UK manufacturing plunged to a 3-year low in the third quarter, one of many negative consequences of the Brexit vote – Britons voting on 23rd June to leave the European Union. Levels of production and incoming new orders both declined, as the effects of greater business uncertainty on the domestic market more than offset any benefits from a weaker pound sterling.

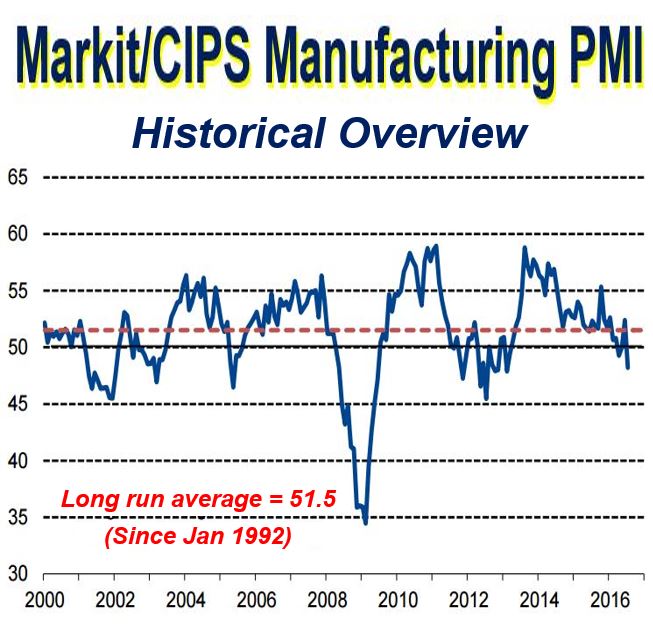

The Markit/CIPS Purchasing Managers’ Index (PMI) plunged to its lowest level since 2013 to 48.2 in July, compared to 52.4 in June. This was lower than the initial flash estimate of 49.1.

This is the second time since the first quarter of 2013 that the PMI has dropped below the 50 mark. Any reading below 50 means activity has shrunk, while one above fifty represents growth. This means that UK manufacturing is currently shrinking.

During the referendum campaign we were all warned about the consequences of voting for Brexit. The British Chambers of Commerce, the CBI, the IMF, the World Bank, the Governor of the Bank of England, and virtually every leader of the advanced economies said that the pound would crash, UK manufacturing would contract, and the overall economy would suffer. (Image: markiteconomics.com/Survey)

During the referendum campaign we were all warned about the consequences of voting for Brexit. The British Chambers of Commerce, the CBI, the IMF, the World Bank, the Governor of the Bank of England, and virtually every leader of the advanced economies said that the pound would crash, UK manufacturing would contract, and the overall economy would suffer. (Image: markiteconomics.com/Survey)

UK Manufacturing down across nearly whole sector

The production decline was the largest since October 2012, with considerable falls across the consumer, intermediate and investment goods sectors. The intermediate goods sector registered the steepest drops in both new orders and output.

Manufacturers of investment goods also posted a moderate decline in new work received during July. However, this partly reflected some payback after June’s steep increase. A moderate increase was seen in new orders to consumer goods producers, but at a significantly lower pace of growth compared to the previous survey month.

In July, new export orders in Britain’s manufacturing sector increased for the second month running. This latest growth was driven by both the weaker pound sterling and companies’ efforts to secure new contracts.

Export business increased moderately at intermediate and investment goods producers, but declined for the second time over the past three months in the consumer goods sector.

Manufacturing output will probably continue weakening over the short-term before it improves. (Image: markiteconomics.com/Survey)

Manufacturing output will probably continue weakening over the short-term before it improves. (Image: markiteconomics.com/Survey)

Manufacturing employment down

This is the seventh successive month of decline in UK manufacturing employment. July’s rate of job loss was the 2nd-steepest for nearly three-and-a-half years. Companies said their lower workforce levels reflected contractions in output and new orders.

Several manufacturers also mentioned natural wastage, redundancies, outsourcing of work, and restructuring as other reasons for fewer jobs in the sector. Redundancy is when the job is no longer required – if you are dismissed and somebody else gets put into that job, it is not redundancy.

Figures suggest that employment could well fall further in the months to come – inflows of new work are weaker, while volumes of outstanding business are also down.

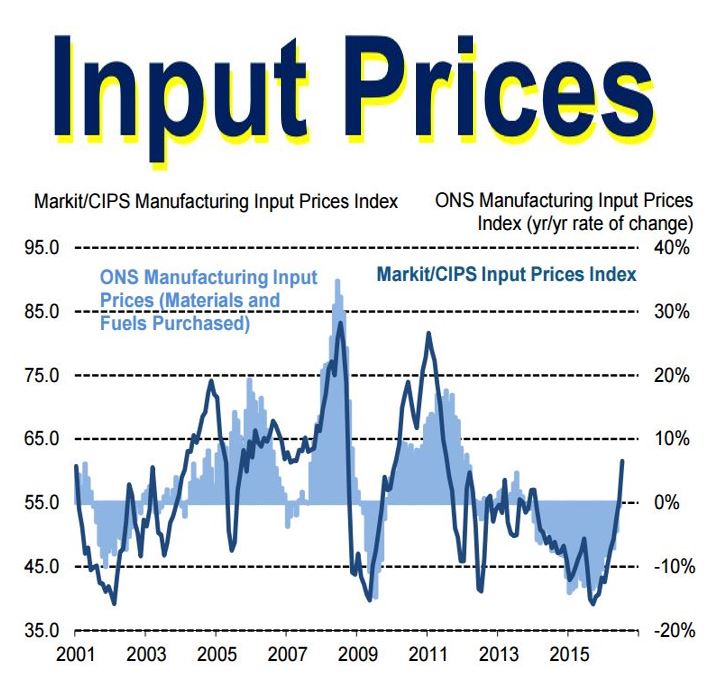

Purchase-price inflation jumped to a 5-year high this month, as import costs started to rise because of a weaker pound and metal and commodity price hikes.

Some of the increase in costs was passed on to clients, however, as selling prices jumped at their fastest rate in nearly two years.

Senior Economist at Markit, Rob Dobson, said:

“The final PMI came in at 48.2, down from the earlier flash print of 49.1. The pace of contraction was the fastest since early-2013 amid increasingly widespread reports that business activity has been adversely affected by the EU referendum. The drops in output, new orders and employment were all steeper than flash estimates.”

“The downturn was felt across industry, with output scaled back across firms of all sizes and across the consumer, intermediate and investment goods sectors, although exporters did report a boost from the weaker pound. However, the improvement in exports was less marked than previously estimated, blamed in part on sluggish overseas demand. The downside of the currency was an upsurge in input price inflation to a five-year high on the back of

rising import costs.”

The weaker pound and recent hikes in metal and commodity prices have pushed up manufacturing input prices. (Image: markiteconomics.com/Survey)

The weaker pound and recent hikes in metal and commodity prices have pushed up manufacturing input prices. (Image: markiteconomics.com/Survey)

More pain to come

According to Markit, the company that compiled the survey, the weakening order book trend and increase in cost inflation both point to further short-term pain for British manufacturers.

Mr. Robson says it is crucial that the Government and Bank of England take swift action to prevent the recent downturn from becoming more embedded. Most experts believe the Bank of England will cut interest rates later this week.

David Noble, Group Chief Executive Officer at the Chartered Institute of Procurement & Supply, said:

“Purchasing activity took a backwards leap with the sharpest drop since March 2013, as falls in both output and new orders battered the sector.”

The only bit of hopeful data to emerge since the Brexit vote has come from the Institute of Chartered Accountants of England and Wales, whose survey shows a slight improvement in the Business Confidence Index in the past few days. (Image: icaew.com)

The only bit of hopeful data to emerge since the Brexit vote has come from the Institute of Chartered Accountants of England and Wales, whose survey shows a slight improvement in the Business Confidence Index in the past few days. (Image: icaew.com)

“Though these falls were not as marked as those seen during the Great Recession in 2007-2008, the drop was harsher than expected. The overall index was at its lowest since February 2013 and lower than reported by the recent flash PMI, which measured the effect of continuing uncertainty and the immediate impact of the EU referendum on the UK economy.”

“Purchasing prices rose at levels not seen for half a decade, with SMEs bearing the brunt of rising input prices while larger corporates were more able to cope. And though export orders rose for the second month in response to the weaker pound, this was

not enough to sustain the sector or make up any shortfall from the sluggish domestic market.”

“After seven months of modest drops, employment figures showed an entrenchment in uncertainty with a sudden deterioration – the second sharpest drop in almost three-and-a-half years, as businesses chose redundancy and restructuring to secure themselves against more possible bad news ahead. Without new orders coming through, this downward trajectory is likely to get worse, at least in the short term.”

Most economic and business related data to emerge since the British electorate voted to leave the EU has been pessimistic. GfK’s Consumer Confidence Index took an 11-point nosedive in July.

Video – Sharp decline in UK Manufacturing PMI

While unfavourable US GDP data pushed the dollar down on Friday, dismal manufacturing PMI in the UK has pulled the already weak pound sterling even further down.