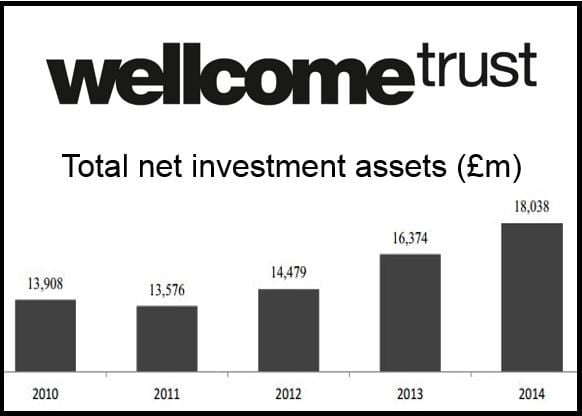

British independent charity that funds research to improve human and animal health, The Wellcome Trust, made £2.5 billion on its investment portfolio valued at £16.4 billion. It recorded a return of 15.4% for the year ending on September 30th, 2014.

The Trust’s high investment return increased partly because of its shareholdings in retail giants Alibaba and JD.com, as well as a portfolio of private equity, London properties, farms and stocks.

Its portfolio of properties includes more than 400 buildings in South Kensington, 250 farms it acquired from the Co-op in August, and a 50% shareholding in the student accommodation group iQ Wellcome. It is today the largest lowland arable farmer in the UK.

The charity’s investment base increased to £18 billion while cash payments in support of its mission grew to £690 million. It has not taken donations since 1946.

Wellcome says it has returned more than £9 billion (10.4% annualized – 81% cumulative) since the global financial crisis started in September 2008. It says it posted positive returns in every year since then. Returns have come in at 163% cumulative (10.2% annualized) over a decade and 645% cumulative (10.6% annualized) over 20 years.

The Trust predicts that it will be able to spend more than £4 billion on its charitable activities between 2014 and 2019, which is 23% more than during the previous 5-year period.

Source: “Annual Report and Financial Statements,” Wellcome Trust.

Chairman of the Trust, Sir William Castell, said:

“I am once again very pleased to report strong investment performance numbers this year, building upon past investment decisions. This success has enabled us to make charitable payments that are now 45 per cent higher than in the year 2008 before the global financial crisis began.”

Danny Truell, CIO of the Trust, said:

“Our internal investment team and external investment partners have again added significant value across the board, enabling us to perform better than global stock markets with considerably lower volatility. Prospective investment returns are now lower, but, with strength in breadth and depth across our investment team and the businesses and partnerships in which we invest, I am confident that we can continue to reinforce the Trust’s robust financial position.”

The Wellcome Trust contributed £2.8 million towards the testing of an Ebola vaccine, and also invested £27 million in a genome sequencing facility near Cambridge.