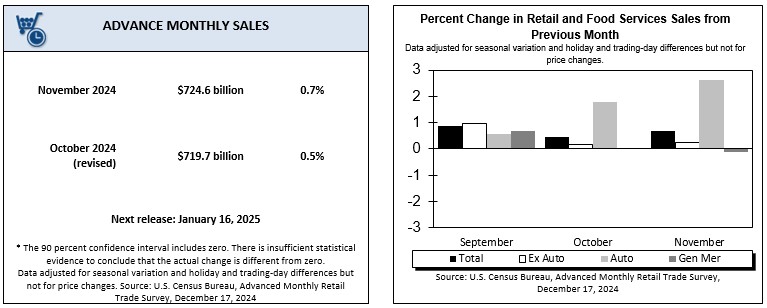

American shoppers turned out in slightly stronger force than anticipated as the holiday season got underway in November, according to fresh data from the Census Bureau released Tuesday. Retail sales edged up by 0.7% last month, a shade above the widely expected 0.6% increase (according to Bloomberg data). This builds on October’s performance, which was revised upward from 0.4% to 0.5%, signaling that consumers are hardly slamming on the brakes, even as the year winds down.

Looking deeper into the figures, it’s clear that a handful of specific categories did much of the heavy lifting. Auto dealerships enjoyed a 2.6% jump in sales, marking the second consecutive month of strong gains. Industry analysts say these results were hardly a fluke: dealers have been cutting deals and offering incentives to clear growing inventories, and consumers, encouraged by stable employment and relatively steady incomes, took advantage. Online retailers also saw a healthy bump, with a 1.8% gain. Early promotions and a more competitive digital landscape likely nudged shoppers to click “add to cart” a bit more often, underscoring how e-commerce remains a bright spot in the broader retail ecosystem.

Still, the retail terrain wasn’t universally smooth. Grocery stores slipped by 0.2%, department stores dropped 0.6%, and restaurants and bars, a segment that tends to reflect how much discretionary spending consumers feel comfortable with, fell 0.4%. While one month’s dip doesn’t rewrite the narrative, it might raise eyebrows among those watching for subtle shifts in spending patterns. Could these declines be an early sign that households, faced with credit card balances inching up and questions about future price tags, are pulling back at the margins? Or are shoppers simply being selective, choosing where they open their wallets rather than cutting spending across the board?

From a broader perspective, retail sales remain about 3.8% ahead of last year’s pace, a number not too far off the pre-pandemic trend. Unemployment remains historically low, and many families still benefit from improved household balance sheets that accumulated during the early pandemic period. Yet economists caution that as we head into 2025, several challenges loom. There is ongoing chatter about new tariffs next year that might push up certain costs, and wages, while still growing, aren’t soaring at the same clip they did earlier. Financing costs, tied to the Federal Reserve’s tighter monetary policy, remain a concern, and consumers aren’t blind to the headlines, either. Even the mention of potential immigration crackdowns or shifting trade policies can cast a shadow over confidence.

The Federal Reserve, set to announce a decision on interest rates on Wednesday, will have its own reading of these figures. The central bank is expected to trim rates by a quarter-point, marking its third cut since September. Strong consumer demand, reflected in these numbers, doesn’t necessarily stop them from doing so, but it may influence the pace of further moves down the line. After all, if spending remains fairly robust, that could keep inflation from cooling as quickly as policymakers hope. In that scenario, officials might think twice before delivering additional cuts early next year.

Meanwhile, businesses that rely on holiday shopping have reason to feel at least somewhat encouraged by November’s bump. Fourth-quarter economic growth could get a lift if the momentum carries into December. But no one is declaring victory too soon. Some industry watchers argue that November’s outperformance may have come from temporary factors; seasonal promotions, generous auto discounts, and the tail end of this year’s relatively good labor market conditions.

As we approach the next chapter, both a new year and the early policies of a new administration, many are wondering what early 2025 will look like. Will consumers maintain their steady stride, or could next year’s potential tariff pressures and credit constraints start weighing more heavily? For now, the data suggests Americans are still spending, just more carefully. They haven’t run for the exits, but they seem to be glancing around, assessing their options, and perhaps pondering where inflation and economic policy will push prices next.

In short, November’s numbers show consumers still in the game, though maybe not sprinting as eagerly in every direction. Retailers can take comfort that the holiday season got off to a decent start, while economists and policymakers puzzle over the mixed signals. The bigger question, as holiday lights twinkle and year-end sales continue: once the gift wrap is thrown away and the incentive-laden car deals dry up, will Americans keep swiping their cards with the same conviction? For now, it’s anyone’s guess, and the coming months will offer a better sense of whether this late-year spark was a season’s greeting or something more lasting.