The head of the German Federal Bank, Jens Weidmann, warned that UK banks would lose valuable passporting rights if Britain leaves the single market.

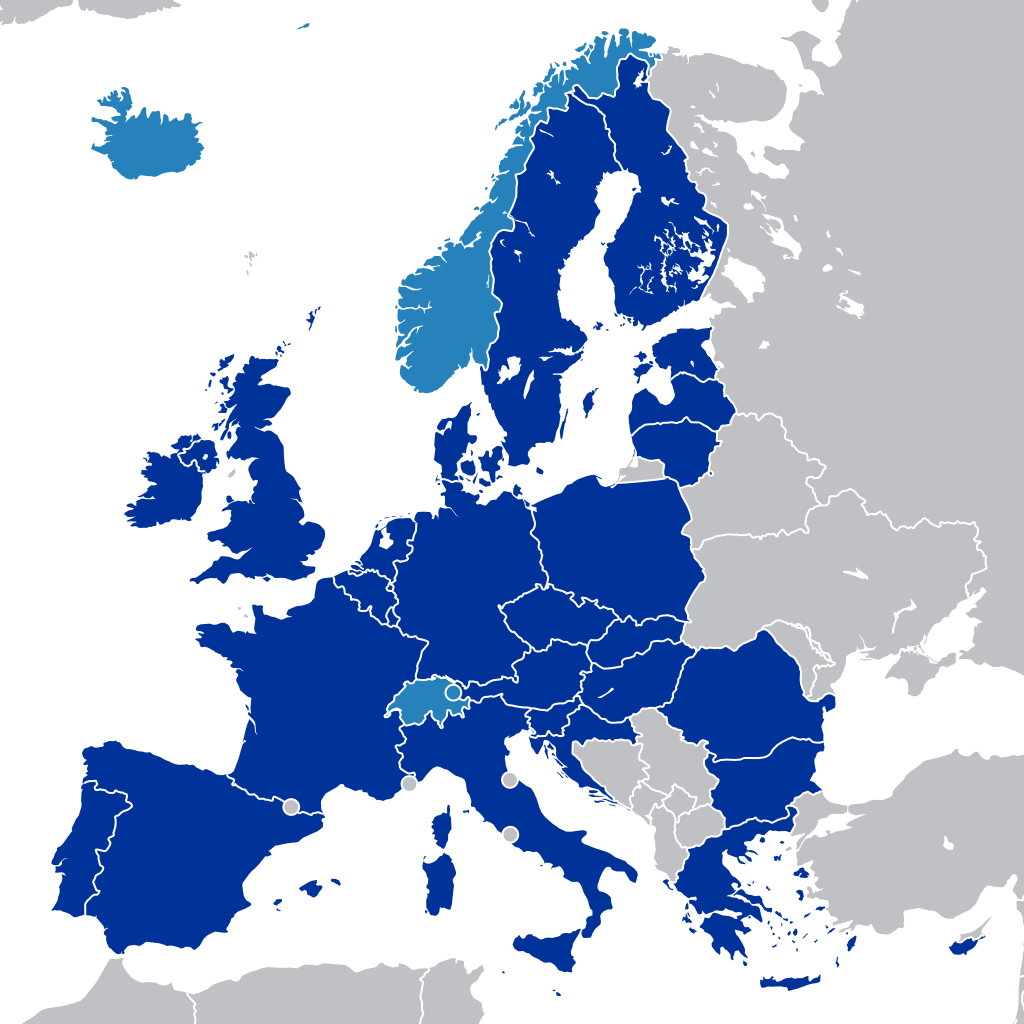

The European Single Market includes all the EU’s 28 member states, as well as non EU members Iceland, Liechtenstein and Norway through the Agreement on the European Economic Area (EEA).

The UK would need to stay in the EEA to keep passporting rights which allows banks based in the country to sell their services across the EU. Iceland, Liechtenstein and Norway can access the bloc’s single market, however, they must accept the EU’s founding principle of free movement of labour.

In an interview with The Guardian Mr Weidmann said that passporting rights were “tied to the single market and would automatically cease to apply if Great Britain is no longer at least part of the European Economic Area”.

He believes “several businesses” would reconsider the location of their headquarters if the UK is not a member of the EEA.

“As a significant financial centre and the seat of important regulatory and supervisory bodies, Frankfurt is attractive and will welcome newcomers. But I don’t expect a mass exodus from London to Frankfurt,” he said.

British Prime Minister Theresa May has said that she will not trigger Article 50 of the EU Treaty, which sets out the process for the exit of countries from the European Union, before the end of the year.

The UK is expected to demand complete control of its borders whilst also retaining access to the European Union’s single market.

Moody’s says loss of passporting rights would be ‘manageable’ for the City

One of the world’s biggest credit agencies said in a report that the impact of leaving the European single market would only have a modest and manageable effect on the City.

Moody’s said in its report: “The greater impact would be felt through higher costs and diversion of management attention, as the companies concerned restructure, reducing profitability for a time. This is credit negative but manageable. And other critical factors such as capital and liquidity, which are largely determined by global standards, are unlikely to face material changes due to Brexit per se.”

The senior vice-president at Moody’s, Simon Ainsworth, said incoming EU financial services laws could provide alternative means of accessing the single market.

“In particular, we consider that the third-country equivalence provisions contained within the incoming MiFID II EU directive may provide firms with an alternative means of accessing the single market,” said Mr Ainsworth.

“The complexity of (quickly) unwinding the status quo and a desire to minimise the initial impact on European domiciled banks will likely lead to the preservation of most cross-border rights to undertake business.”

Meanwhile, Mark Boleat, the policy chairman at the City of London Corporation, was quoted by The Guardian as saying:

“Passporting is still a crucial issue for financial services firms and the uncertainty is causing real problems for some businesses. What exactly its loss would be depends on both the sector and business model of any company.

“In the City many firms are still analysing what impact the loss of passporting will have on them. For some retail banks it is of almost no real importance. But for the whole of international investment banking and an institution such as Lloyds of London it is an absolute necessity. We are making this point clear to policymakers in our ongoing discussions.”