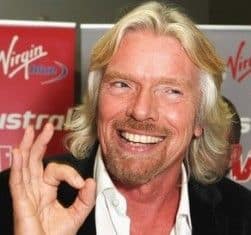

The Miami/Fort Lauderdale-based new venture of Virgin Group – Virgin Cruises – has been launched. Virgin Group founder Sir Richard Branson says he aims to “shake up the cruise industry and deliver a holiday that customers will absolutely love.”

Virgin Cruises says it will design and build two new world class cruise ships.

Tom McAlpin, who was President and CEO of The World, Residences at Sea, will become Virgin Cruises’ CEO. He had previously been President of Disney Cruise Line.

According to Sir Richard, passengers will be sailing in state-of-the-art ships “offering great quality, a real sense of fun, and many exciting activities all delivered with the famed Virgin service.”

The Virgin Group, which is cash rich after floating Virgin Money on the London Stock Exchange and Virgin America on NASDAQ, invested at least $100 million in the cruise ship company.

Sir Richard Branson adds yet another business to his empire.

Sir Richard Branson adds yet another business to his empire.

A few months ago Sir Richard had said he had been planning to set up a cruise ship unit worth about $1.7 billion.

For “competitive reasons” Virgin Cruises has not announced yet when it will start operating.

Mr. McAlpin said:

“Cruise guests deserve something better and different to what is being offered today, and Virgin Cruises is committed to creating breathtaking experiences for them and a new generation of guests.”

“Opportunities like this do not come often, so I am very excited to lead this business and introduce the Virgin brand to the cruise industry, as it has always put customers at the heart of what it does.”

Tom McAlpin, who was born in Miami, will head Virgin Cruises’ management team. (Photo: Virgin)

Virgin Cruises has teamed up with Bain Capital, a leading private investment firm, to work on the new venture.

Stephen Pagliuca, Managing Director with Bain Capital, said:

“From our earliest conversations with the Virgin team, we recognized there is a unique opportunity here to help build the next great cruise line serving travelers from around the world.”

In November, Virgin Cruises announced that Bain Capital was investing hundreds of millions of dollars into the venture, making the Massachusetts-based alternative investment firm a major shareholder in the cruise ship business. Alternative investments include those that are not of the traditional asset classes of bonds, cash and stocks.