The Toronto stock market closed flat on Wednesday, following news from the US Fed that it won’t be increasing rates any time soon.

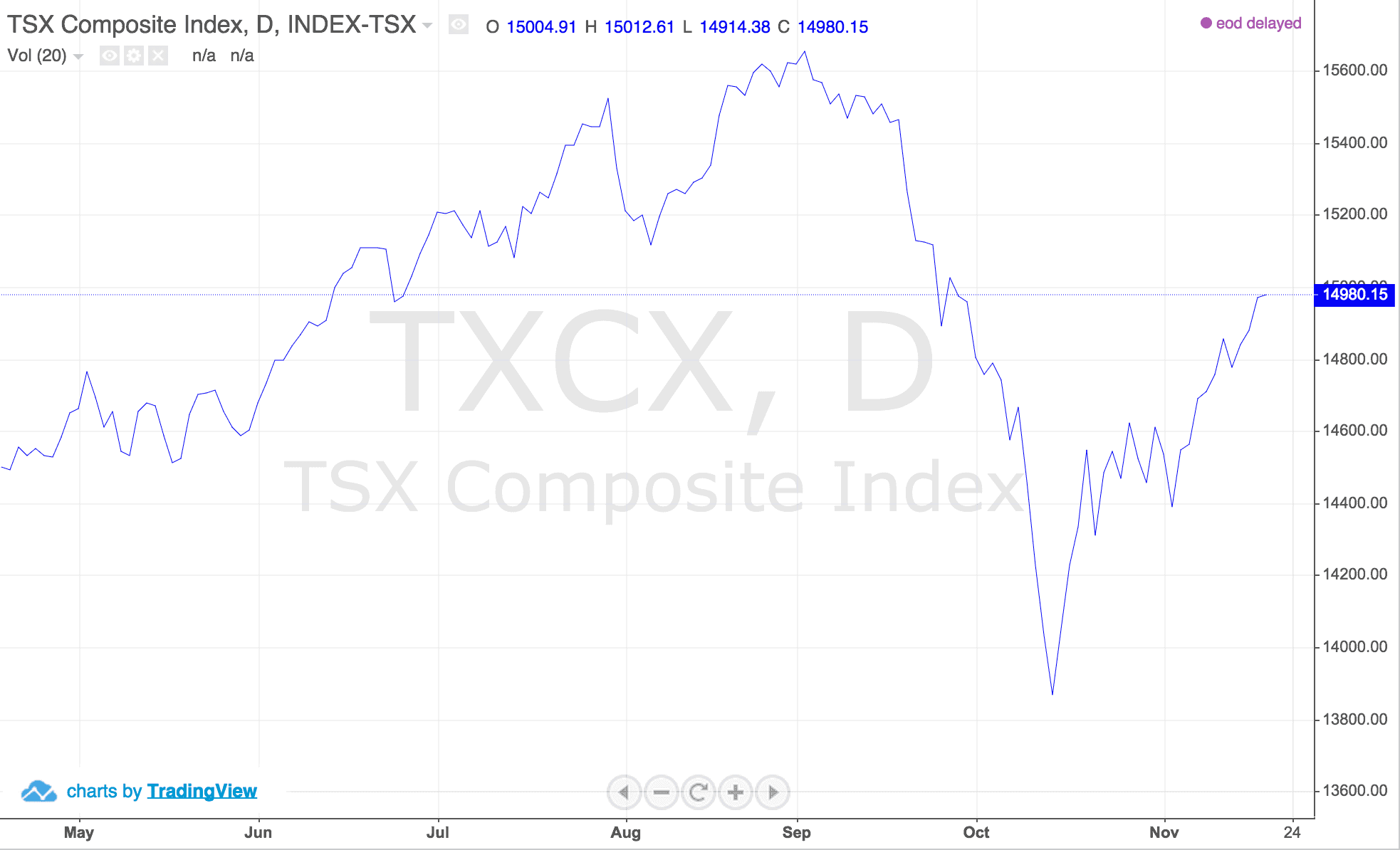

The S&P/TSX composite index climbed up 7.18 points to 14,980.15. The index’s energy sector (accounting for 24% of the index) dropped by 0.75%, and the materials sector was down 3.78%.

All other eight sectors experienced gains, led by Consumer Staples, which gained 2.62%.

Metro Inc. shares surged by 9.70%, closing at 90.50 after it reported profit of $115.6-million – ahead of estimates.

TransCanada Corp. rose by 2.68%, closing at 57.50, after CEO Russ Girling said he expects the company’s dividend to grow at an average annual rate of at least 8% through 2017.

Notable drops include Iamgold Corp., which dropped by 9.45%, down to 2.49 per share, as well as BlackBerry Limited, which fell by 5.01% down to 11.56. Suncor Energy was down 1.17%, in addition to Pacific Rubiales Energy, which fell by 1.13%.

Energy companies have been affected by slumping oil prices, with crude oil at around the US$75-a-barrel level.

Paul Vaillancourt, executive vice-president, private wealth at Fiera Capital in Calgary, told the Financial Post:

“I think the oil price has overshot to the downside,”

“I’m not sure we’re going to revisit the $100-a-barrel level. That wasn’t warranted where we were in the economic recovery. But 75 bucks is not accurate either. It’s not a proper reflection. I think it should be bouncing back towards the $80 level.”

The Canadian dollar dropped 0.40 of a cent to 88.10 cents US.

In US markets the New York’s Dow industrials fell by 2.09 points to 17,685.73, the Nasdaq dropped 26.73 points to 4,675.71 and the S&P 500 index edged down 3.08 points to 2,048.72.