According to the latest British Chambers of Commerce’s (BCC) Quarterly Economic Survey, domestic *demand dropped for both manufacturing and services companies in the first three months of the year.

* Demand is an economic term that refers to consumers’ desire and willingness to pay a price for a certain (or all) goods or services.

The results of the survey follow a series of similarly disappointing economic data since the start of the year. Industrial output has fallen and consumer confidence has dropped from last year’s highs.

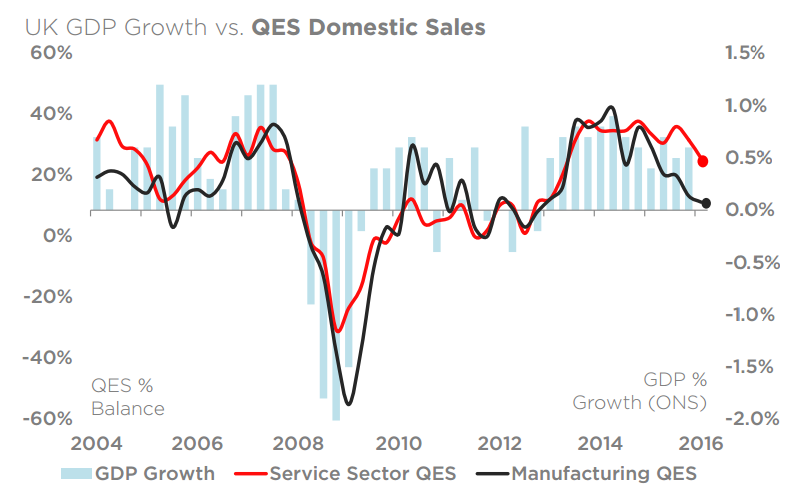

The survey, based on more than 8,500 responses from firms in Q1 2016, suggests that growth in the UK economy continued to soften in the first quarter, with most key survey indicators either static or decreasing.

The BCC’s gauge of services exports dropped to its lowest since the end of 2011, while domestic sales growth for manufacturers dropped to the lowest level in four years.

Results of the BCC Quarterly Economic Survey

Domestic sales:

11% of manufacturers reported improved domestic sales in Q1 2016, down from +13% in Q4 2015.

25% of service firms reported improved domestic sales in Q1 2016, down from +32% in Q4 2015.

Export sales:

8% of manufacturers reported improved export sales in Q1 2016, up from +1% in Q4 2015.

13% of service firms reported improved export sales in Q1 2016, down from +15% in Q4 2015.

Employment growth:

13% of manufacturers reported an increase in their workforce in Q1 2016, down from +20% in Q4 2015.

16% of service firms reported an increase in their workforce in Q1 2016, down from +23% in Q4 2015.

Dr Adam Marshall, Acting Director General, British Chambers of Commerce, said:

“Our latest survey results suggest that the UK economy is in a holding pattern. While the picture is static overall, there are clear indications that economic growth is continuing to soften. From sales and orders to confidence and investment intentions, many of the business indicators we track are at a low ebb.”

David Kern, Chief Economist, British Chambers of Commerce, commented:

Although GDP growth for the previous quarter was upgraded slightly, our survey points to a slowdown in Q1 2016. This is the inevitable consequence of mounting global and domestic uncertainties, but it is nevertheless concerning that the vibrant and dominant services sector is likely to face mounting challenges in the next few years.

Companies were questioned between February 22 and March 14. A total of 2,112 firms in the manufacturing sector, employing approximately 317,000 people, took part in the survey. In the services sector, 6,430 businesses with approximately 889,000 employees responded.