Import duty – definition and meaning

Import duty is a kind of tax which countries levy on some imports, i.e., goods and services from abroad. We also call it customs duty.

The type of import duty that governments levy on goods may depend on where they come from. For example, when there is trade between two countries within the same trade zone, there is little to no import duty on most goods. Even if there is, it is likely to be less than for goods coming from outside the trade zone.

Governments impose import duty for several reasons:

- To generate revenue.

- Perhaps there are domestic industries that the government feels need protection.

- To protect public health. For example, cigarettes are extremely expensive in the UK and other advanced economies. They are expensive because the authorities tax them heavily.

Governments say they tax tobacco heavily to protect public health and gather income to pay for the health consequences of smoking. They use the same argument when they levy import duty on tobacco products.

Investing Answers says the following regarding the term:

“In the tax and import/export world, an import duty (or customs duty) is money collected under a tariff.”

We also refer to taxes that the government levies on imports ‘tariffs.’ Countries have two weapons to improve their balance of trade and protect domestic producers: quotas and tariffs.

An import quota is a limit on the quantity of a product or service a country may import.

Import duty – European Union

In the European Union (EU), for example, the authorities call goods that come from another EU member ‘acquisitions.’ Consumers have to pay Import VAT on acquisitions.

Goods coming from outside the EU into a EU member state may be liable for import duty. In the EU, the authorities tend to call it ‘customs duty.’

Import duty – economic consequences

As mentioned earlier, import duties raise revenue for the government and protect domestic companies.

Import duty on a product can make it more expensive for consumers. Subsequently, demand for that product falls.

Trade surplus and deficit

If imports become more expensive, their sales decline. Lower imports are better for a country’s balance of trade, i.e., they can turn a trade deficit into a surplus.

A trade deficit exists if a country imports more than it exports. We also call it a negative trade gap.

A trade surplus, on the other hand, exists when the country exports more than it imports. We all prefer trade surpluses to deficits.

If an import duty has made something more expensive, domestic producers are more likely to raise output

Some economists say that import duties are a way of transferring money from American consumers to the US Treasury. If taxes on imports are higher, more money from consumers will end up in the Treasury’s coffers.

Tariffs and the free market

Free market thinkers are against tariffs. They say it interferes with free competition. If domestic producers have an unfair advantage, they are less motivated to offer the best prices and quality.

Also, if import duties are severe, consumers end up with either less choice or having to pay much more for things.

Put simply; free market believers say that import duties make a country less efficient and high cost.

Import duties, if they are severe, can encourage black market activities. The back market refers to ‘under the radar’ trade, i.e., smuggling and doing business without declaring incomes or paying taxes.

Video – import duty

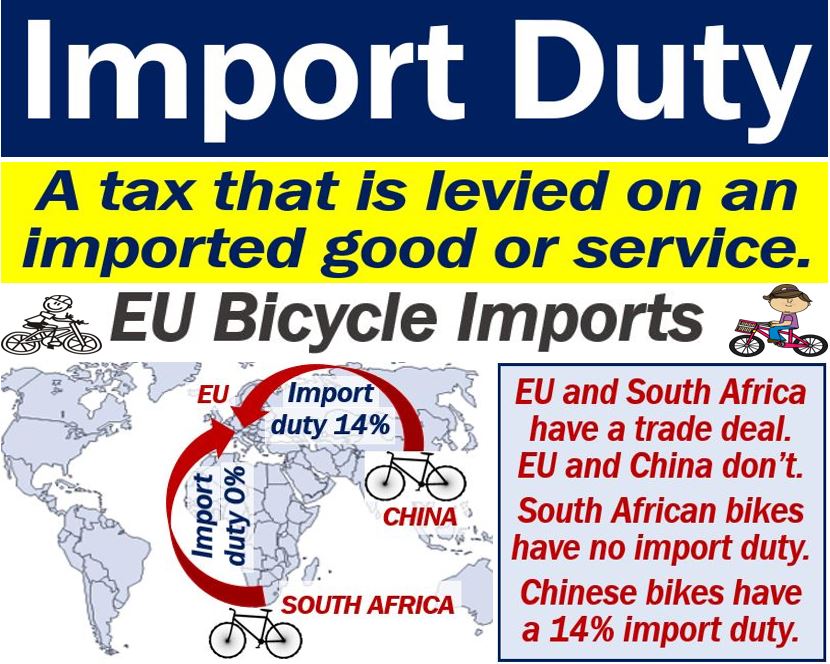

In this Maco video, the speaker talks about European Union trade treaties with other countries and regions. It looks at the agreements the EU has signed with South Africa and China.

While there are no longer any import duties on most South African goods, this is not yet the case with China.