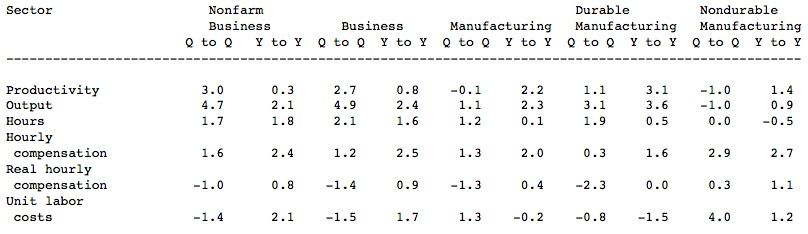

Non-farm US labor productivity in the business sector rose by an annualized rate of 3% during Q3 2013, according to the US Bureau of Labor Statistics.

Compared to Q3 2012, there was a 4.7% growth in output and 1.7% more hours worked in Q3 2013.

Unit labor costs among nonfarm business fell by 1.4% in Q3 2013, while hourly pay rose by 1.6%. Over the past four quarters unit labor costs increased by 2.1%.

The Bureau of Labor Statistics (BLS) defines unit labor costs as “the ratio of hourly compensation to labor productivity; increases in hourly compensation tend to increase unit labor costs and increases in output per hour tend to reduce them.”

Below are some highlighted data published by the BLS today:

- Manufacturing sector productivity fell 0.1% in Q3 2013. Employees’ output rose by 1.1%, and they worked 1.2% more hours.

- Productivity in the durable goods sector rose 1.1%.

- Productivity in the non-durable goods sector fell 1%.

- Manufacturing productivity improved by 2.2% over the last four months, with 2.3% greater output and 0.1% more hours worked.

- Manufacturing unit labor costs increased 1.3% in Q3 2013 and fell 0.2% compared to Q3 2012.

- Non-financial corporate sector productivity declined by 0.7% in Q3 2013.

In Q4 2013, productivity will probably slow as companies try to sell their inventories. If demand grows companies will have to raise wages to increase production.

(Source: US Bureau of Labor Statistics.)

Will US labor productivity influence the Federal Reserve?

The US Federal Reserve meets on Tuesday and Wednesday this week. It indicated some months ago that when unemployment dipped below 7% it could consider tapering its $85 billion per month bond-buying stimulus program. Unemployment has not dipped below, but is at 7%.

The Fed also monitors labor costs and productivity for signs of accelerating inflation. It is doubtful that the latest US labor productivity figures will influence the Fed’s decisions this week. However, with clear signs that the US economy is expanding healthily, a growing number of economists are saying that easing back on the stimulus program will start sooner than later.