What is prospect theory? Definition and meaning

Prospect theory, also known as loss-aversion theory, holds that as humans dislike losses more than equivalent gains, we are more willing to take risks in order to avoid a loss than to take a risk in order to obtain an equivalent gain. It is a behavioral model that shows how we decide between alternatives that involve uncertainty and risk – such as the percentage likelihood of gains or losses.

The theory, one of the theories of behavioral economics, based on experimental work of Daniel Kahneman, an Israeli-American psychologist who was awarded the 2002 Nobel Memorial Prize in Economic Sciences, and Amos Tversky (1937-1996), an Israeli-American cognitive and mathematical psychologist, holds that there are recurring biases that influence our choices under uncertainty – driven by psychological factors.

Kahneman and Tversky’s study – Loss-Aversion Theory: An Analysis of Decision under Risk – was published by the journal Econometrica in March 1979.

According to prospect theory, humans process information illogically by valuing gains and losses differently.

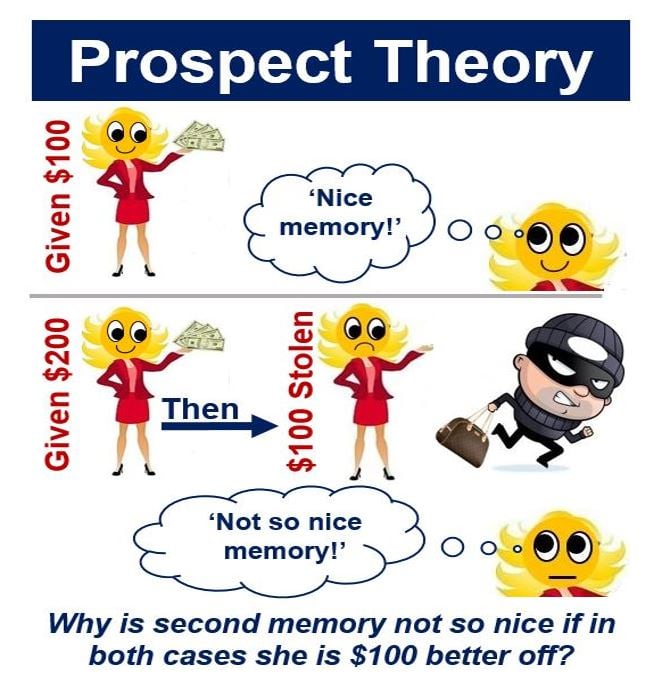

The second memory is not so nice because, according to loss-aversion theory, we give an unpleasant event more negative weight than the equivalent positive weight for a positive event. Losing $100 has more negative weight than the positive weight we get from receiving $100. This irrational or illogical way of thinking is what Kahneman and Tversky observed.

The second memory is not so nice because, according to loss-aversion theory, we give an unpleasant event more negative weight than the equivalent positive weight for a positive event. Losing $100 has more negative weight than the positive weight we get from receiving $100. This irrational or illogical way of thinking is what Kahneman and Tversky observed.

In an Abstract preceding their paper, Kahneman and Tversky wrote:

“Choices among risky prospects exhibit several pervasive effects that are inconsistent with the basic tenets of utility theory.”

“In particular, people underweight outcomes that are merely probable in comparison with outcomes that are obtained with certainty. This tendency, called the certainty effect, contributes to risk aversion in choices involving sure gains and to risk seeking in choices involving sure losses.”

“In addition, people generally discard components that are shared by all prospects under consideration. This tendency, called the isolation effect, leads to inconsistent preferences when the same choice is presented in different forms.”

Prospect theory and irrational behavior

Prospect theory is very useful for explaining people’s apparent irrational behavior. Kahneman and Tversky found that losses had more emotional impact than the equivalent amount of gain for people.

For example, in a traditional way of thinking, we should gain the same amount of utility (pleasure, satisfaction) if we received $100, or first received $200 and then lost $100, because the end result would be the same – a $100 net gain.

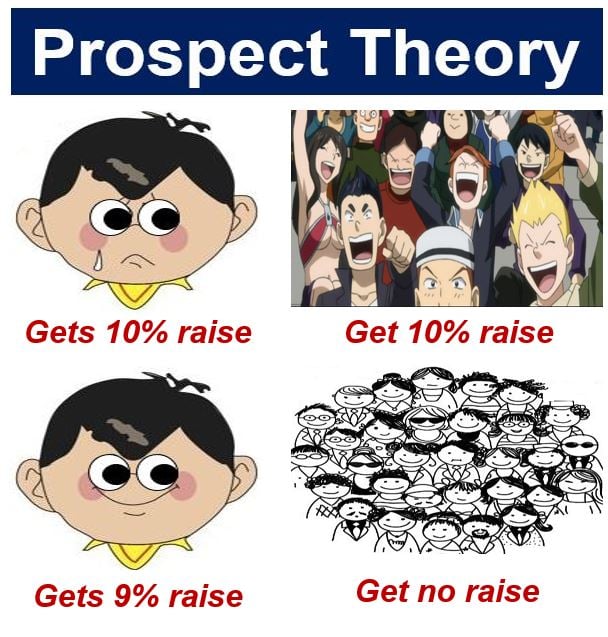

The man in this image is more interested in how much better off he is than the people around him than his own outcome in isolation. Most of us are like him, according to prospect theory.

The man in this image is more interested in how much better off he is than the people around him than his own outcome in isolation. Most of us are like him, according to prospect theory.

However, this is not how humans see it. Despite ending up $100 better off in either case, the vast majority of people perceive a single $100 gain more favorably than gaining $200 and then losing $100.

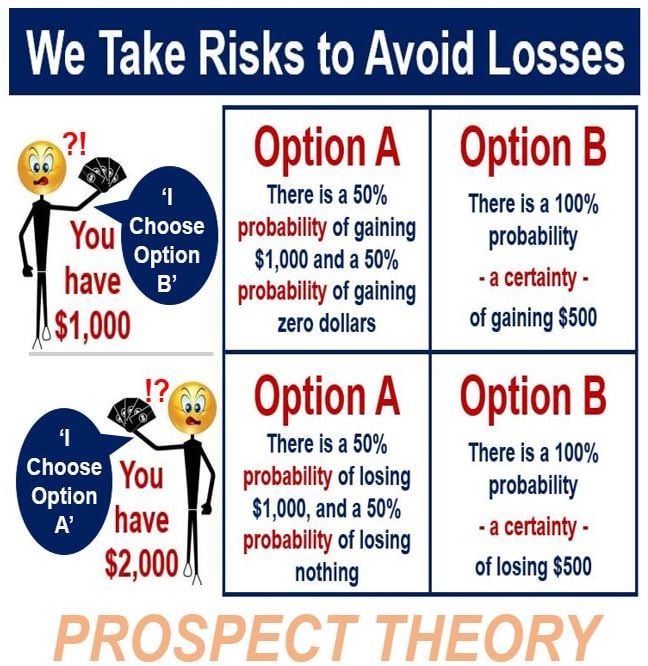

Tversky and Kahneman carried out several studies in which the participants had to answer questions that involved making judgments between two money-related decisions – in all the cases, there was a probability of losses and gains. Below is an example of some of the questions:

1. You are holding $1,000 in your hand and you have to choose either Option A or Option B:

– Option A: There is a 50% probability of gaining $1,000 and a 50% probability of gaining zero dollars.

– Option B: There is a 100% probability – a certainty – of gaining $500.

2. You are holding $2,000 in your hand and you have to choose either Option A or Option B:

– Option A: There is a 50% probability of losing $1,000, and a 50% probability of losing nothing.

– Option B: There is a 100% probability – a certainty – of losing $500.

The vast majority of the participants chose Option B for question 1, and Option A for question 2. It seems that people are willing to accept a reasonable level of gain – if they think there is a reasonable probability of gaining more – but will engage in risk-seeking behaviors where they can minimize their losses – our losses are weighted more heavily than gains of equivalent amounts.

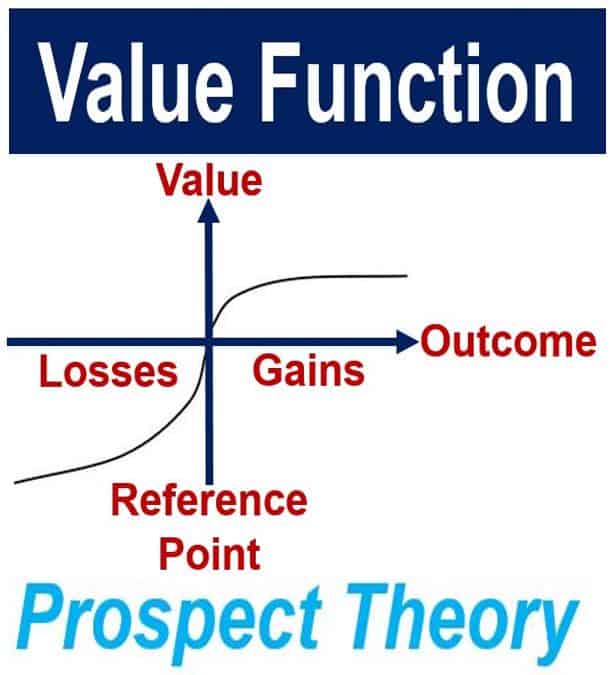

As you can see in this graph, the value function that passes through the reference point is an asymmetrical s-shape. The value function for losses is steeper than for gains, suggesting that – in our perception – losses outweigh gains. (Image: Wikipedia)

As you can see in this graph, the value function that passes through the reference point is an asymmetrical s-shape. The value function for losses is steeper than for gains, suggesting that – in our perception – losses outweigh gains. (Image: Wikipedia)

Characteristics of loss-aversion theory

Prospect theory is characterized by:

– Certainty: when presented with options, humans will nearly always choose the one with certainty. In fact, in order to achieve more certainty, people are willing to sacrifice income.

– Relative Positioning: humans are less interested in their final income and wealth than their relative gains and losses. If people’s relative position remains the same, they will not feel better off, even if their income rises considerably.

How we see ourselves in relation to our neighbors, friends, colleagues and family members matters to us more than whether we are better/worse off now than we were one or two years ago.

If I get a 20% wage rise and so does everybody else, I will not feel better off. However, if I get a 10% rise and nobody else gets one, I will feel rich – so says prospect theory.

– Low Probabilities: we have a tendency to under-react to low-probability events. If the probability of something is very low, even if that means we could lose all our wealth, we tend to discount the probability. This trait may result in individuals choosing ultra-risky options.

Most of the participants in Tversky and Kahneman’s study made the same choices as those in the image above. The researchers said that it shows that people will engage in risk-seeking behaviors in order to try and minimize their losses. We really do seem to give losses more weight than their equivalent gains.

Most of the participants in Tversky and Kahneman’s study made the same choices as those in the image above. The researchers said that it shows that people will engage in risk-seeking behaviors in order to try and minimize their losses. We really do seem to give losses more weight than their equivalent gains.

Prospect theory in non-monetary situations

Kahneman and Tversky believed that their theory is relevant to many situations in life, and not just monetary ones.

Prospect theory could have implications for policymakers when making decisions that could affect the lives of many people.

At the end of their paper, the authors wrote:

“Although the present paper has been concerned mainly with monetary outcomes, the theory is readily applicable to choices involving other attributes, e.g. quality of life or the number of lives that could be lost or saved as a consequence of a policy decision.”

“The main properties of the proposed value function for money should apply to other attributes. In particular, we expect outcomes to be coded as gains or losses relative to a neutral reference point, and losses loom larger than gains.”

Video – Prospect theory explained

This Sanlam Investments video explains what prospect theory is. It gives the example of three Olympic medal winners, and why the 3rd-place Bronze Medal inner is usually happier than the 2nd-place Silver Medal winner.

According to the theory, we process information in an illogical way by valuing losses and gains differently.