A bank run or a run on the bank occurs when customers panic and start taking their money out. They withdraw their money because they are afraid the bank is in trouble. This fear subsequently spreads, and other customers also fear losing all their money. Eventually, panic ensues, and masses of account holders withdraw their funds.

If it turns into a stampede, the bank may run out of cash and face sudden bankruptcy. The financial institution can take some measures to protect itself. For example, it can limit how much customers can withdraw or close its doors temporarily. Additionally, the bank can try to obtain cash from the central bank or other banks.

Panic can kill a business. Even though a bank run might be the result of just panic, it cannot ignore the psychological factor.

Like many types of fishes, as well as geese, flamingos, sheep, etc., we are herd animals. We, therefore, have a herd instinct. This instinct can influence our judgment and decision making. We like to do what most other people are doing.

A bank run and the national economy

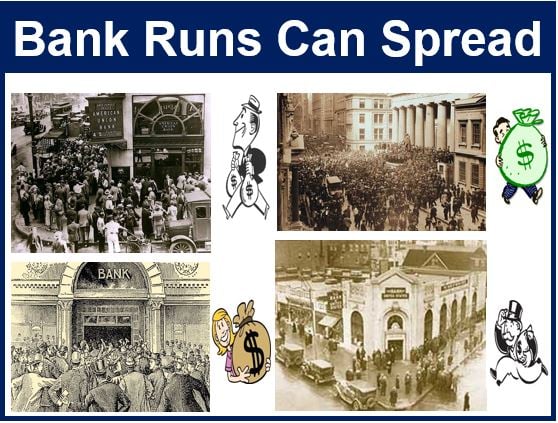

A bank run may not destroy just one bank, but a whole string of them. There have been several cases across the world of panic spreading to other bank’s customers. As soon as the second financial institution falls, it is not usually long before others also collapse.

Put simply; it is like standing a series of dominoes in a line, one behind the other. When you knock one down, all the others start falling too.

When several banks start to fall, the snowballing panic can damage the whole economy.

Former U.S. Federal Reserve chairman Ben Bernanke once pointed to what caused the Great Depression of the 1930s. He said that bank runs directly caused the most severe economic downturn in modern US history.

In the United States, there were many bank runs in the 1920s and early 1930s. In response to these incidents, Congress created the FDIC (Federal Deposit Insurance Corporation).

The FDIC insures banking deposits. Its aim is to prevent bank runs by maintaining stability and public confidence in the nation’s financial system.

Techniques to minimize bank run effects

Governments, central banks, and regulators have used many techniques to minimize the effects of bank runs, including:

- A higher reserve requirement. Regulations to make banks keep more of their reserves as cash.

- Arranging insurance to protect people’s bank accounts.

- Government bailouts.

- The temporary suspension of withdrawals after a bank run begins.

- Closer monitoring and regulation of commercial banks.

- Having the central bank as lender of last resort.

Despite all these techniques, there are times depositors still feel unsure about the safety of their money.

Historically, bank runs have appeared at the end of an economic boom, namely, just before the bust. In other words, they are more common during an economic contraction that follows a boom.

Examples include the unrest and famine that hit England in the 16th century and the Dutch Tulip manias (1634-1637).

The British South Sea Bubble (1717-1719) and the post-Napoleonic Depression (1815-1830) also triggered mass panic.

The Great Depression was the most famous example in the 20th century. It struck at the end of the 1920s and lasted almost a decade.

A depression is a recession that lasts at least three years and causes GDP to contract by over 10%.

Video – The Bank Run

A clip from the 1946 movie ‘It’s a Wonderful Life’ with James Stewart. In the story, he marries on the same day as the Wall Street Crash of 1929. The situation gets so bad that he has to use his honeymoon money to weather a bank run.