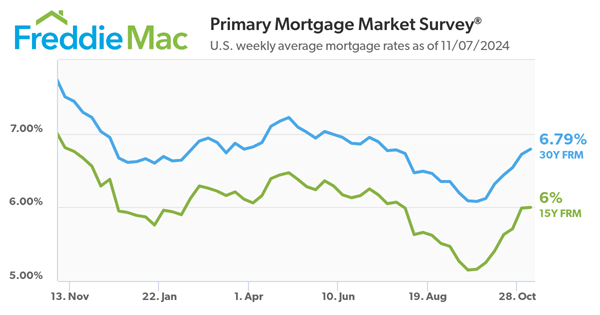

US mortgage rates are on the rise again. According to Freddie Mac, the average rate on a 30-year fixed mortgage rose to 6.79% this week from 6.72% last week.

The 30-year fixed rate has now reached its highest level since early July, moving in a direction that isn’t hopeful for homebuyers.

“Mortgage rates continued to inch up this week, reaching 6.79 percent,” said Freddie Mac’s Chief Economist, Sam Khater. “It is clear purchase demand is very sensitive to mortgage rates in the current market environment. As soon as rates began to rise in early October, purchase applications fell and over the last month have declined 10 percent,” Khater added.

Higher rates mean higher monthly payments, which may result in some would-be homebuyers putting purchases on hold — especially those with tight budgets. While rates are less than they were last year, the recent upward trend is concerning — rates have climbed for six consecutive weeks.

A look at the numbers

Let’s break down the key figures:

30-year fixed-rate mortgage (FRM): Averaged 6.79% this week.

- Up from 6.72% last week.

- Down from 7.50% a year ago.

15-year fixed-rate mortgage (FRM): Averaged 6.0%.

- Slightly up from 5.99% last week.

- Down from 6.81% this time last year.

So, what’s causing mortgage rates to rise?

After the US election results, the 10-year Treasury yield rose by more than 4% to a four-month high. When the 10-year Treasury yield rises, mortgage rates typically increase as well. This is because since the U.S. government backs Treasury notes, they are considered one the safest investments available and serve as a benchmark for various interest rates.

Earlier this week, we reported that first-time home buyers now make up only 24% of the market, down from 32% last year to the lowest since 1981. With rates rising to early July levels, it looks unlikely that the percentage of first-time home buyers will change significantly.