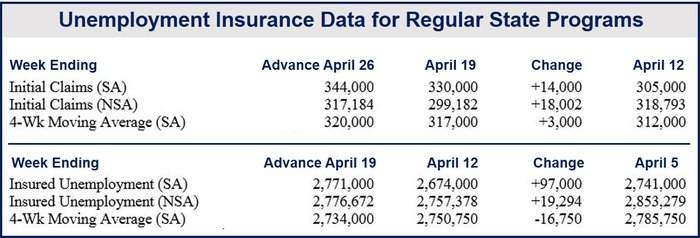

US initial jobless claims increased in the week ending April 26th by 14,000 to 344,000, a nine week high, compared to the previous week. The four-week moving average stood at 320,000, a 3,000 rise over the previous week’s revised average.

A Wall Street Journal survey had forecast 320,000 initial claims for the week ending April 26th.

The US Department of Labor said it did not identify any particular factors impacting this week’s initial claims.

The Labor Department uses US initial jobless claims to measure how many people have been laid off.

US initial jobless claims figures during Easter unreliable

Economists within the labor department say the moving date of Easter makes it difficult to make accurate seasonal adjustment at this time of year. They added that the underlying fundamentals of the employment market continue to improve as the detrimental harsh winter effects recede.

(Source: US Department of Labor)

In an interview with Bloomberg Businessweek, Stephen Stanley, chief economist at Pierpont Securities LLC in Stamford, Connecticut, said “This is a time of the year when there’s a lot of seasonal issues to work through. Eventually we’ll settle out. If we were to settle at 320,000, it would be modest improvement.” Stanley had forecast initial jobless claims of 340,000.

The number of people who have been making unemployment benefit claims for more than one week increased by 97,000 to 2,771,000 in the week ending April 19th.

US economy slowed right down in Q1 2014

During the first quarter of 2014 the US economy virtually stopped growing, with GDP expansion reported at 0.1%, according to the Department of Commerce. However, the Federal Reserve yesterday said there are clear signs of accelerating economic activity this month.

Another Labor Department study found that during February and March the pace of hiring had picked up.

In a separate report, the Bureau of Economic Analysis, part of the Commerce Department, announced that personal spending increased by 0.9% in March, the highest increase since August 2009.

Personal income rose $74.8 billion or 0.5% while disposal personal income grew $68.0 billion of 0.5%.