What is disinflation?

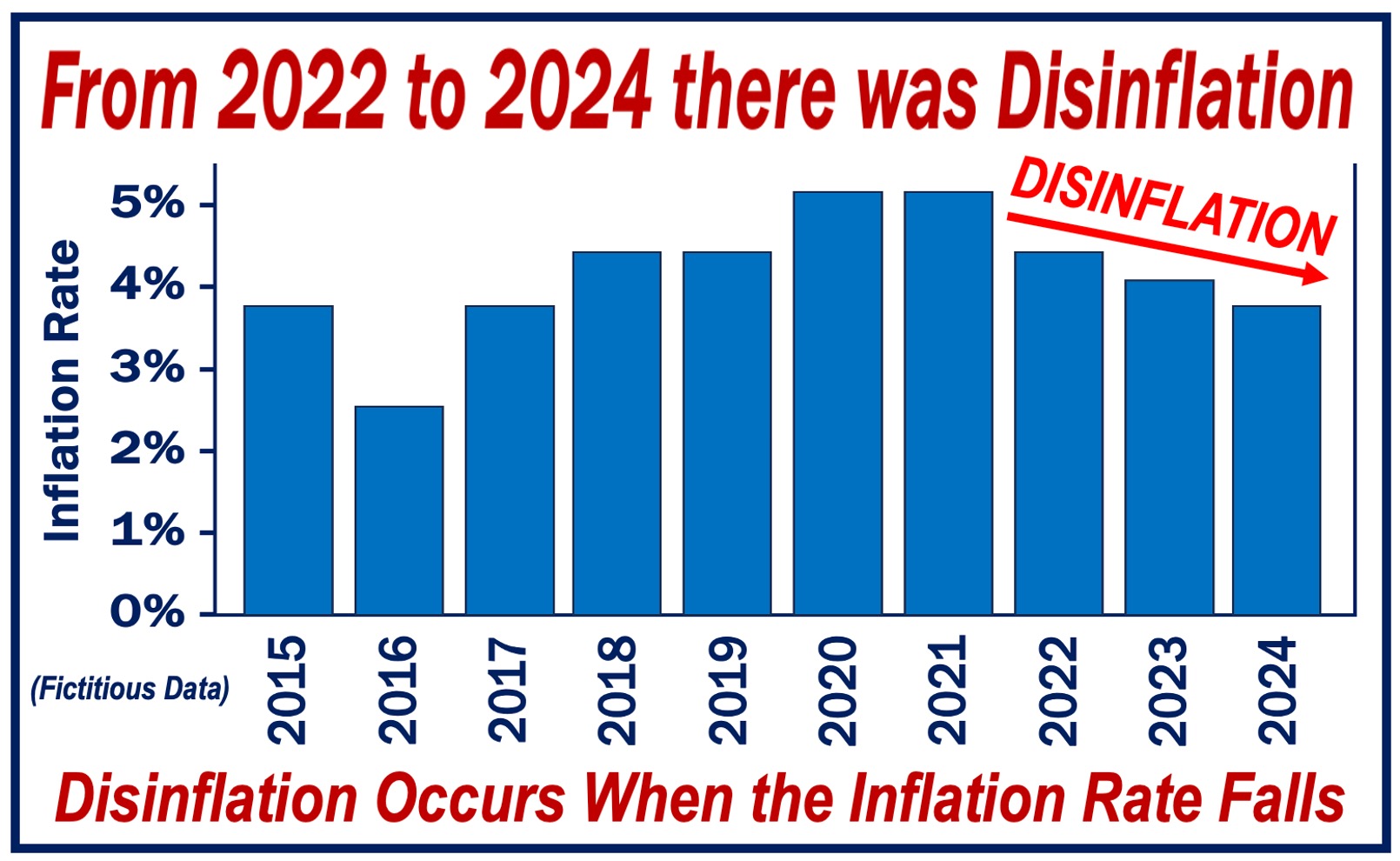

When the rate of inflation goes down, there is Disinflation. It does not mean that prices are falling, but rather that they are not rising as fast as before. If prices are falling, we say there is deflation.

Disinflation is the opposite of reflation, which is when the rate of inflation goes up due to economic stimulus.

Disinflation, reflation, and deflation

Let’s look at the meanings of these three words again:

-

Disinflation

This occurs when the rate of inflation goes down. For example, if the inflation rate this year is 4%, compared to 5% last year, we say that there is disinflation.

-

Reflation

An increase in the inflation rate when measures are taken to boost the economy after a period of deflation or disinflation. If inflation this year is at 3%, up from 2% last year due to economic stimulus, there is reflation.

-

Deflation

If prices fall, we say there is deflation. Deflation (falling prices) is the opposite of inflation (rising prices).

Disinflation and reflation matter

If the rate of inflation slows down, goes up, or remains the same, it matters to us. If you are shopping and notice that last year’s prices were climbing faster than they are this year, you are observing disinflation in progress.

If the money in your wallets goes down in value more slowly than it did before, you will be pleased.

Desirable and undesirable disinflation

If inflation was high, and now it is less than before, that is a good thing. This is an example of desirable disinflation.

However, if inflation was already low, say, at 0.5% last year, and now it is at 0.1%, policymakers and central bankers may wonder whether there is an economic slowdown or downturn. This kind of disinflation is usually undesirable.

If the economy then slides into deflation, the economy could stagnate. This happened in Japan during the “lost decade,” which started in the 1990s and lasted much more than ten years.

Interest Rates

Central banks adjust interest rates based on multiple factors, including the rate of inflation. If inflation is high, they may increase interest rates. Should this lead to disinflation (a decrease in the rate of inflation), central bankers will generally view this outcome favorably.

However, if the inflation rate falls to 0% and the gross domestic product (GDP) growth stalls, the central bank may reduce rates. Lowering rates tends to encourage borrowing by individuals and businesses, which can help jump-start economic activity.

Video – What is Inflation?

This educational video, from our sister channel on YouTube – Marketing Business Network, explains what the term ‘Inflation’ means using simple and easy-to-understand language and examples.