Account – definition and meaning

The term account has several different possible meanings. We use it extensively in the world of business, as well as in non-commercial situations. In non-business English, it can mean a report or description of something that happened or an experience. For example, “His account of what happened during the car chase was amazing.”

In banking

In banking, the term ‘accounts’ refers to ongoing financial relationships between customers and their bank. ‘Accounts’ processes debts and deposits in the world of banking.

Bank accounts are arrangements that customers have with their bank. People with bank accounts may deposit and withdraw funds, and in some cases earn interest.

What does this question mean ‘Do you want to see your account statement?’ The ATM or online account service is asking whether you want to see a list of your recent transactions.

In accounting

In accounting, accounts are chronological records of changes in the value of a company’s liabilities and assets. Additionally, they include data on the owner’s equity. Entries appear on separate pages in the ledger.

These entries, often called postings, become part of a book of final entry or ledger. Examples of typical financial accounts are accounts receivable (money a company is owed), accounts payable (money a company owes), sales, loans, and mortgages. More examples of financial account entries are PP&E (property, plant & equipment), wages, payroll, and common stock. When a company’s accounts are inspected, it is called an audit.

In commerce

In commerce, accounts are continuing relationship between suppliers (sellers) and buyers. Buyers pay for goods or services that they have received at a later date. Payment terms may be two weeks, 30 days, or even 60 or 90 days.

Large companies and government departments may ask for longer credit terms. In business, a customer who has an account, a special relationship, or an arrangement is a client.

When we have a new customer, we want to set up an account which offers payment terms. However, we will probably first check whether the company is reliable, i.e. good for it.

We might do this by using the services of a reputable credit agency such as Experian. As with most commercial entities, credit agencies charge for their services.

You can also write to your customer’s bank manager and ask whether they are good for a specific amount. You must ask the customer’s permission first. The bank will send you a letter, which will not directly say a flat ‘Yes’ or ‘No.’ Probably, the letter will provide enough subtle information for you to make an informed decision.

Individual people may have commercial accounts, as with Amazon.com or their local corner shop. You may even have an account with a taxi company, especially if they take your kids to school daily.

Trust is crucial for an account to succeed

The most necessary feature for accounts to exist is trust – both by the customer and supplier. The supplier needs to trust that his or her customer will pay. Additionally, the customer trusts that the supplier will deliver the goods or services on time and in good condition.

Unsurprisingly, countries where the degree of trust in business is high, are richer compared to those with lower levels.

According to experian.co.uk, an entity’s business credit score is a number typically between zero and 100. The higher the credit score, the lower the risk. Suppliers consider the following factors when calculating a customer’s business score:

- How much is currently owed to other businesses or accounts?

- Payment history. If the firm pays late and still owes money, its credit score will decline. Late-payment patterns lower the credit score.

- Information that is available from public records such as court judgments and bankruptcies.

- Credit history length. A credit history of just three months will bring down the credit score, compared to one ten years long. Even if the customer always pays on time, a short history length will lower the score significantly.

A business account may be a bank account for a company or trading individual. It might also be a commercial account between seller and buyer.

Etymology of the word:

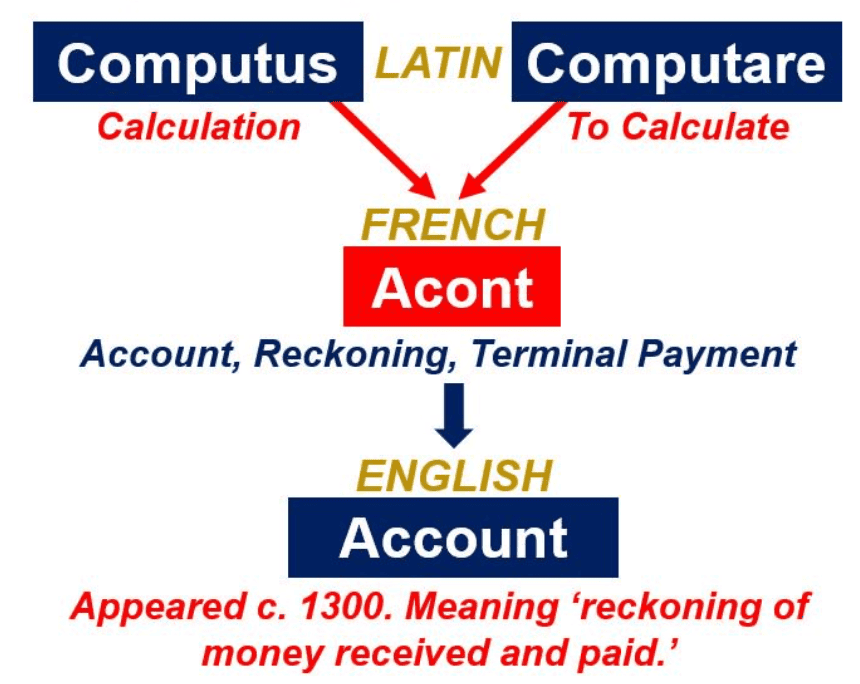

According to etymonline.com, the English word account comes from Old French ‘acont’, which came from Latin ‘computare’ and ‘computus’.

According to etymonline.com, the English word account comes from Old French ‘acont’, which came from Latin ‘computare’ and ‘computus’.

Verb ‘To Account’

As a verb, ‘to account’ has several different meanings:

- Consider or regard in a specific way: as in “His intervention could not be accounted a success.”

- To give an explanation: “How do you account for the accident?” (followed by ‘for’)

- To cause: as in “The slippery road accounted for the rise in accidents yesterday.” (followed by ‘for’)

- To impute or assign: as in “The many virtues accounted to her.” (followed by ‘to’)

In most cases, the verb has the same meaning in business and lay contexts.