Wall Street suffered its biggest one-day loss in nearly four years on Friday amid fears of a global economic slowdown.

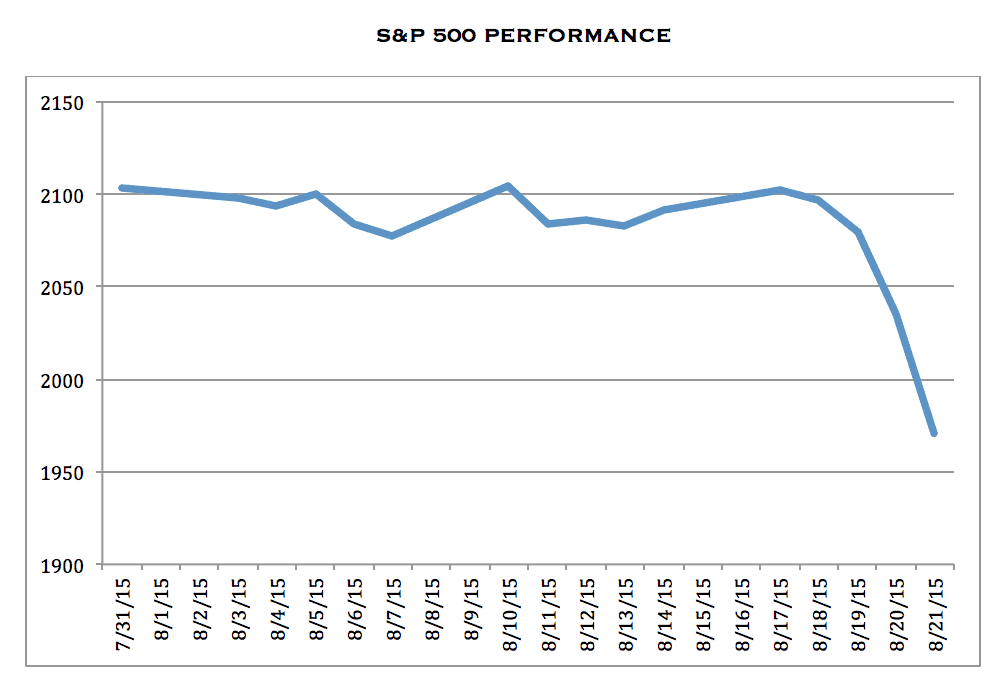

The S&P 500 plunged 3.2 percent – the biggest drop since November 2011 – to 1,970.89. The index is now 7 percent down from the record high it hit earlier this year.

The S&P 500 fell 5.8 percent for the week, with more than $1 trillion has been stripped off the index’s value. According to S&P Dow Jones Indexes, only 10 components were up on Friday.

The Dow Jones Industrial Average dropped 530.94 points, or 3.12 percent, to 16,459.75.

The Nasdaq Composite dropped 3.5 percent, with Apple down 6 percent – now in bear market territory.

Bruce Bittles, chief investment strategist at Milwaukee-based Robert W. Baird & Co., said in an interview on Bloomberg Television’s “Market Makers” with Cory Johnson and Olivia Sterns that the selloff “simply means that all areas of the market are in gear now, and unfortunately it’s on the downside,” adding that “investors have to be much more careful now with that technical development.”

The US is the largest market for stocks and shares, and most other products and services globally.

Sixth straight month of disappointing Chinese manufacturing data

Volatility in the markets spiked this month when China unexpectedly devalued its currency.

In addition, concerns of a China-led economic slowdown intensified after a surprise drop in the Chinese stock market, as well as weak Chinese manufacturing on Friday.

The latest factory output reading for China was the lowest since March 2009. The private Caixin/Markit manufacturing purchasing managers’ index (PMI) fell to 47.1 from 47.8 in July.

It’s not just China that investors are keeping an eye on. Another big factor is the expected rate hike by the U.S. Federal Reserve, which will end a decade of cheap debt financing – allowing businesses to expand using debt capital at a lower cost.

Markets in Europe also plunged

London’s FTSE 100 index had its biggest weekly loss this year, with the index down 5.2%, or 363 points, since Monday. The index closed 2.8% lower on Friday.

Markets in Paris and Frankfurt saw similar falls of around 3%.