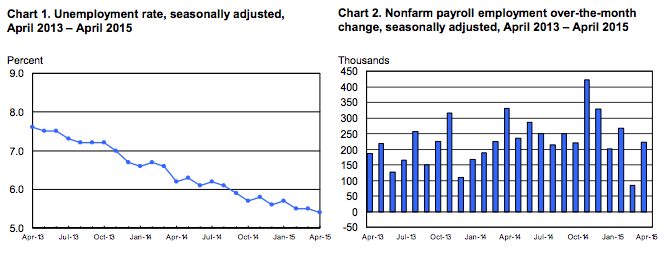

Job growth in the US rebounded in April, with the country’s unemployment rate dropping to almost a seven-year low of 5.4 percent.

The results quelled concerns about the economy stalling after a disappointing first quarter, revealing that performance in the second quarter is off to a good start.

However, analysts are saying that the results aren’t strong enough for the Fed to hike rates in June.

Source: US Labor Department

Brian Jacobsen, chief portfolio strategist at Wells Fargo Advantage Funds in Menomonee Falls, Wisconsin, told Bloomberg:

“It’s not a bad report for the economy, but it’s not so good it raises concerns about the Fed taking the punch bowl away,”

The Labor Department said that non-farm payrolls gained 223,000, with the construction and services sector offsetting weakness in mining.

Professional and business services added 62,000 jobs in April. Health care employment increased by 45,000. Employment in construction rose by 45,000. The transportation and warehousing sector added 15,000 jobs, While employment in mining fell by 15,000

Employment growth averaged 257,000 per month in the 12 months prior to April.

Wage growth missed expectations though. In April average hourly earnings increased by just three cents, or 0.1 percent, compared to a 0.2 percent gain in March.

Over the past 12 months, average hourly earnings have increased by 2.2 percent.

According to Reuters, Scott Anderson, chief economist at Bank of the West in San Francisco, said:

“With the unemployment rate approaching full-employment levels it will only be a matter of time before wages start to rise at a somewhat swifter pace.”

March payrolls were revised down from 126,000 to only 85,000 jobs created – the fewest since June 2012.

After the Labor Department report US stock prices surged. The Standard & Poor’s 500 index climbed 1.3 percent to 2116.1. Long-term interest rates declined, with the yield on the 10-year Treasury note down three basis points, or 0.03 percentage point, to 2.15 percent.