ABA routing number – definition and meaning

The ABA Routing Number is a unique code that the ABA (American Bankers Association) assigns to identify the financial institution that issued a check. The code was first established in 1910.

Banks and financial institutions in the USA use the 9-digit ABA routing number to process check transactions, including clearance and deposits.

The nine-digit code identifies US banks, facilitating transactions like automatic bill payments or direct deposits.

This numerical system also ensures compliance with the United States’ regulatory framework for financial transactions.

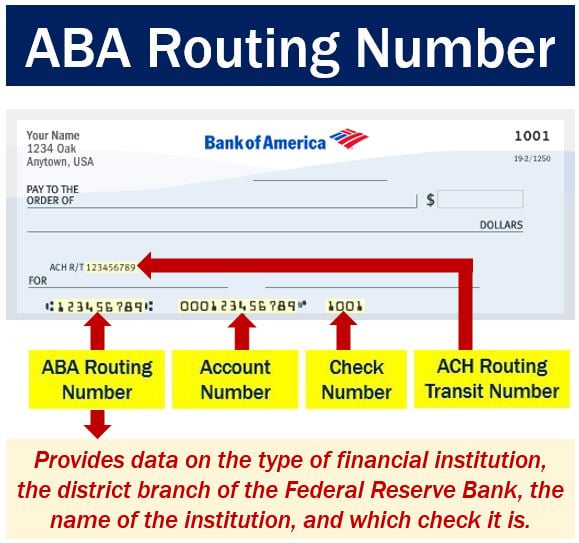

According to UC San Diego: “The ABA routing number is a unique, 9 digit identifying transit number assigned to each bank.” (Image: adapted from Bank of America Corporation website)

What is my ABA routing number?

Find your ABA routing number at the bottom left-hand corner of your checkbook or contact your bank for assistance.

The ABA routing number can also be found on deposit slips and computer-generated checks.

Never give out your ABA routing number along with other banking information as it should remain confidential.

thebalance.com suggests searching your bank’s website for direct deposit forms or ACH information for finding your ABA routing number.

The nine digits of the ABA routing number contain important information for the financial institution and facilitate successful transactions. (Data Source: bankroutingnumber.us)

Sometimes there are many ABA numbers

Use the ABA routing number specific to your account, which can be found on your checkbook or deposit slip.

Mergers and acquisitions may result in a bank having multiple ABA numbers.

For accurate transactions, confirm your ABA routing number with your bank, especially for wire transfers or automatic bill payments.

Routing number format

The ABA routing number consists of nine digits:

- Digits 1 and 2 indicate the type of financial institution.

- 3 and 4 indicate the Federal Reserve Bank district branch.

- 5 through 8 tell us the name of the financial institution where the account is held.

- Digit 9 is the single check digit.

For international wire transfers, the SWIFT code or BIC code, ranging from 8 to 11 characters, is used.

The ABA routing number system plays a crucial role in maintaining the integrity and speed of the national payment system.

UK equivalent

In the United Kingdom, the equivalent of the ABA routing number is the Sort Code. A sort code is a six-digit number that British banks use for identifying the bank and branch where an account is held. It is used in domestic bank transfers and also for setting up direct debits and standing orders within the UK.

For international transfers, the UK uses BIC/SWIFT codes along with IBAN (International Bank Account Number).

Video – What is an ABA Routing Number?

This video from the Marketing Business Network on YouTube explains the term “ABA Routing Number” with simple language and examples.