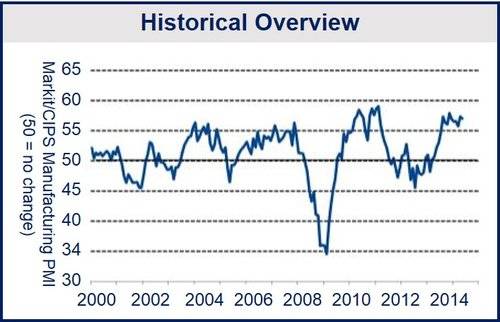

UK May manufacturing output grew for the fifteenth consecutive month, reflecting better economic conditions and improved order books, according to the Markit/CIPs UK Manufacturing PMI (Purchasing Managers’ Index).

The UK’s PMI for May stood at 57.0, one of the highest readings in the survey’s history, compared to 57.3 in April (5-month high). Anything above 50 suggests growth.

New orders grew most steeply for investment goods producers, which was good news after declining demand had been registered during the previous two months.

In contrast, the Eurozone’s Manufacturing PMI for May saw its sharpest slowdown in six months. However, the ‘periphery’ countries, such as Spain and Italy did well, while the ‘core’ nations had disappointing results.

The pound sterling rose against a floundering euro and recovered losses against the dollar on Monday after publication of Markit’s PMI figures.

Neil Prothero, Deputy Chief Economist at EEF, the UK’s manufacturing trade body, said:

“Despite the headline number edging marginally, lower manufacturing remains in strongly positive territory and well above the index long-term average, underlining the important role being played by industry in the UK’s continuing recovery.”

“The sector is firmly on track to expand for a fifth consecutive quarter, its strongest performance in four years. Signs of a pick-up in export orders are especially welcome, as the broader rebalancing story still requires a significant boost in net trade to support the recent rebound in business investment.”

Brightest spell in decades

According to Markit, the UK May manufacturing output reflected one of the brightest spells in manufacturing and new order growth in the survey’s 22-year history.

“As manufacturers ramped up production to meet strong inflows of new work from both domestic and export markets, the benefits were also shared with the wider economy through solid job creation and rising levels of input purchasing,” Markit wrote.

Manufacturing saw export orders rise for the fourteenth successive month. Demand rose especially sharply from Canada, the US, Asia, the Middle East, New Zealand and Europe. Markit commented “Where an increase was signaled, this was linked to new product launches and efforts to increase market share.”

Manufacturing employment grew

May saw the thirteenth consecutive month of increased employment in manufacturing. Employment growth was broad-based across investment goods, intermediate goods, and consumer goods producers, and both at SMEs (small- and medium-sized enterprises) and large companies.

With both output and employment increasing, manufacturers reduced order backlog levels for the third month running.

(Source: Markit)

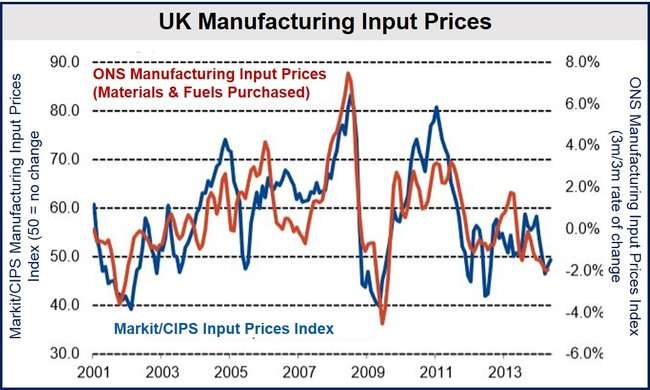

Selling prices up, purchasing costs down

With stronger demand, manufacturers were able to raise average selling prices in May for the 11th successive month. However, the inflation rate slid to its lowest rate since August 2013.

May saw purchasing costs decline for the fourth successive month, reflecting cheaper commodity, energy and dairy product prices. The increased value of the pound also helped push import values down.

Rob Dobson, Senior Economist at Markit, said:

“The (manufacturing) sector basked in one of its brightest growth spells of the past two decades. Manufacturing production is currently expanding at a quarterly rate close to 1.5%, helping the sector take huge strides towards recouping the output lost during the recession.”

(Source: Markit)

Still a long way to go

However, Dobson pointed out that manufacturing is still about 7.5% smaller than it was before the global crisis hit. At its current rate of growth, achieving a full recovery will take until the end of next year.

As manufacturing represents only about 10% of the UK’s GDP (gross domestic product), Dobson doubts the strong May data will trigger a shift in the Bank of England’s MCP’s current monetary policy.

Dobson added that if data on other sectors of the economy also report sharp increases, the stakes for an earlier-than-expected rise in interest rates could be raised.

David Noble, Group Chief Executive Office at the Chartered Institute of Purchasing & Supply, said that suppliers are taking longer to deliver goods as the pace of production filters through.

Strong data coming from UK

The British Chambers of Commerce upgraded its economic forecast for 2014 to 3.1 GDP growth. The economy is then expected to grow by 2.7% in 2015 and 2.5% in 2016.

If the projected growth is achieved it will be the biggest increase in seven years. However, John Longworth, Director General of the BCC added that to ensure long-term growth prospects, the UK “still has a lot of work to do.”

The Confederation of British Industry (CBI) informed that the UK’s economic growth for May came in at a record high. It added that during the second quarter GDP should continue growing strongly.