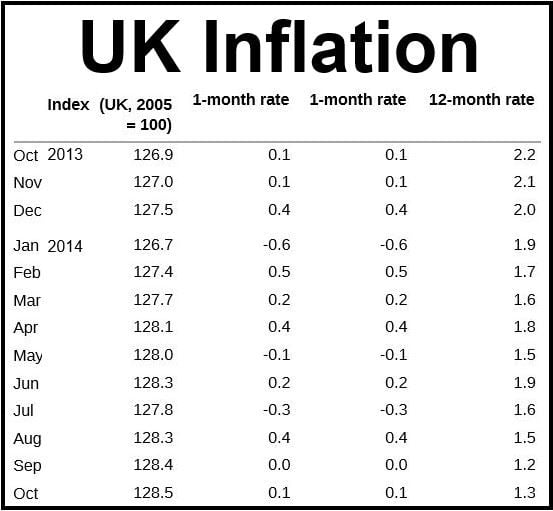

UK inflation edged up in October compared to the previous month. The Office for National Statistics (ONS) reported on Tuesday that the Consumer Price Index (CPI) increased by 1.3% in the year to October 2014, compared to 1.2% in September.

The slight increase pushes the inflation rate above its recent five-year low.

The marginal increase was mainly driven by more expensive computer games and toys, and smaller declines in transport costs, notably air fares and motor fuels, than one year ago.

Motor fuel and food prices, which typically have pushed up the 12-month CPI rate, are currently reducing the inflation rate by 0.3 of a percentage point.

Education fees overall were 7.9% up between September and October 2014 compared to a 8.2% increase over the same period last year.

Food and non-alcoholic drinks prices fell by -1.4% in October, making it the sixth-consecutive month without an increase – the longest such stretch in fourteen years. Household equipment and furniture prices fell by -1.1%. Motor fuel prices declined by -4.8%.

Source: “CPI index values,” Office for National Statistics.

Inflation is still well below the Bank of England’s annual target of 2%, a target it shares with nearly all the advanced economies’ central banks. The UK’s central bank warned last week that inflation would fall to 1% over the next six months.

Despite October’s slight inflation rate increase, the BoE is unlikely to re-consider its current monetary policy.

Most British economists predict inflation will hover around 1% until the end of 2015, and then approach the 2% target in 2016.