The fierce price war within the UK’s grocery sector has pushed supermarket sales below the £100 billion level for the first time since 2010, according to a new report.

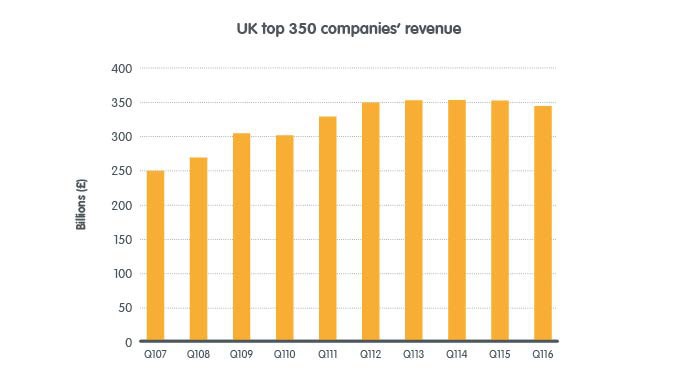

The Share Centre’s Profit Watch UK study found that food retail revenues in the second quarter of 2016 fell 3% to £99 billion, while overall revenues of UK plc dropped 2.2% to £341.7 billion – a decline of £7.8 billion year on year.

Tesco, the UK’s largest supermarket chain, accounted for most of the drop, with weak UK sales and foreign exchange losses on overseas business.

All of the UK’s big four grocers have struggled to retain market share amid the rising popularity of discounters Aldi and Lidl.

Fierce competition caused intense price pressure, which led to a tough year for British supermarkets.

Meanwhile, other companies exposed to consumer spending enjoyed a boost from a “burgeoning” economy, according to Helal Miah, investment research analyst at The Share Centre.

However, he added that the boost won’t last long as uncertainty following the Brexit vote hits UK economic growth.

“The implications of the economic slowdown will mean lower demand for sectors such as housebuilders and retailers, while the travel industry is already feeling the effects.

“Easyjet saw its costs soar by £40 million within four weeks of the referendum. Financial services may suffer too, if passporting to the EU fall by the wayside. Profits in these sectors will be harder to come by in Brexit Britain.”

The devaluation of the pound is forecast to help companies with overseas operations, but which publish accounts in sterling. The report said: “The overseas business lines of these companies have suddenly become a lot more valuable in sterling terms. This will be reflected in higher sales and profits in their sterling accounts.”

Mr Miah added: “The devaluation of the pound will boost the sterling value of any overseas business, whether via exports, or from translating the value of overseas operations back into pounds.

“This is more than just accounting. For sterling investors, that will mean extra dividend income from those supercharged profits. This is mainly why the FTSE 100 has performed so well since the referendum.

“Elsewhere, defensive sectors like utilities and pharmaceuticals are likely to be well insulated, not only because demand is relatively steady, but also because they offer high and stable dividends. The one downside is the revaluation of overseas liabilities, which would typically lead to a one-off charge on the sterling income statement.”