The U.S. Census Bureau’s 2023 Annual Social and Economic (ASEC) report reveals a nuanced picture of the economic state of American households.

While the data shows significant improvement in real household income, other key indicators, such as poverty rates and gender pay disparities, highlight ongoing challenges for many families.

The report underscores the uneven economic recovery as the U.S. emerges from the disruptions of the COVID-19 pandemic.

Real Median Household Income Climbs to Pre-Pandemic Levels

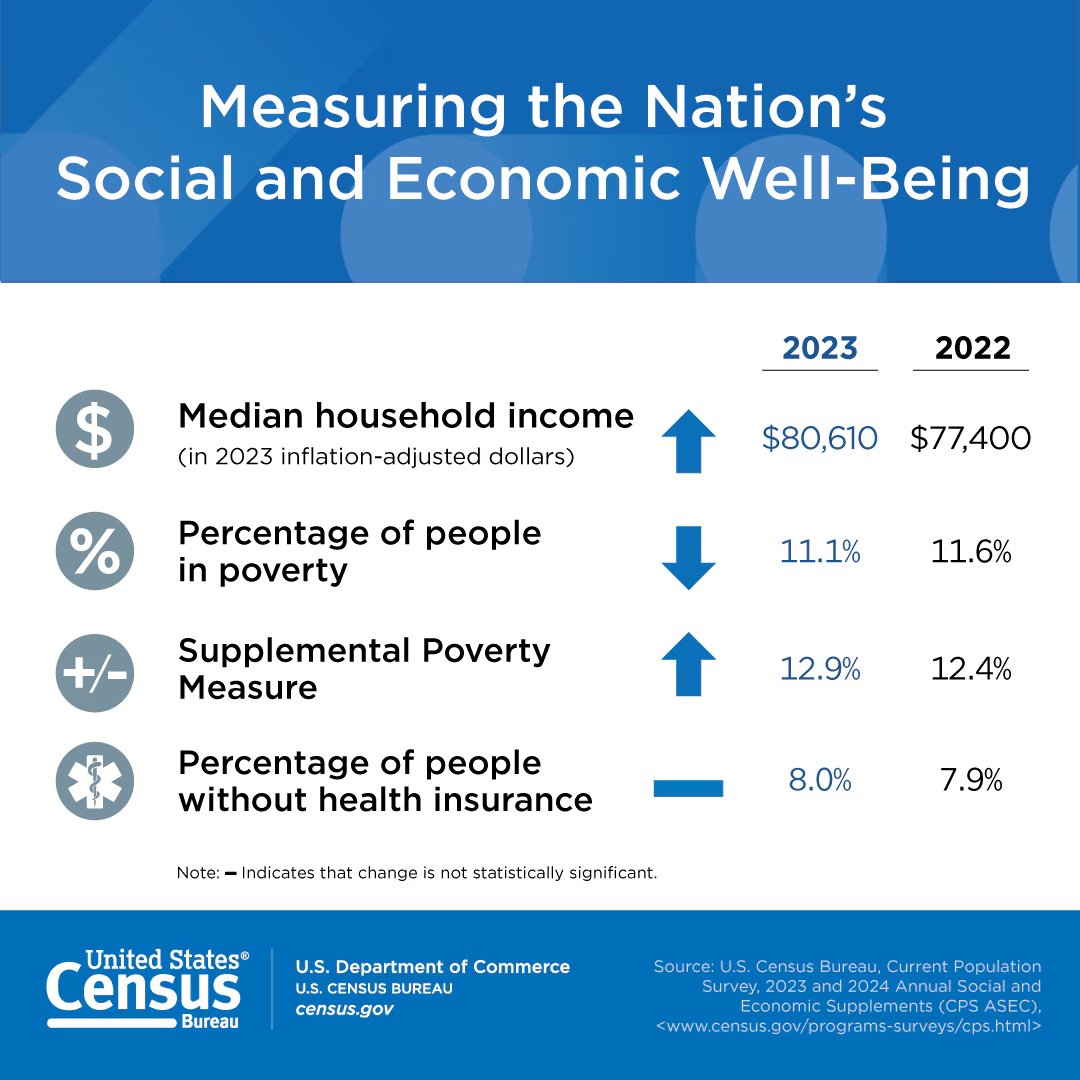

In a positive development, real median household income increased by 4.0% in 2023 to $80,610. This marked the first statistically significant annual increase since 2019. The recovery of income levels to pre-pandemic highs is attributed to a combination of strong job growth, easing inflation, and continued demand for labor .

However, the income gains were not evenly distributed across all demographic groups. White households saw a substantial rise in income, with a 5.4% increase for White households and a 5.7% increase for non-Hispanic White households. Conversely, Black, Asian, and Hispanic households did not experience statistically significant changes in their median incomes, reflecting persistent racial disparities in economic outcomes .

The income increases were also spread across the distribution, with those at the lower end seeing more substantial gains. The income for households in the 10th percentile rose by 6.7%, while those in the 90th percentile saw a 4.6% increase. This indicates some progress in reducing income inequality, although other measures, such as the Gini index, showed no statistically significant changes.

Gender Pay Gap Widens for the First Time in Two Decades

While overall income levels improved, the gender pay gap widened in 2023 for the first time since 2003. Real median earnings for men working full-time, year-round increased by 3.0%, while women in the same category saw just a 1.5% rise. As a result, the female-to-male earnings ratio fell to 82.7%, down from 84.0% in 2022.

Census officials attribute part of this disparity to demographic changes in the workforce, particularly an increase in Hispanic women, who tend to earn less than other groups. This widening gap highlights the ongoing structural inequalities in the U.S. labor market, where women, especially women of color, continue to earn less than their male counterparts.

Poverty Rates Show Mixed Results

Poverty rates in 2023 presented a complex picture. The official poverty rate, which is based solely on pre-tax income and excludes government assistance, fell by 0.4 percentage points to 11.1%. This translates to approximately 36.8 million people living in poverty, a slight improvement from 2022 . Groups that saw declines in official poverty rates included White individuals, non-Hispanic Whites, women, and workers aged 18 to 64.

However, the Supplemental Poverty Measure (SPM), which includes government benefits like tax credits and food assistance while accounting for living expenses, rose by 0.5 percentage points to 12.9%. This increase is largely due to the expiration of pandemic-related support programs, such as enhanced food assistance, which ended in March 2023 for most states. The end of these benefits particularly impacted families with children, as the child poverty rate under the SPM jumped from 12.4% to 13.7%.

Timothy Smeeding, an expert on the poverty line, told USA TODAY: “People are paying more in rent, people aren’t getting as much childcare support. Even though they’re earning more they’re not really getting ahead,”

The rise in child poverty is a stark reminder of how critical government support was in shielding vulnerable households from economic hardship during the pandemic. As these programs have phased out, many families are feeling the financial strain once again.

Olivia Golden, interim executive director of the Center for Law and Social Policy, a progressive advocacy group, was quoted by The New York Times as saying:

“You need two kinds of strategies to keep poverty down: One is the economic strategy, and one is the investments in core programs and the safety net.”

“To me, the idea that policies have high stakes in terms of the lives of families and their material hardship is very vivid as you look over the last few years,” Golden added.

Post-Tax Income and Income Inequality

When accounting for taxes and government transfers, real median post-tax household income increased by 3.7%, rising to $69,240 in 2023. This measure provides a clearer picture of household resources after taxes and credits, showing that while pre-tax income grew, tax policies also played a role in boosting post-tax income for many households.

Despite these gains, income inequality, as measured by the Gini index, remained largely unchanged between 2022 and 2023. The lack of significant movement in income inequality suggests that while incomes rose across the board, the gap between the wealthiest and poorest households has not substantially narrowed.