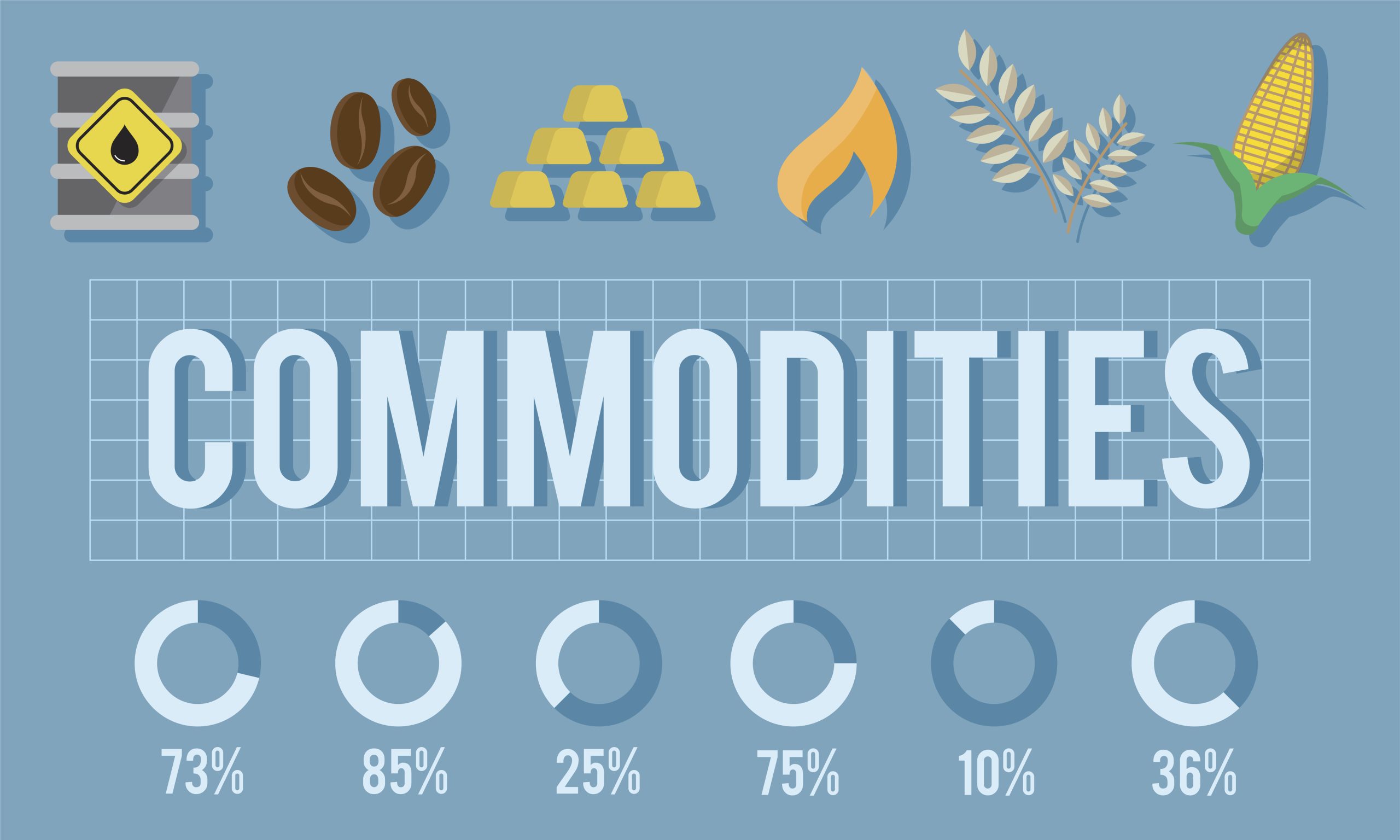

Wondering how to take advantage of the global commodities market? Commodity trading offers a dynamic opportunity to invest in essential goods like agricultural products and raw materials. This guide from INFINOX provides a comprehensive introduction for beginners, exploring the world of soft and hard commodities.

What Are Soft and Hard Commodities?

Soft commodities or agricultural commodities are products that are naturally produced and grown. These commodities are a key part of the global supply chain and include products such as coffee, cotton, cocoa, and sugar. Due to their sensitivity to weather conditions, crop diseases, and other agricultural factors, soft commodities are considered highly volatile in terms of price, which makes them appealing to traders seeking high-risk investments.

Hard commodities are non-agricultural raw materials or natural resources extracted through mining or drilling. These are metals such as gold, silver, and copper and energy resources such as crude oil, natural gas, and coal. Hard commodities’ prices respond to geopolitical factors, technology, and supply shocks, which offer a unique risk-reward profile for traders.

Commodity Trading Basics

Commodity trading is the act of buying, selling, or trading these raw materials in various financial markets. Commodity prices are determined by supply and demand factors which can fluctuate greatly due to macroeconomic conditions, geopolitical events, and market speculation. Traders and investors participate in commodity markets to hedge against inflation and diversify their portfolios.

How to Trade Commodities

Commodity trading can be done through various financial instruments and markets. Here are the main ones:

-

- Stocks: One way of getting exposure to the commodity markets is by investing in stocks of companies that manufacture, mine, or refine commodities.

- ETFs (Exchange-Traded Funds): Commodity ETFs are designed to track the prices of a group of commodities, offering market access in a diversified manner. Some ETFs hold physical commodities, others use derivatives to track the prices.

- Futures Contracts: Futures contracts are binding contracts to purchase or sell a given amount of a commodity at a fixed price and time in the future. These are quoted on exchanges and are used by traders to bet on future price directions.

- Contracts for Difference (CFDs): CFDs allow speculation on commodity price movements without owning the underlying asset. You can profit from both up and down markets, amplify your exposure, and open short-term trades. Having said that, you must also remember that alongside the profit potential also comes a risk of loss – both on up and down markets. INFINOX is a leading broker that simplifies commodity trading by offering CFDs on many commodities. Its main advantage is its multi-regulation, which means that the brand promotes responsible and educated decision making, mitigating unwanted risks.

Key Considerations for Commodity Trading

- Commodity trading requires a lot of research and awareness of market trends, supply and demand, and geopolitical events that can impact pricing.

- Risk management is key in volatile commodity markets. Set stop-losses, diversify your portfolio, and use leverage with care.

- Monitor market news, economic data, and geopolitical events that can impact commodities. Staying informed will help you make better trading decisions and respond to market movements.

Wrapping Up

Commodity trading opens a versatile avenue for traders looking to capitalize on global trends. Whether you prefer the agricultural focus of soft commodities or the industrial aspect of hard commodities, a well-informed approach and careful strategy can help you succeed in this exciting trading landscape.

Interesting Related Article: “How to Start Commodity Trading“