What is a majority shareholder?

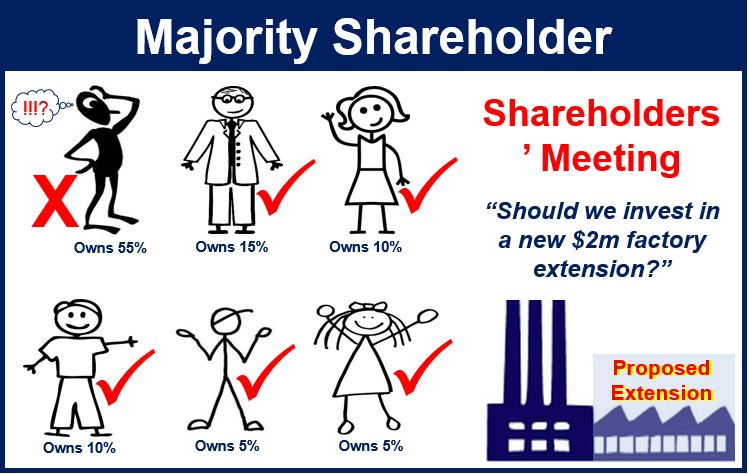

A majority shareholder, also known as a controlling shareholder or a person with a majority interest, generally means an individual who owns more than 50% of the voting shares in a company. The majority shareholder might also be an entity, such as a government.

We say that somebody with a controling interest in a company has a majority ownership.

The majority shareholder has more power in a business than all its other shareholders combined.

An individual with a majority interest is usually the founder of the company, or a descendant of the founder if it is a long-established business.

Controlling shareholders are more common in private companies than public companies (those whose shares can be traded in stock markets).

Owners of common stock (called ordinary shares in the UK), also known as voting shares, vote on who become members of the board of directors, the company’s objectives and policy, and a number of other things. Therefore a majority shareholder wields considerable power over a corporation.

In some parts of the world, to have a controlling interest in a business might mean more or less than 50% of the shares. In the state of Delaware in the United States, for example, companies need a 2/3 vote for a motion to pass.

How majority shareholders manage a company

How majority shareholders manage a company varies considerably. Some may be actively involved in the everyday running of the business, while others may have chosen a more hands-off approach and leave its management to other people.

A predatory corporation aiming to acquire other companies will usually find it much harder to buy a company with a majority shareholder if that person is not interested. It is not possible to ‘divide and conquer’ when trying to persuade shareholders to accept a takeover offer. Whether the business is acquired depends on just one person’s decision.

Some people say the controlling interest must be at least 51%, this is not necessarily true. If a corporation has 10,000 shares and you own 5,001 of them, you are a majority shareholder – in percentage terms that is only 50.01%.

So, a more accurate way to define a controlling interest would be a person who owns at least 50% of all shares plus one share.

According to the Nasdaq Business Glossary, a majority shareholder is:

“A shareholder who is part of a group that controls more than half the outstanding shares of a corporation.”

With rights come duties

The majority shareholder has the right to control the company and put the management in place, or to be the management, and to make decisions regarding the direction of the business.

Of course, with those rights come certain duties. They have fiduciary duties to the other shareholders, they have the duty to act in good faith and not misapply the corporate assets and be engaged in fraudulent activities.

If they exercise their business judgement to the best of their abilities, for the most part they are protected in the law in doing so.

World’s richest people and the companies they founded

Most of the world’s richest people are no longer majority shareholders in the companies they founded.

Warren Buffet, one of the richest people in the world, owns 32.4% of Berkshire Hathaway’s common stock, which means he is not a majority shareholder.

In 2014, Bill Gates, the world’s richest person and founder of Microsoft Corp., owned just 4% of the company’s common stock. In fact, today he is not even the company’s largest shareholder. That title now belongs to Steve Ballmer, who served as Chief Executive Officer from 2000 to 2014.

Amancio Ortega, the world’s fourth richest person, is a majority shareholder. He owns 59% of Industria de Diseño Textil, S.A. (Inditex), the Spanish multinational clothing giant headquartered in Arteixo, Galicia.