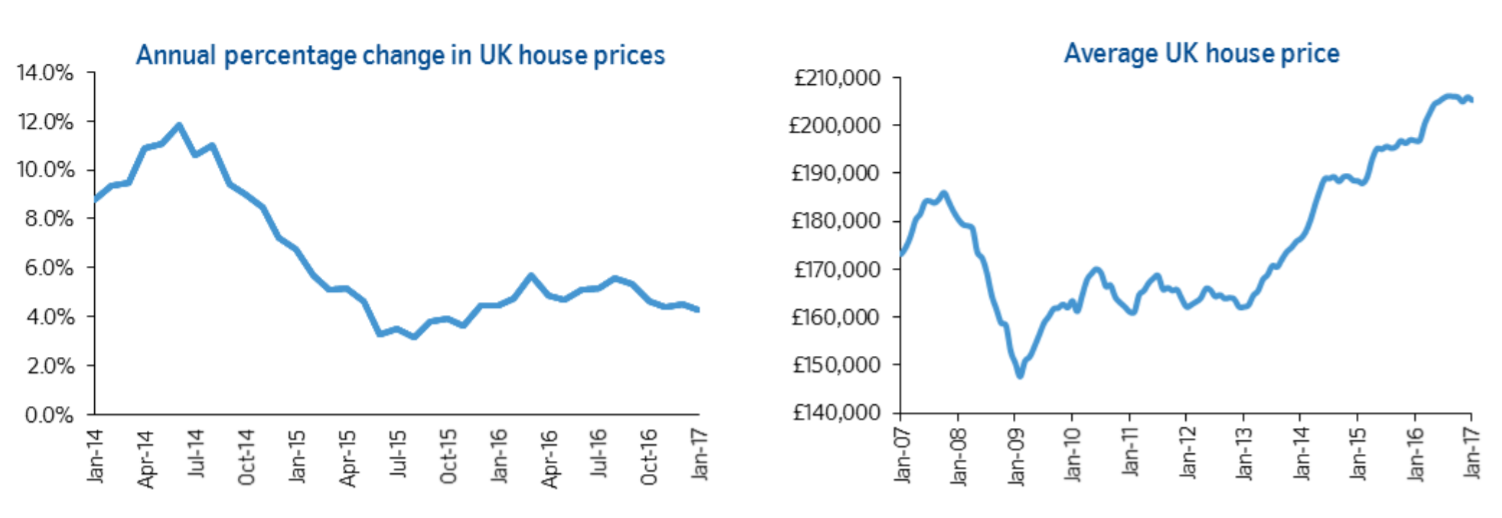

UK house price growth dropped to its weakest level in over a year last month and there are signs that conditions may be about to soften, according to mortgage lender Nationwide.

House prices rose by 0.2% in January, down from a 0.8% rise in December.

House prices were 4.3% higher last month compared to January 2016, with the average price of a property rising to £205,240 – up £8,400.

However, Nationwide economist Robert Gardner, said “the outlook for the housing market remains clouded.”

Although there had not been a negative impact on the British economy after the Brexit vote last summer, Gardner warned that “there are tentative signs that conditions may be about to soften.”

“With inflation set to rise further in the months ahead as a result of the weaker pound, real wages are likely to come under further pressure,” he said.

Adding, “Employment growth is also likely to continue to moderate, should the economy slow as most forecasters expect.”

Prices are expected to continue to rise though, Gardner said, albeit at a slower rate of around 2%, since “low borrowing costs and the dearth of homes on the market will continue to support prices.”