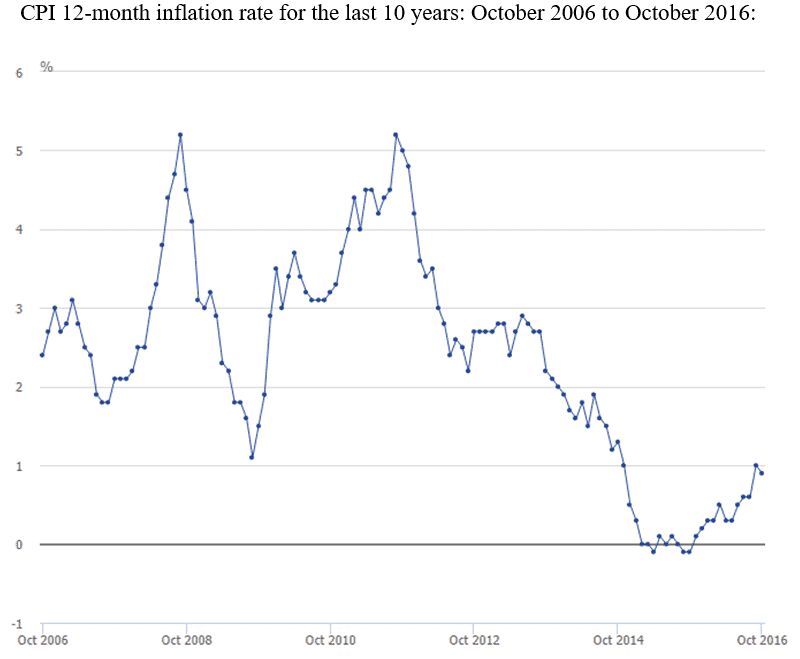

UK inflation unexpectedly fell in October.

Consumer Prices Index (CPI) inflation in Britain fell to 0.9% in October from 1% the previous month, according to the Office for National Statistics, meaning that a basket of goods and services that cost £100.00 in October 2015 would have cost £100.90 in October 2016.

The reading was lower than what economists polled by Reuters had forecast of 1.1% inflation.

The main downward contributors to the change in the rate were “prices for clothing and university tuition fees, which rose by less than they did a year ago, along with falling prices for certain games and toys, overnight hotel stays and non-alcoholic beverages,” the ONS said in in its statistical bulletin.

However, the drop in the value of the pound since the EU referendum vote in June is expected to eventually translate into higher costs for British consumers. Since June, the pound has dropped about 16% against the US dollar and 11% against the euro.

As a result, British factories are facing higher costs for their inputs – in October prices paid by factories for inputs surged by 4.6%.

Chris Williamson, chief economist at IHS Markit said in a statement:

“It’s therefore likely to be only a matter of time before price hikes in retailers’ supply chains start feeding through to the customer, as retailers seek to protect margins,” he said.

“The concern is that consumers are driving the economy at the moment, and higher inflation is starting to eat into people’s spending power, subduing consumer spending.”

Williamson added: “While we see inflation breaching the Bank of England’s 2.0% target in early 2017, and rising to 3.0% by the end of the year, the rate of increase is expected to peak at 3.5% in 2018.”

The Retail Prices Index (RPI), a measure of inflation which includes housing costs stood at 2.0% in October, unchanged from the previous month, the ONS said.