What is flipping? Definition and examples

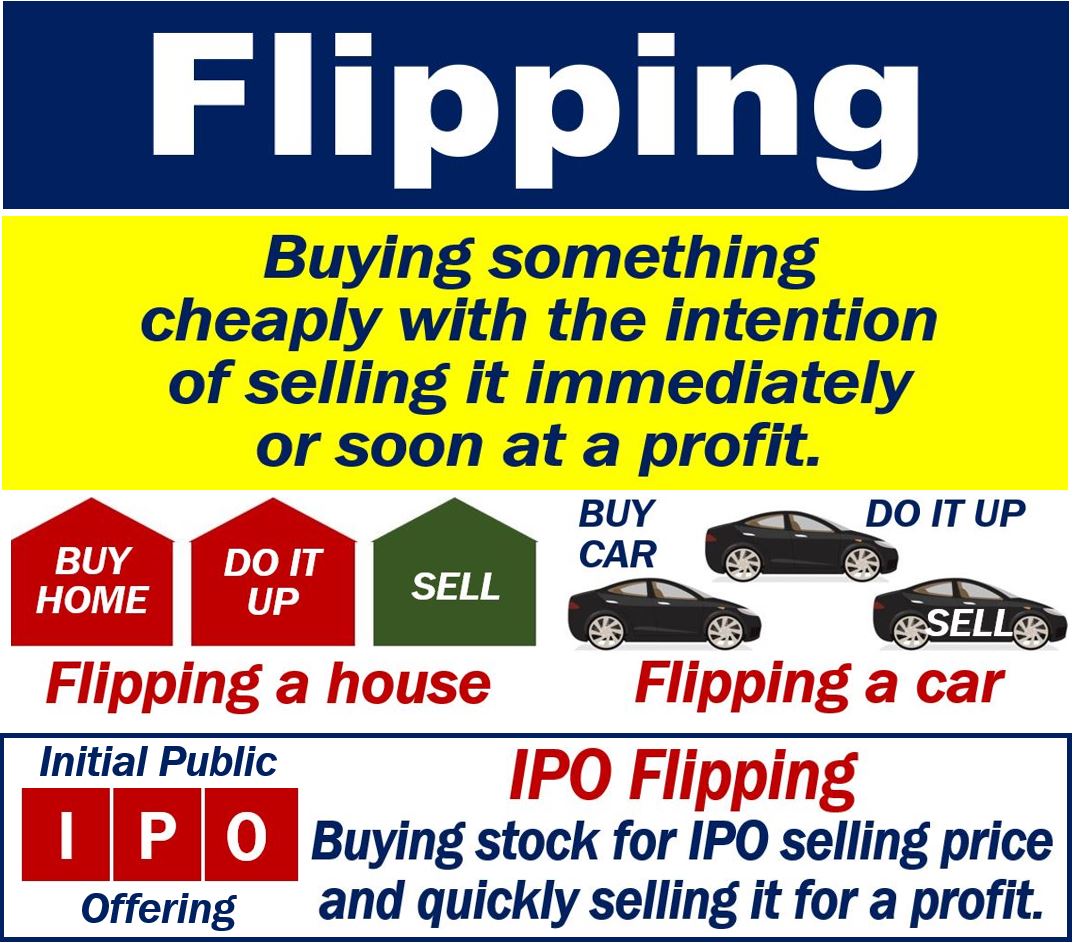

Flipping involves buying an asset and then selling it straight away. The aim is to make a quick profit. Flipping is a form of speculation in which the speculator moves rapidly. We can apply the term to stocks and shares and real estate. We can also apply the term to commodities. For example, if I buy lots of gold this morning and sell it this afternoon, I am flipping gold. Gold is a commodity.

We also use the term outside the world of investments, real estate, and commodities. If I buy and sell a car, concert tickets, sports tickets, I am flipping. Specifically, If I buy and then sell the item immediately or very soon. Put simply, flipping involves the reselling of a product with the sole aim of making a profit.

Many people today buy cryptocurrencies and then sell them straight away if the price is right. A cryptocurrency is a kind of digital money, i.e., it exists purely electronically.

BusinessDictionary.com has the following definition of the term:

“Quick-profit strategy in which the shares of a new issue or IPO are bought for selling immediately upon an increase in their market price.”

This meaning of the term is common in the United States and Canada, but less so in other countries.

Flipping – politics

In the United Kingdom, people use the term in politics. It is a technique MPs use to maximize their taxpayer-funded allowances.

If an MP is switching their second home between many houses, they are flipping. MP stands for Member of Parliament.

This article focuses on the meaning of the word in the world of business.

Flipping – IPOs

IPO stands for Initial Public Offering. An IPO occurs when shares of stock of a company become available for members of the public to purchase. In other words, when a company goes public.

During most IPOs, the company sells its shares cheaply. It does this because it wants to make sure people buy them.

Some speculators buy IPO shares and sell them soon afterward at a profit. Those people are IPO flippers.

Flipping – real estate

When we use the term in real estate, it often has a derogatory meaning. For example, it may include schemes that involve market manipulation. It may also involve socially destructive or unethical activities.

However, the term may also apply to normal and respectable business activities. For example, companies like Get Fair Home Offers buy a house that needs major repairs, fix it up, and then sell it. This process is known as fixing and flipping and it allows home sellers to avoid costly repairs and significant realtor fees.

When flipping a house, most investors will make use of a hard money loan to fund the property purchase and the necessary renovations. This is mainly because many banks consider real estate flipping too risky to warrant a traditional loan.

Car flipping

In this case, the term refers to buying a car cheaply and then selling it at a higher price.

We call people who do this ‘car flippers.’ They are good at identifying bargain vehicles. They buy the vehicle and subsequently sell it for a higher price.

Many US states have laws that limit how many vehicles one individual can flip in one year. However, if that person is a dealer or associate, the legislation does not impose limits.